Question

The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment.

The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4 Purchased a used delivery truck for $9,600, paying cash. Nov. 2 Paid garage $240 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation on the truck for the year. The estimated useful life of the truck is 4 years, with a residual value of $2,000 for the truck. Year 2 Jan. 6 Purchased a new truck for $6,000, paying cash. Apr. 1 Sold the used truck purchased on Jan. 4 of Year 1 for $3,900. (Record depreciation to date in Year 2 for the truck.) June 11 Paid garage $420 for miscellaneous repairs to the truck. Dec. 31 Record depreciation for the new truck. It has an estimated residual value of $1,100 and an estimated life of 5 years. Year 3 July 1 Purchased a new truck for $80,000, paying cash. Oct. 2 Sold the truck purchased January 6, Year 2, for $2,320. (Record depreciation to date for Year 3 for the truck.) Dec. 31 Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $14,400 and an estimated useful life of eight years. Required: Journalize the transactions and the adjusting entries. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Round your final answers to the nearest cent.

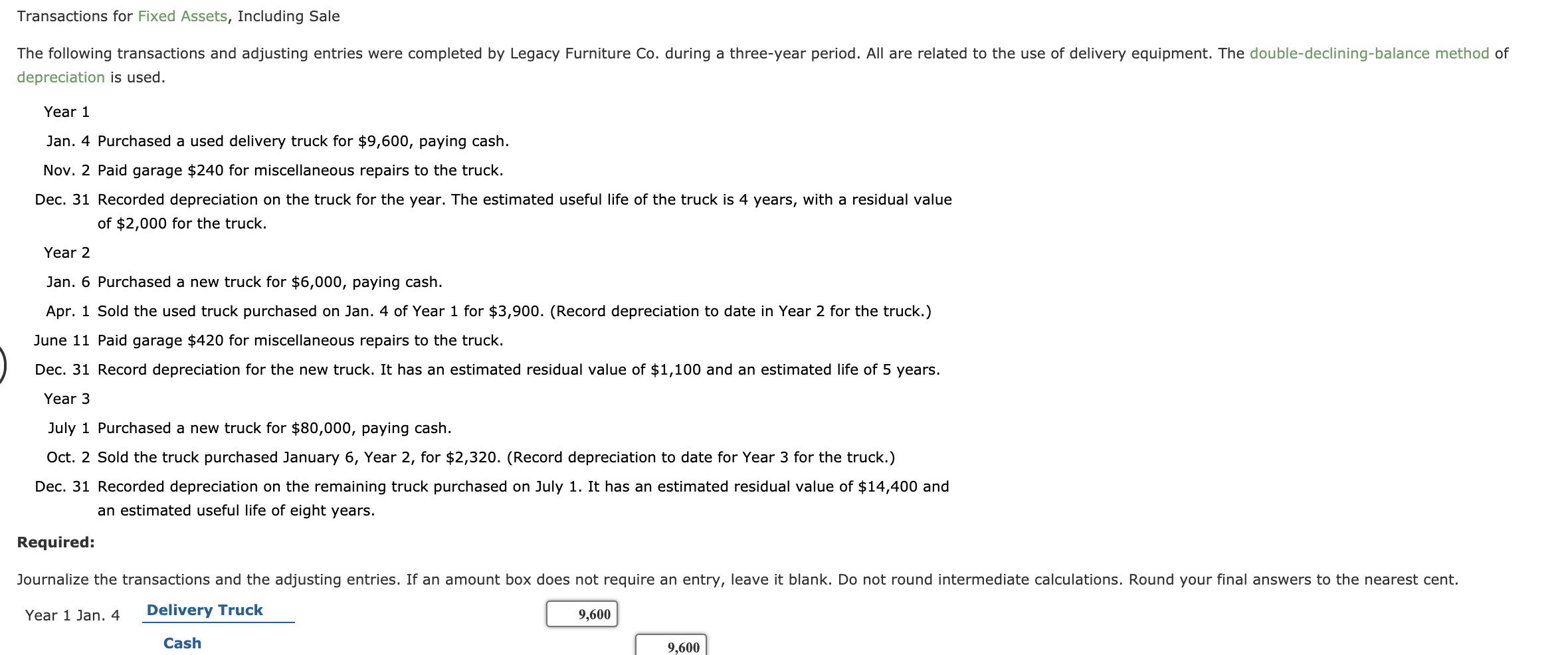

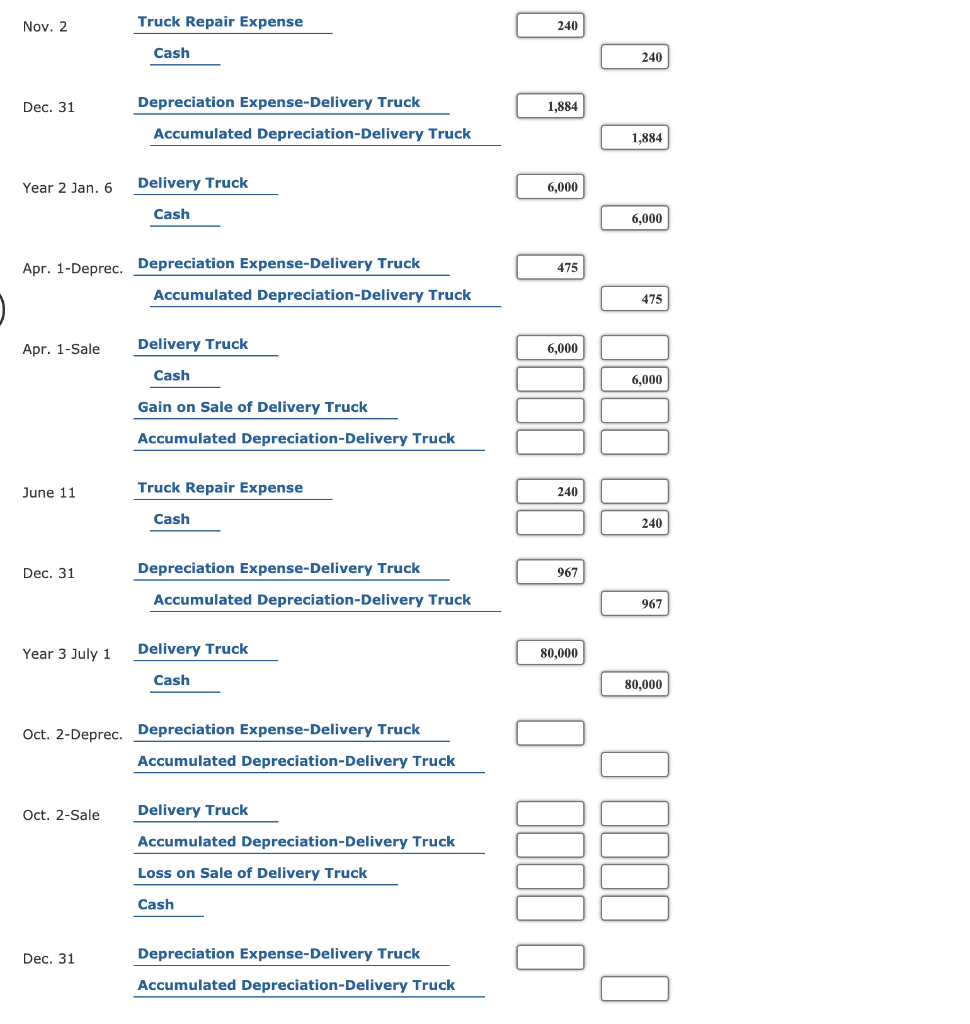

Transactions for Fixed Assets, Including Sale The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4 Purchased a used delivery truck for $9,600, paying cash. Nov. 2 Paid garage $240 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation on the truck for the year. The estimated useful life of the truck is 4 years, with a residual value of $2,000 for the truck. Year 2 Jan. 6 Purchased a new truck for $6,000, paying cash. Apr. 1 Sold the used truck purchased on Jan. 4 of Year 1 for $3,900. (Record depreciation to date in Year 2 for the truck.) June 11 Paid garage $420 for miscellaneous repairs to the truck. Dec. 31 Record depreciation for the new truck. It has an estimated residual value of $1,100 and an estimated life of 5 years. Year 3 July 1 Purchased a new truck for $80,000, paying cash. Oct. 2 Sold the truck purchased January 6, Year 2, for $2,320. (Record depreciation to date for Year 3 for the truck.) Dec. 31 Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $14,400 and an estimated useful life of eight years. Required: Journalize the transactions and the adjusting entries. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Round your final answers to the nearest cent. Year 1 Jan. 4 Delivery Truck 9,600 Cash 9,600 Nov. 2 Truck Repair Expense 240 Cash 240 Dec. 31 Depreciation Expense-Delivery Truck 1,884 Accumulated Depreciation-Delivery Truck 1,884 Year 2 Jan. 6 Delivery Truck 6,000 Cash 6,000 475 Apr. 1-Deprec. Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck 475 Apr. 1-Sale Delivery Truck 6,000 Cash 6,000 Gain on Sale of Delivery Truck Accumulated Depreciation-Delivery Truck June 11 Truck Repair Expense 240 Cash i lll1. IIII 2 1 1 I bill I ] O JUILLIQ Big 240 Dec. 31 967 Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck 967 Year 3 July 1 Delivery Truck 80,000 Cash 80,000 Oct. 2-Deprec. Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck Oct. 2-Sale Delivery Truck Accumulated Depreciation-Delivery Truck Loss on Sale of Delivery Truck Cash Dec. 31 Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started