Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions occurred between Gregory Pharmaceuticals and Atwater Drug Stores during December of the current year. (Click the icon to view the transactions.) Required

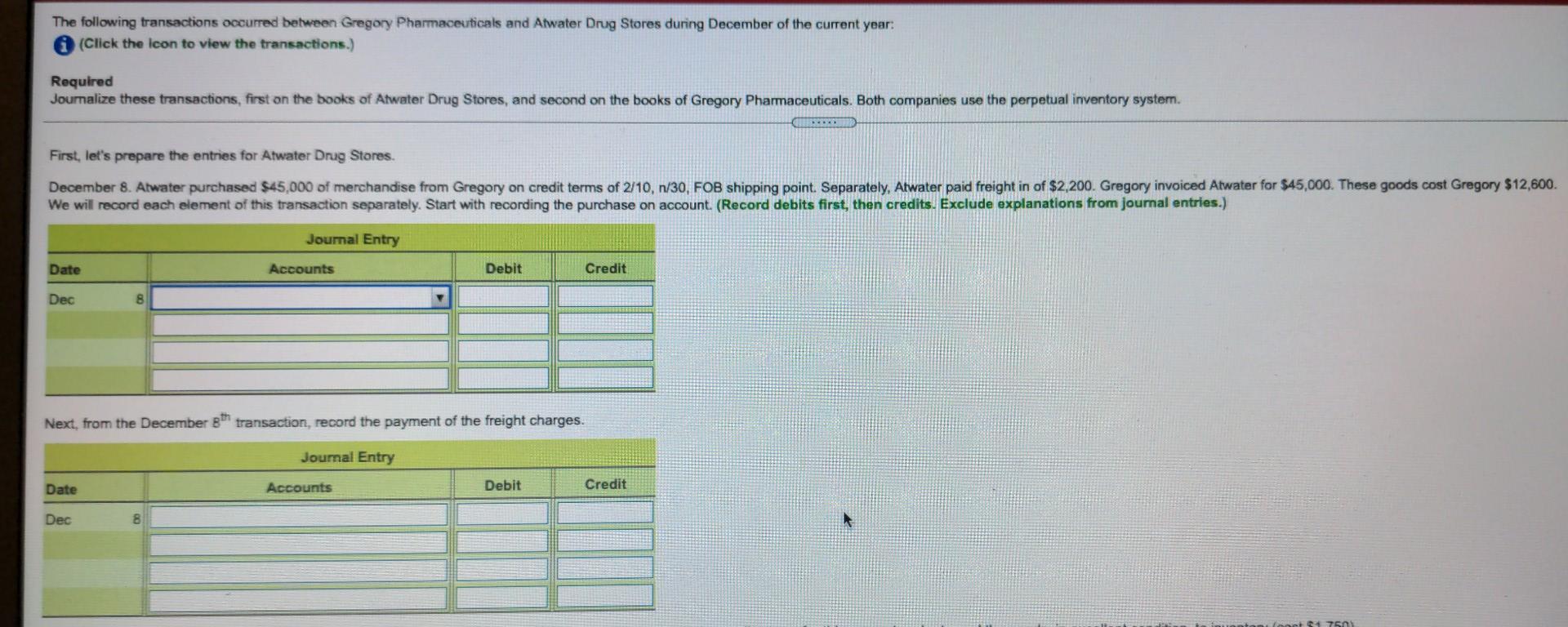

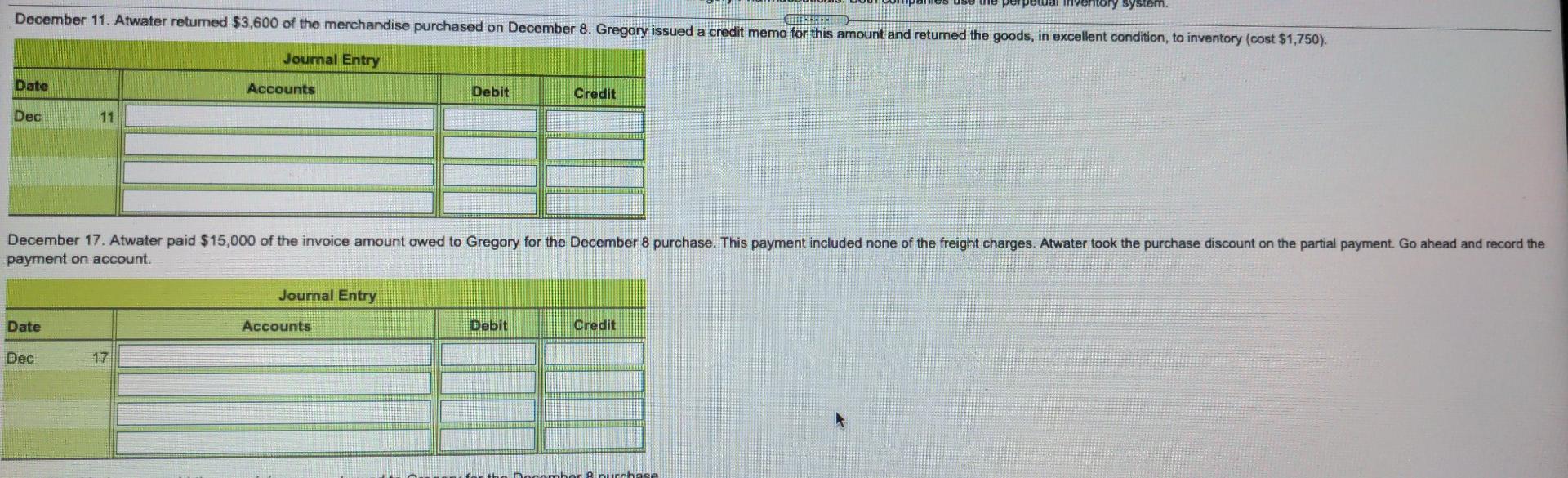

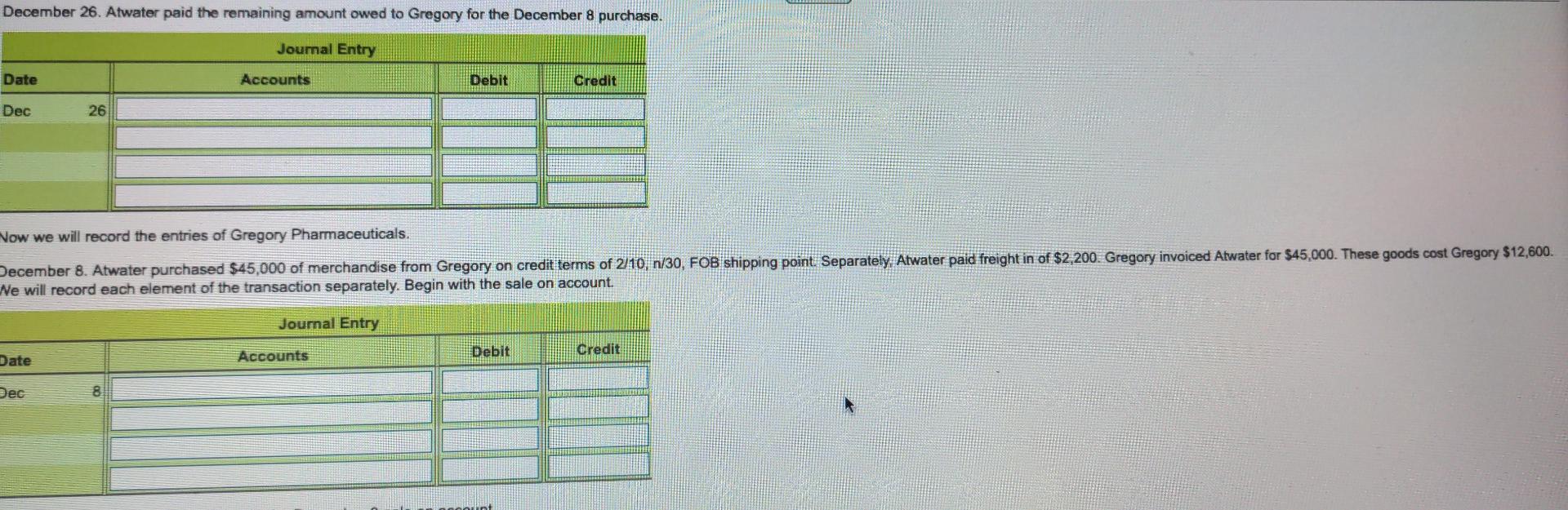

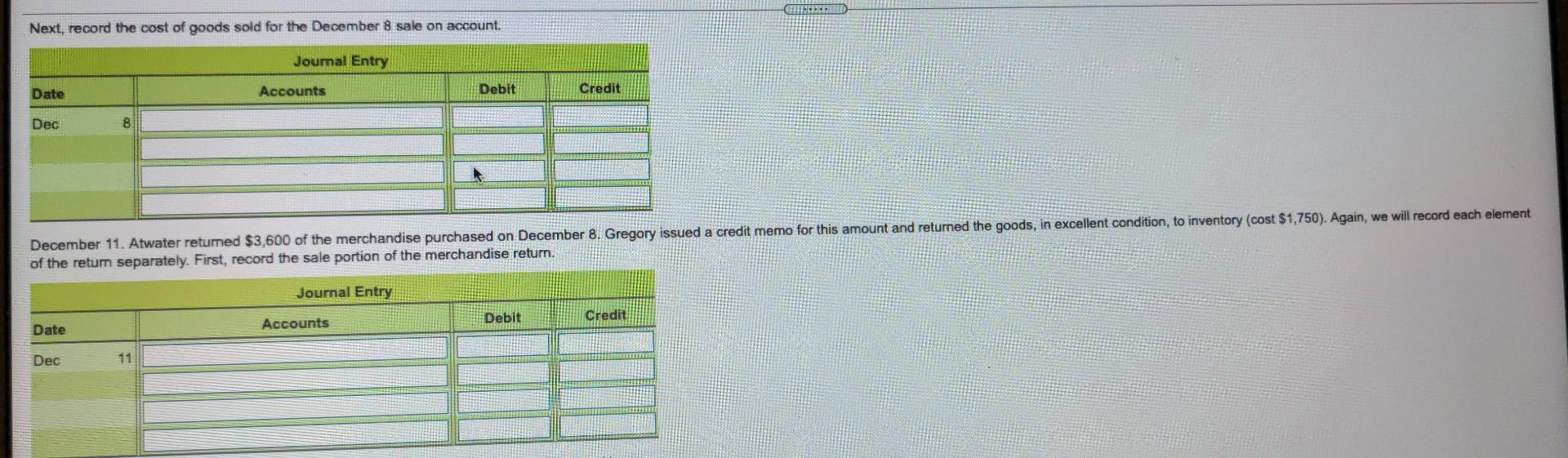

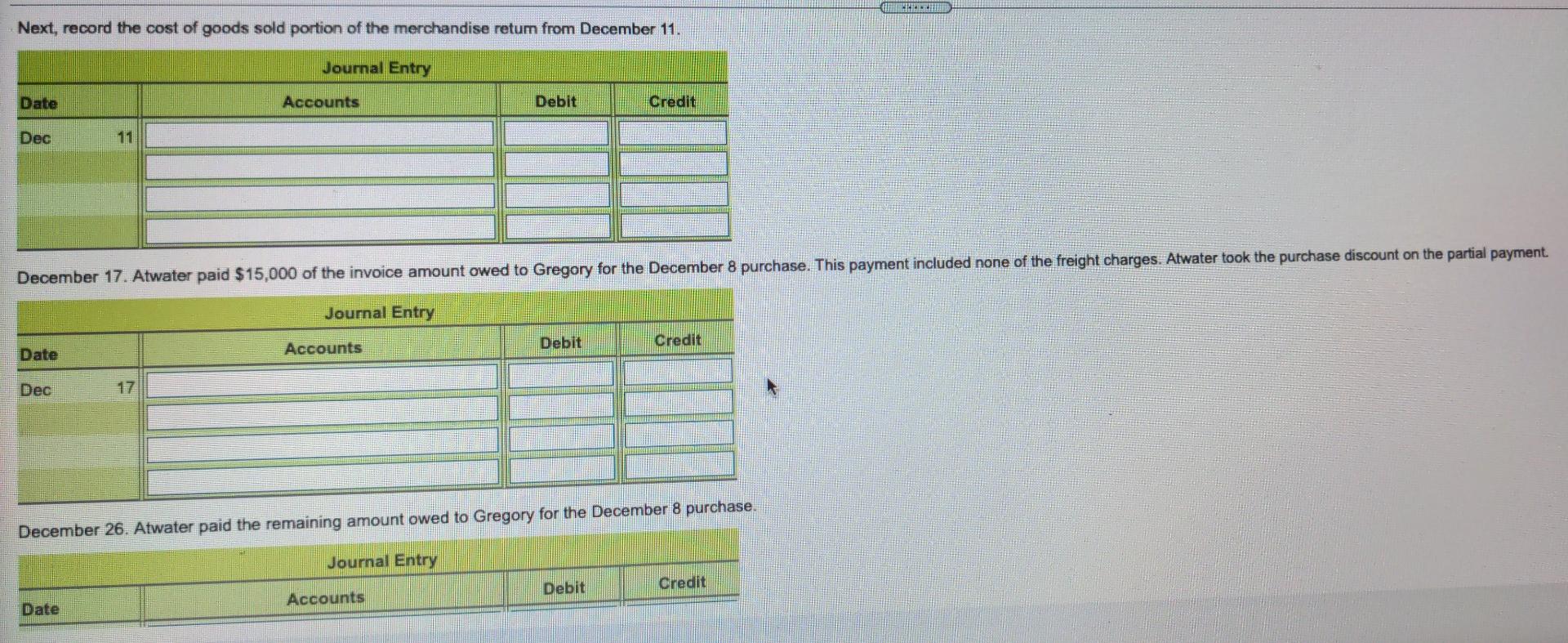

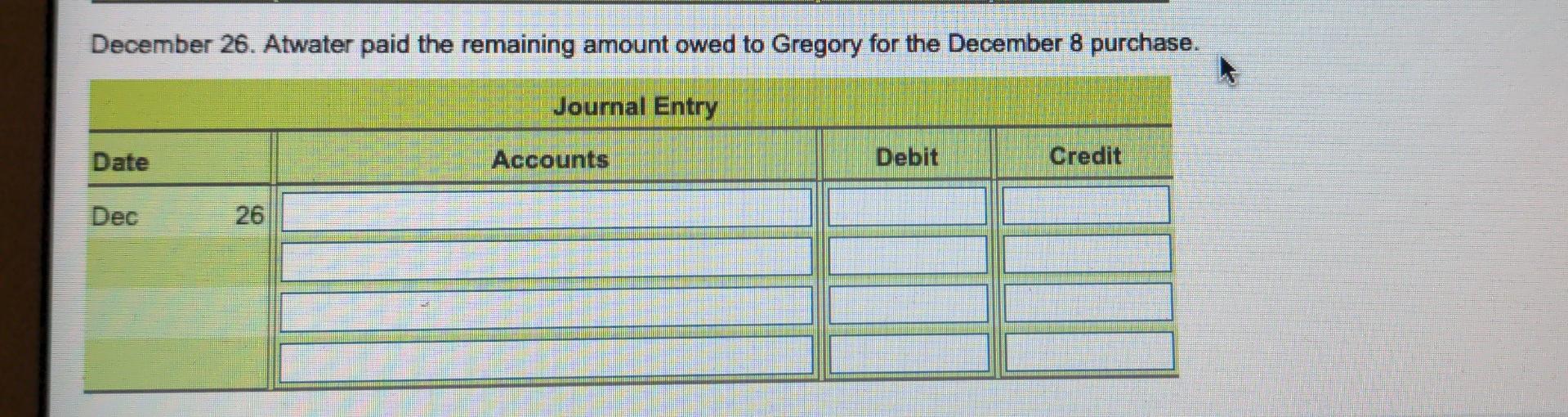

The following transactions occurred between Gregory Pharmaceuticals and Atwater Drug Stores during December of the current year. (Click the icon to view the transactions.) Required Journalize these transactions, first on the books of Atwater Drug Stores, and second on the books of Gregory Pharmaceuticals. Both companies use the perpetual inventory system. C First, let's prepare the entries for Atwater Drug Stores. December 8. Atwater purchased $45,000 of merchandise from Gregory on credit terms of 2/10, n/30, FOB shipping point. Separately, Atwater paid freight in of $2,200. Gregory invoiced Atwater for $45,000. These goods cost Gregory $12,600. We will record each element of this transaction separately. Start with recording the purchase on account. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Dec 8 Next, from the December 8th transaction, record the payment of the freight charges. Journal Entry Date Accounts Debit Credit Dec 8 750 al inventory system. December 11. Atwater retumed $3,600 of the merchandise purchased on December 8. Gregory issued a credit memo for this amount and returned the goods, in excellent condition, to inventory (cost $1,750). Journal Entry Date Accounts Debit Credit Dec 11 December 17. Atwater paid $15,000 of the invoice amount owed to Gregory for the December 8 purchase. This payment included none of the freight charges. Atwater took the purchase discount on the partial payment. Go ahead and record the payment on account. Journal Entry Date Accounts Debit Credit Dec 17 nurchase December 26. Atwater paid the remaining amount owed to Gregory for the December 8 purchase. Journal Entry Date Accounts Debit Credit Dec 26 Now we will record the entries of Gregory Pharmaceuticals. December 8. Atwater purchased $45,000 of merchandise from Gregory on credit terms of 210, n/30, FOB shipping point Separately, Atwater paid freight in of $2,200. Gregory invoiced Atwater for $45,000. These goods cost Gregory $12,600. Ne will record each element of the transaction separately. Begin with the sale on account. Journal Entry Accounts Debit Date Credit Dec 8 Next, record the cost of goods sold for the December 8 sale on account. Journal Entry Date Accounts Debit Credit Dec 8 December 11. Atwater retumed $3,600 of the merchandise purchased on December 8. Gregory issued a credit memo for this amount and returned the goods, in excellent condition, to inventory (cost $1,750). Again, we will record each element of the retum separately. First, record the sale portion of the merchandise return. Journal Entry Debit Credit Date Accounts Dec 11 Next, record the cost of goods sold portion of the merchandise retum from December 11. Journal Entry Date Accounts Debit Credit Dec 11 December 17. Atwater paid $15,000 of the invoice amount owed to Gregory for the December 8 purchase. This payment included none of the freight charges. Atwater took the purchase discount on the partial payment. Journal Entry Accounts Debit Date Credit Dec 17 December 26. Atwater paid the remaining amount owed to Gregory for the December 8 purchase. Journal Entry Debit Credit Accounts Date December 26. Atwater paid the remaining amount owed to Gregory for the December 8 purchase. Journal Entry Date Accounts Debit Credit Dec 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started