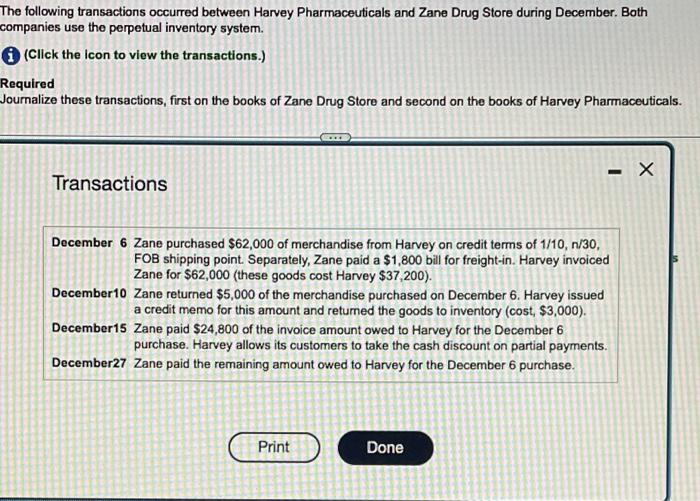

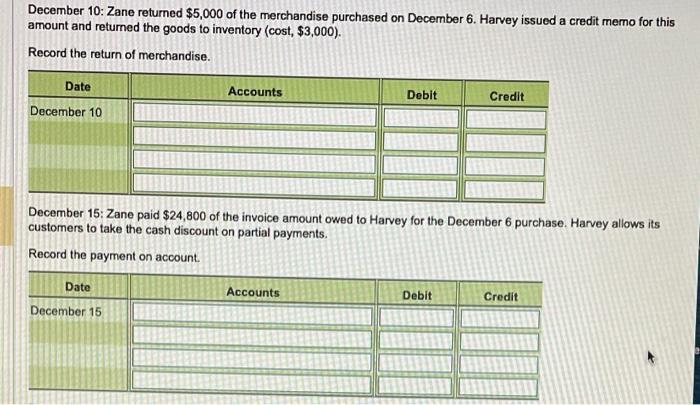

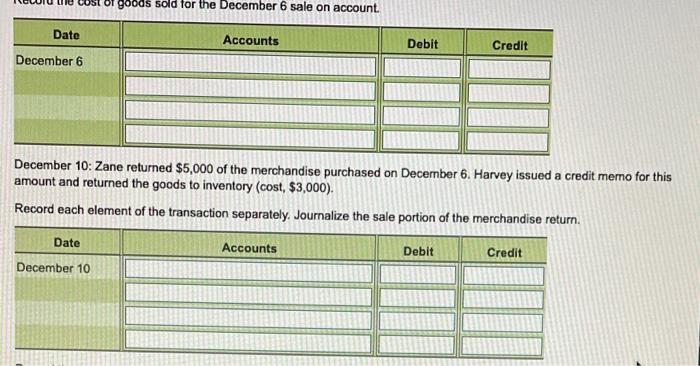

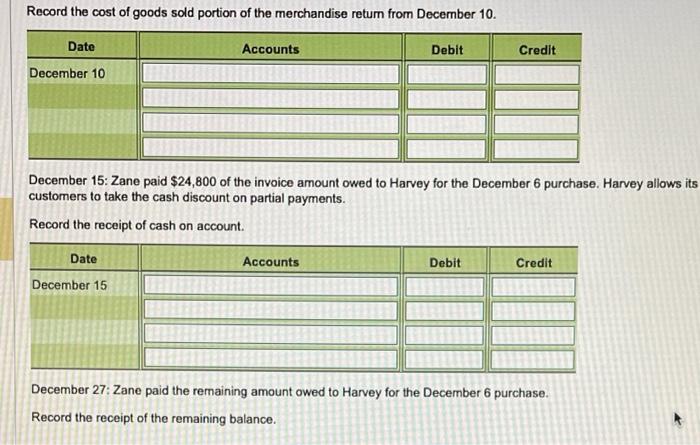

The following transactions occurred between Harvey Pharmaceuticals and Zane Drug Store during December. Both ompanies use the perpetual inventory system. i) (Click the icon to view the transactions.) Required ournalize these transactions, first on the books of Zane Drug Store and second on the books of Harvey Pharmaceutical Transactions December 6 Zane purchased $62,000 of merchandise from Harvey on credit terms of 1/10,n/30, FOB shipping point. Separately, Zane paid a $1,800 bill for freight-in. Harvey invoiced Zane for $62,000 (these goods cost Harvey $37,200 ). December10 Zane returned $5,000 of the merchandise purchased on December 6 . Harvey issued a credit memo for this amount and retumed the goods to inventory ( cost, $3,000). December15 Zane paid $24,800 of the invoice amount owed to Harvey for the December 6 purchase. Harvey allows its customers to take the cash discount on partial payments. December27 Zane paid the remaining amount owed to Harvey for the December 6 purchase. First, prepare the entries for Zane Drug Stores. December 6: Zane purchased $62,000 of merchandise from Harvey on credit terms of 1/10,n/30, FOB shipping point. Separately, Zane paid a $1,800 bill for freight-in. Harvey invoiced Zane for $62,000 (these goods cost Harvey $37,200 ). Record the December 6 purchase on account. We will record each element of this transaction separately. (Record debits first, then credits. Exclude explanations from journal entries.) Next, record the entry for freight from the December 6 purchase. December 10: Zane returned $5,000 of the merchandise purchased on December 6 . Harvey issued a credit memo for this amount and returned the goods to inventory (cost, $3,000). Record the return of merchandise. December 15: Zane paid $24,800 of the invoice amount owed to Harvey for the December 6 purchase. Harvey allows its customers to take the cash discount on partial payments. Record the payment on account. December 27: Zane paid the remaining amount owed to Harvey for the December 6 purchase. Now record the journal entries of Harvey Pharmaceuticals. December 6: Zane purchased $62,000 of merchandise from Harvey on credit terms of 1/10,n/30, FOB shipping point. Separatoly, Zane paid a $1,800 bill for freight-in. Harvey invoiced Zane for $62,000 (these goods cost Harvey $37,200 ). Record each event in this transaction separately. Begin with recording the sale on account. December 10: Zane returned $5,000 of the merchandise purchased on December 6 . Harvey issued a credit memo for this amount and returned the goods to inventory (cost, $3,000). Record each element of the transaction separately. Journalize the sale portion of the merchandise return. Record the cost of goods sold portion of the merchandise retum from December 10. December 15: Zane paid $24,800 of the invoice amount owed to Harvey for the December 6 purchase. Harvey allows its customers to take the cash discount on partial payments. Record the receipt of cash on account. December 27: Zane paid the remaining amount owed to Harvey for the December 6 purchase. Record the receipt of the remaining balance. December 27: Zane paid the remaining amount owed to Harvey for the December 6 purchase. Record the receipt of the remaining balance