Answered step by step

Verified Expert Solution

Question

1 Approved Answer

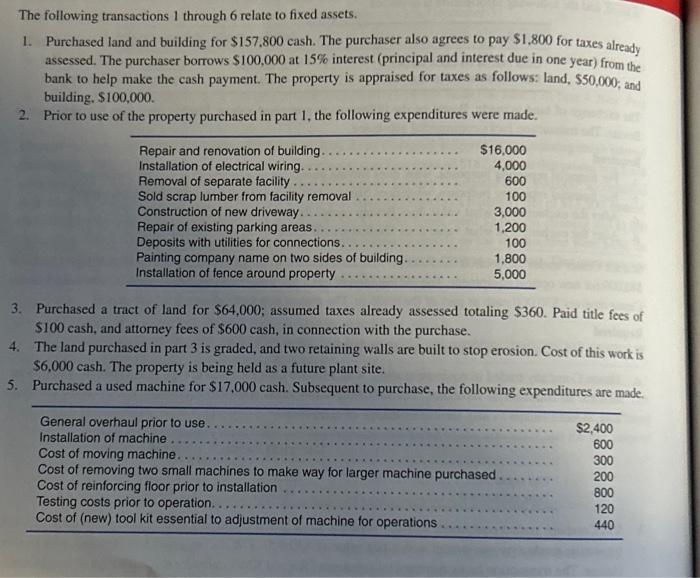

The following transactions 1 through 6 relate to fixed assets. 1. Purchased land and building for $157,800 cash. The purchaser also agrees to pay

The following transactions 1 through 6 relate to fixed assets. 1. Purchased land and building for $157,800 cash. The purchaser also agrees to pay $1,800 for taxes already assessed. The purchaser borrows $100,000 at 15% interest (principal and interest due in one year) from the bank to help make the cash payment. The property is appraised for taxes as follows: land, $50,000; and building, $100,000. 2. Prior to use of the property purchased in part 1, the following expenditures were made. Repair and renovation of building.. Installation of electrical wiring.. Removal of separate facility. 5. Sold scrap lumber from facility removal Construction of new driveway.. Repair of existing parking areas. Deposits with utilities for connections. Painting company name on two sides of building. Installation of fence around property **** 3. Purchased a tract of land for $64,000; assumed taxes already assessed totaling $360. Paid title fees of $100 cash, and attorney fees of $600 cash, in connection with the purchase. 4. The land purchased in part 3 is graded, and two retaining walls are built to stop erosion. Cost of this work is $6,000 cash. The property is being held as a future plant site. Purchased a used machine for $17,000 cash. Subsequent to purchase, the following expenditures are made. General overhaul prior to use. Installation of machine $16,000 4,000 600 100 3,000 1,200 100 1,800 5,000 Cost of moving machine. Cost of removing two small machines to make way for larger machine purchased Cost of reinforcing floor prior to installation Testing costs prior to operation.... Cost of (new) tool kit essential to adjustment of machine for operations $2,400 600 300 200 800 120 440 perty, Plant, and Equipment: Acquisition and Disposition 6. Immediately sold the machine described in part 5 for $16,000 cash after discovering that the machine was not compatible with its operations. Required Prepare journal entries to record each of the transactions 1 through 6.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Transaction 1 Date Date of transaction Land and Building Fixed Asset 157800 Cash 157800 Land Apprais...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started