Answered step by step

Verified Expert Solution

Question

1 Approved Answer

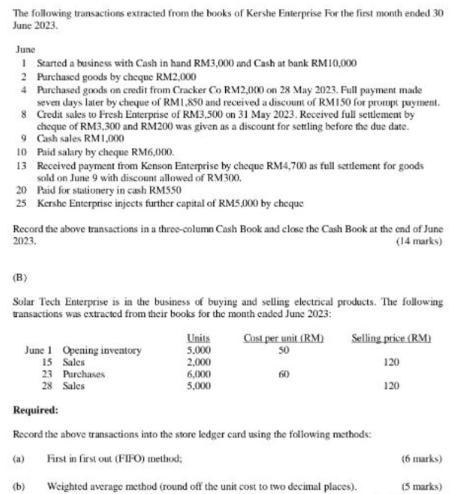

The following transactions extracted from the books of Kershe Enterprise For the first month ended 30 June 2023. June 1 Started a business with

The following transactions extracted from the books of Kershe Enterprise For the first month ended 30 June 2023. June 1 Started a business with Cash in hand RM3,000 and Cash at bank RM10,000 2 Purchased goods by cheque RM2,000 4 8 Purchased goods on credit from Cracker Co RM2,000 on 28 May 2023. Full payment made seven days later by cheque of RM1,850 and received a discount of RM150 for prompt payment. Credit sales to Fresh Enterprise of RM3.500 on 31 May 2023. Received full settlement by cheque of RM3,300 and RM200 was given as a discount for settling before the due date. Cash sales RM1,000 9 10 Paid salary by cheque RM6,000. 13 Received payment from Kenson Enterprise by cheque RM4,700 as full settlement for goods sold on June 9 with discount allowed of RM 300. Paid for stationery in cash RM550 20 25 Kershe Enterprise injects further capital of RM5,000 by cheque Record the above transactions in a three-column Cash Book and close the Cash Book at the end of June 2023. (14 marks) (B) Solar Tech Enterprise is in the business of buying and selling electrical products. The following transactions was extracted from their books for the month ended June 2023: June 1 Opening inventory 15 Sales 23 Purchases 28 Sales Units 5.000 2,000 (b) 6,000 5,000 Cost per unit (RM) 50 60 Selling price (RM) 120 Required: Record the above transactions into the store ledger card using the following methods: (a) First in first out (FIFO) method; Weighted average method (round off the unit cost to two decimal places). 120 (6 marks) (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A ThreeColumn Cash Book for Kershe Enterprise for June 2023 Date Particulars Cash Receipts RM Cash P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started