The following transactions are typical operating activities for Florida Flippers (FF), a scuba diving and instruction company. Indicate the amount of revenue, if any,

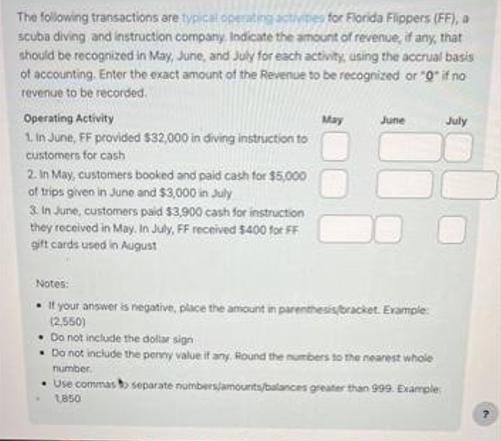

The following transactions are typical operating activities for Florida Flippers (FF), a scuba diving and instruction company. Indicate the amount of revenue, if any, that should be recognized in May, June, and July for each activity, using the accrual basis of accounting. Enter the exact amount of the Revenue to be recognized or "0" if no revenue to be recorded. Operating Activity 1. In June, FF provided $32,000 in diving instruction to customers for cash 2. In May, customers booked and paid cash for $5,000 of trips given in June and $3,000 in July 3. In June, customers paid $3,900 cash for instruction they received in May. In July, FF received $400 for FF gift cards used in August May June Notes: If your answer is negative, place the amount in parenthesis/bracket. Example: (2,550) Do not include the dollar sign Do not include the penny value if any. Round the numbers to the nearest whole number. Use commas separate numbers/amounts/balances greater than 999. Example 1850 July

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 as per accrual concept of accounting sales must be recorded as ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started