Answered step by step

Verified Expert Solution

Question

1 Approved Answer

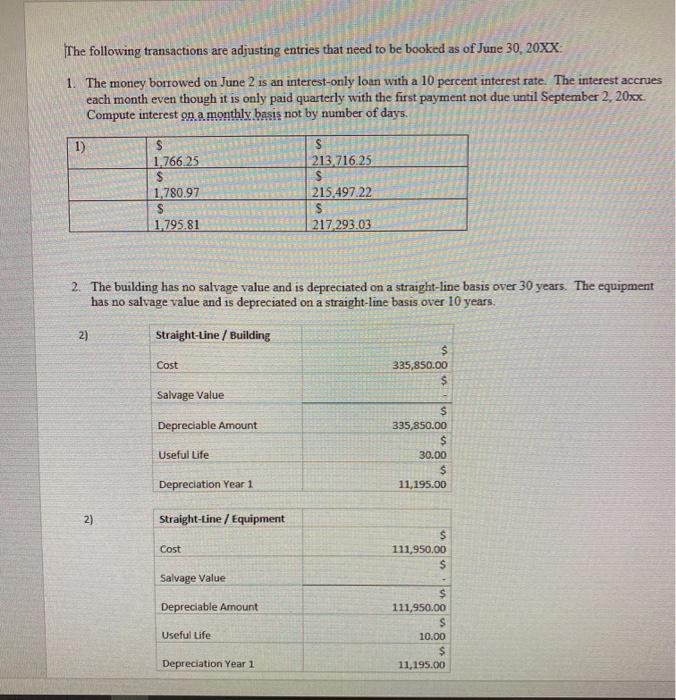

The following transactions are adjusting entries that need to be booked as of June 30, 20XX: 1. The money borrowed on June 2 is

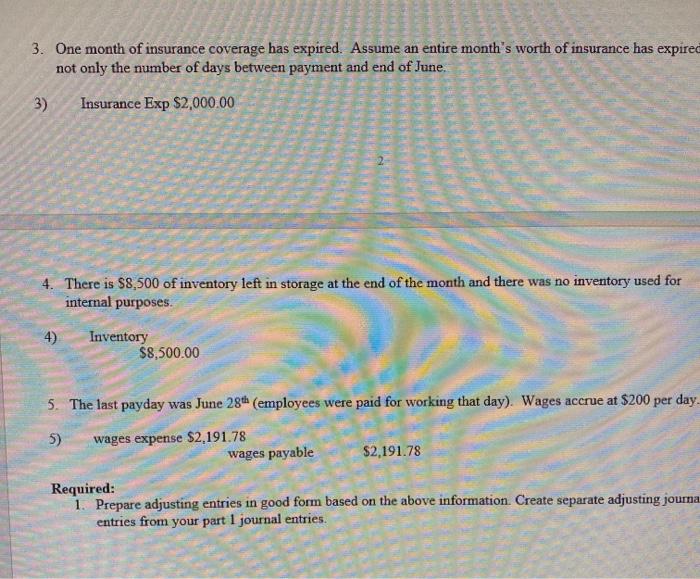

The following transactions are adjusting entries that need to be booked as of June 30, 20XX: 1. The money borrowed on June 2 is an interest-only loan with a 10 percent interest rate. The interest accrues each month even though it is only paid quarterly with the first payment not due until September 2, 20xx. Compute interest on a monthly basis not by number of days. 1) $ 1,766.25 S 213,716.25 S 1,780.97 215,497.22 S 1,795.81 217,293.03 2. The building has no salvage value and is depreciated on a straight-line basis over 30 years. The equipment has no salvage value and is depreciated on a straight-line basis over 10 years. 2) Straight-Line / Building Cost $ 335,850.00 $ Salvage Value $ Depreciable Amount 335,850.00 $ 30.00 $ 11,195.00 2) Useful Life Depreciation Year 1 Straight-Line/Equipment Cost Salvage Value Depreciable Amount Useful Life $ 111,950.00 $ $ 111,950.00 $ 10.00 $ Depreciation Year 1 11,195.00 3. One month of insurance coverage has expired. Assume an entire month's worth of insurance has expired not only the number of days between payment and end of June. 3) Insurance Exp $2,000.00 4. There is $8,500 of inventory left in storage at the end of the month and there was no inventory used for internal purposes. 4) Inventory $8,500.00 5. The last payday was June 28th (employees were paid for working that day). Wages accrue at $200 per day... 5) wages expense $2,191.78 wages payable $2,191.78 Required: 1. Prepare adjusting entries in good form based on the above information. Create separate adjusting journa entries from your part 1 journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here are the adjusting entries in good form for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started