Question

The following transactions and events affected the consolidated funds of Berjaya Nasional Local Government during 2016. The following information summaries the transaction of Berjaya Nasional

The following transactions and events affected the consolidated funds of Berjaya Nasional Local Government during 2016.

The following information summaries the transaction of Berjaya Nasional Local Government during 2016:

1. Recording the budget

At the beginning of the fiscal year, the budget approved for 2016 are as follows:

a. Estimated Revenue RM6,200,000

b. Estimated Expenditure RM5,200,000

c. Estimated Transfer to Debt Service Fund RM650,000

d. Estimated Equity Transfer Fund RM150,000

2. The Berjaya Nasional Local Government liabilities that are Voucher Payable and Due to Federal Government amounted to RM165,000, while the Cash amounted to RM100,000 (as shown in the above Trial Balance). Although some collections of Taxes Receivable are expected early in the year, payrolls and other liabilities are incurred and must be paid before substantial amount of cash can be collected accordingly. Therefore, it is desirable for Berjaya Nasional Local Government to arrange a short term loan amounting to RM200,000.

3. Cheques were drawn to pay the Vouchers Payable and the amount Due to Federal Government as at the end of 2016.

4. Account Payable of 2015

In the Trial Balances as at 1st January 2016, the items of Account Payable (2015) indicates that purchase orders or contracts issued in 2015 were charge to 2015 allocation and will be paid in 2016.

5. Commitment Entry Purchase order for materials and supplies are issued with a total of RM800,000.

6. At the end of 2015, Berjaya Nasional Local Government Deferred Revenues (Permit and Licenses) amounted to RM20,000 is reflected in the beginning Trial Balance as revenue.

7. Recording Assessment Taxes Levy

Budget revenue from assessment taxes was RM3,200,000. In order to generate tax collection, 2% of these taxes are estimated to be uncollectable due to the tax collection policy and local economic condition. In order to generate revenues of RM3,200,000, the gross levy must be RM3,265,306.

8. Collection of Assessment Taxes Receivable

Berjaya Nasional Local Government received late payment of Assessment Taxes by tax payers amounting to RM330,000 and the Interest and Penalties on this Assessment Taxes of RM20,000 had been recorded as receivable at the end of 2015. Another additional Interest and Penalties on this Assessment Taxes of RM5,000 is assumed to be paid on the 1st January of 2016.

9. Collection of current Taxes

Collections during 2016 of Assessment Taxes for 2016 are RM 2,700,000.

10. Revenue recognized on Cash Basis

Revenue for Permit and Licenses is recognized on cash basis. Collections during the year of 2016 amounted to RM2,800,000.

11. Repayment of Notes Payable

Berjaya Nasional Local Government will have to pay the local bank for the money borrowed (as stated in no. 2 information) with interest.

12. Recognition of expenditures for Commitment items

As stated in information no. 5 earlier, the invoices for materials and supplies amounted to RM800,000 were received. After the materials and supplies have been inspected, they were approved for payment and voucher was then issued.

13. Payrolls and Payroll Taxes

The gross payment of payroll for employees amounted to RM3,345,000. This includes the deduction of insurance for RM78,000 and Employee Provident Fund (EPF) of RM430,000. The gross pay is chargeable to the appropriation of the individual department of the employees.

14. Inter Fund Transfer

The SADA Water Utility Department (government owned) provides water utilities with fire hydrants and water service for the fire protection at a flat annual charge. As such, a government owned water utility is expected to support the cost of its operation by charging the users under Water Utility Fund. The amount charged by SADA Water Utility Department to the Berjaya Nasional Local Government Water Utility Fund was RM80,000.

15. Write-off of Uncollectible Taxes Receivables

The age of receivables periodically were reviewed to determine the adequacy of allowance account and to authorise the write-off of items judged to be uncollectable. The accountant of Berjaya Nasional Local Government has received the approval to write-off Uncollectable Assessment Taxes amounting to RM30,000 and the related Interest and Penalties of RM3,000.

16. Deferred Revenues of Permit and Licenses

A review on the Permit and Licenses Revenue Ledger indicated that approximately RM40,000 would probably will be received more than sixty days beyond the end of the fiscal year.

REQUIRED:

(a) Prepare the journal entries for Berjaya Nasional Local Government according to the transactions given above.

(b) Prepare the Statement of Financial Performance (Consolidated Council Fund) for the year ended 31st December 2016 for Berjaya Nasional Local Government.

(c) Prepare the Statement of Financial Position for the year ended 31st December 2016 for Berjaya Nasional Local Government

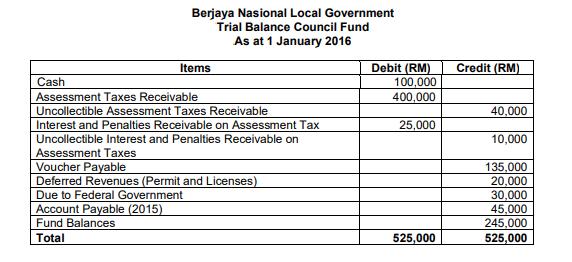

Berjaya Nasional Local Government Trial Balance Council Fund As at 1 January 2016 Items Cash Assessment Taxes Receivable Uncollectible Assessment Taxes Receivable Interest and Penalties Receivable on Assessment Tax Uncollectible Interest and Penalties Receivable on Assessment Taxes Voucher Payable Deferred Revenues (Permit and Licenses) Due to Federal Government Account Payable (2015) Fund Balances Total Debit (RM) 100,000 400,000 25,000 525,000 Credit (RM) 40,000 10,000 135,000 20,000 30,000 45,000 245,000 525,000

Step by Step Solution

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Recording the budget No journal entry is required 2 The Berjaya Nasional Local Government liabilities that are Voucher Payable and Due to Federal Government amounted to RM165000 while the Cash amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started