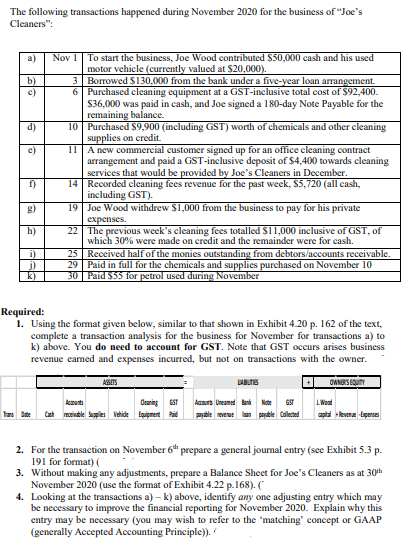

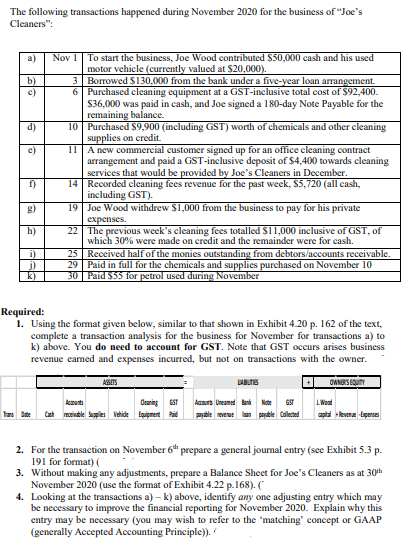

The following transactions happened during November 2020 for the business of "Joe's Cleaners": b) c) d) e) Nov 1 To start the business, Joe Wood contributed $50,000 cash and his used motor vehicle (currently valued at $20,000). 3 Borrowed $130.000 from the bank under a five-year loan arrangement. 6 Purchased cleaning equipment at a GST-inclusive total cost of $92,400. $36,000 was paid in cash, and Joe signed a 180-day Note Payable for the remaining balance. 10 Purchased $9,900 (including GST) worth of chemicals and other cleaning supplies on credit. 11 A new commercial customer signed up for an office cleaning contract arrangement and paid a GST-inclusive deposit of $4,400 towards cleaning services that would be provided by Joe's Cleaners in December. 14 Recorded cleaning fees revenue for the past week, S5,720 (all cash, including GST). 19 Joe Wood withdrew $1,000 from the business to pay for his private expenses. 22 The previous week's cleaning fees totalled $11,000 inclusive of GST, of which 30% were made on credit and the remainder were for cash. 25 Received half of the monies outstanding from debtors/accounts receivable. 29 Paid in full for the chemicals and supplies purchased on November 10 50 Paid 55 for petrol used during November f) g) h) i) j) Required: 1. Using the format given below, similar to that shown in Exhibit 4.20 p. 162 of the text, complete a transaction analysis for the business for November for transactions a) to k) above. You do need to account for GST. Note that GST occurs arises business revenue camed and expenses incurred, but not on transactions with the owner. ASSETS LALTIES OWNERSEBUTY Geaning ST Cah ble Supplies Vide Louipment Pid Asus Uneamed Bank payable en payable Collected 1. Wood agital Remap Tas Bate 2. For the transaction on November 6 prepare a general journal entry (see Exhibit 5.3 p. 191 for format) 3. Without making any adjustments, prepare a Balance Sheet for Joe's Cleaners as at 30th November 2020 (use the format of Exhibit 4.22 p.168).( 4. Looking at the transactions a) - k) above, identify any one adjusting entry which may be necessary to improve the financial reporting for November 2020. Explain why this entry may be necessary (you may wish to refer to the matching concept or GAAP (generally Accepted Accounting Principle)). / The following transactions happened during November 2020 for the business of "Joe's Cleaners": b) c) d) e) Nov 1 To start the business, Joe Wood contributed $50,000 cash and his used motor vehicle (currently valued at $20,000). 3 Borrowed $130.000 from the bank under a five-year loan arrangement. 6 Purchased cleaning equipment at a GST-inclusive total cost of $92,400. $36,000 was paid in cash, and Joe signed a 180-day Note Payable for the remaining balance. 10 Purchased $9,900 (including GST) worth of chemicals and other cleaning supplies on credit. 11 A new commercial customer signed up for an office cleaning contract arrangement and paid a GST-inclusive deposit of $4,400 towards cleaning services that would be provided by Joe's Cleaners in December. 14 Recorded cleaning fees revenue for the past week, S5,720 (all cash, including GST). 19 Joe Wood withdrew $1,000 from the business to pay for his private expenses. 22 The previous week's cleaning fees totalled $11,000 inclusive of GST, of which 30% were made on credit and the remainder were for cash. 25 Received half of the monies outstanding from debtors/accounts receivable. 29 Paid in full for the chemicals and supplies purchased on November 10 50 Paid 55 for petrol used during November f) g) h) i) j) Required: 1. Using the format given below, similar to that shown in Exhibit 4.20 p. 162 of the text, complete a transaction analysis for the business for November for transactions a) to k) above. You do need to account for GST. Note that GST occurs arises business revenue camed and expenses incurred, but not on transactions with the owner. ASSETS LALTIES OWNERSEBUTY Geaning ST Cah ble Supplies Vide Louipment Pid Asus Uneamed Bank payable en payable Collected 1. Wood agital Remap Tas Bate 2. For the transaction on November 6 prepare a general journal entry (see Exhibit 5.3 p. 191 for format) 3. Without making any adjustments, prepare a Balance Sheet for Joe's Cleaners as at 30th November 2020 (use the format of Exhibit 4.22 p.168).( 4. Looking at the transactions a) - k) above, identify any one adjusting entry which may be necessary to improve the financial reporting for November 2020. Explain why this entry may be necessary (you may wish to refer to the matching concept or GAAP (generally Accepted Accounting Principle)). /