Answered step by step

Verified Expert Solution

Question

1 Approved Answer

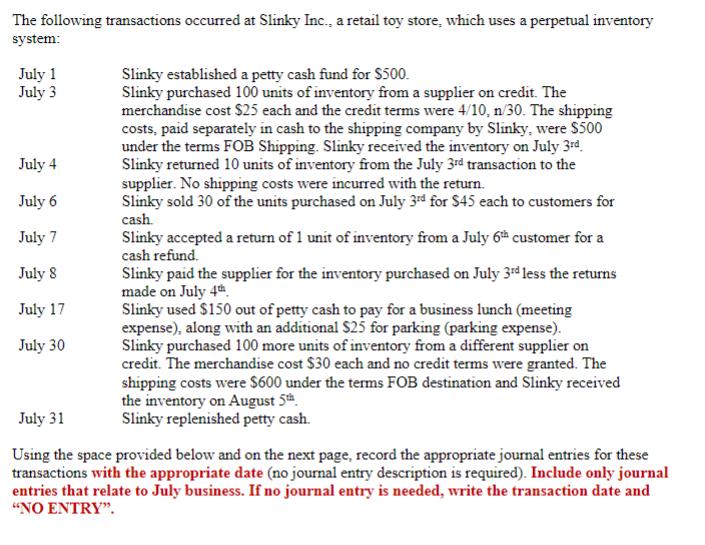

The following transactions occurred at Slinky Inc., a retail toy store, which uses a perpetual inventory system: July 1 July 3 July 4 July

The following transactions occurred at Slinky Inc., a retail toy store, which uses a perpetual inventory system: July 1 July 3 July 4 July 6 July 7 July 8 July 17 July 30 Slinky established a petty cash fund for $500. Slinky purchased 100 units of inventory from a supplier on credit. The merchandise cost $25 each and the credit terms were 4/10, n/30. The shipping costs, paid separately in cash to the shipping company by Slinky, were $500 under the terms FOB Shipping. Slinky received the inventory on July 3rd Slinky returned 10 units of inventory from the July 3rd transaction to the supplier. No shipping costs were incurred with the return. Slinky sold 30 of the units purchased on July 3rd for $45 each to customers for cash. Slinky accepted a return of 1 unit of inventory from a July 6th customer for a cash refund. Slinky paid the supplier for the inventory purchased on July 3rd less the returns made on July 4th Slinky used $150 out of petty cash to pay for a business lunch (meeting expense), along with an additional $25 for parking (parking expense). Slinky purchased 100 more units of inventory from a different supplier on credit. The merchandise cost $30 each and no credit terms were granted. The shipping costs were $600 under the terms FOB destination and Slinky received the inventory on August 5th Slinky replenished petty cash. July 31 Using the space provided below and on the next page, record the appropriate journal entries for these transactions with the appropriate date (no journal entry description is required). Include only journal entries that relate to July business. If no journal entry is needed, write the transaction date and "NO ENTRY".

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Date Jul01 Petty Cash Cash Jul06 Cash Jul04 Accounts Payable Inventory 1025 To rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started