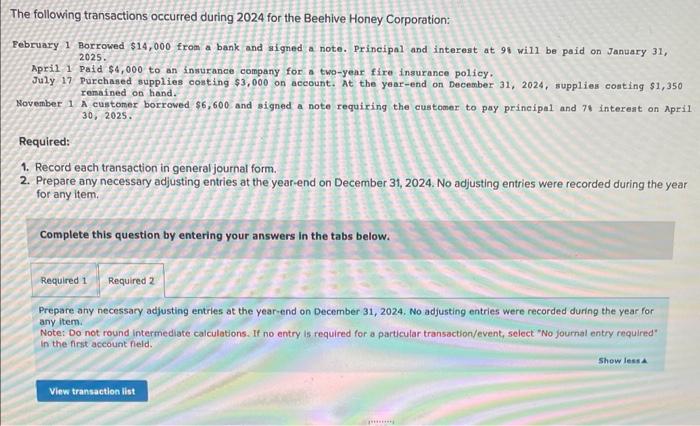

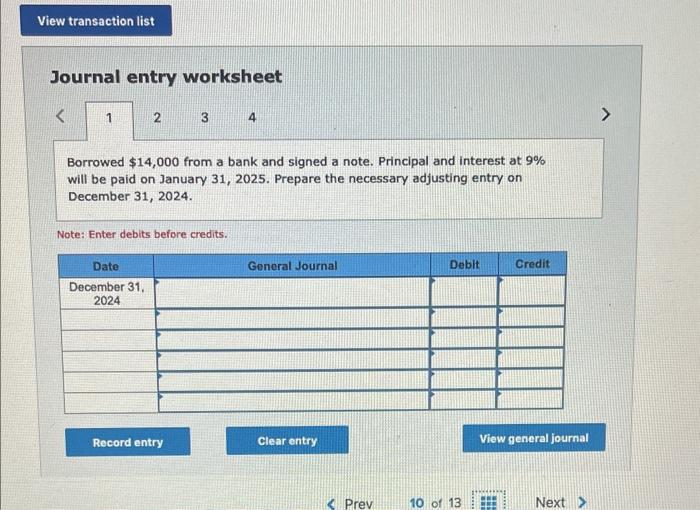

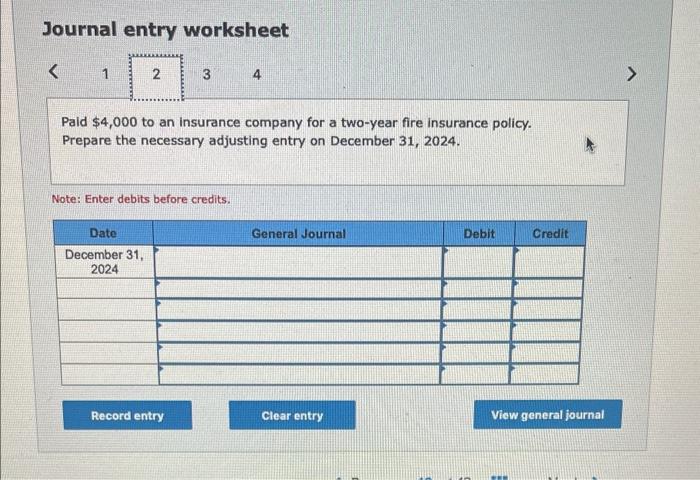

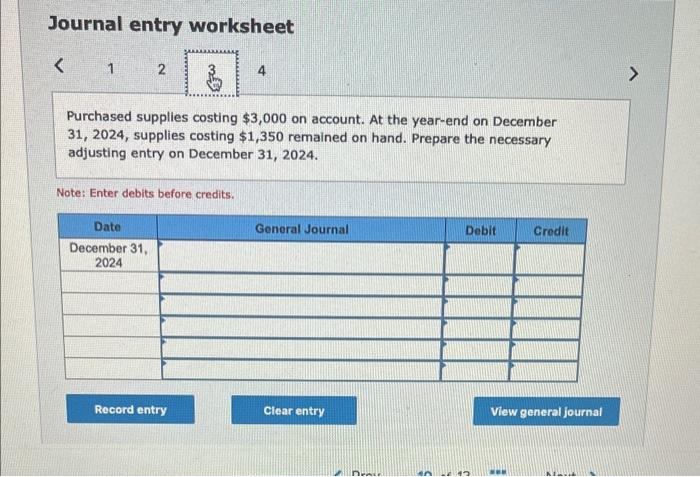

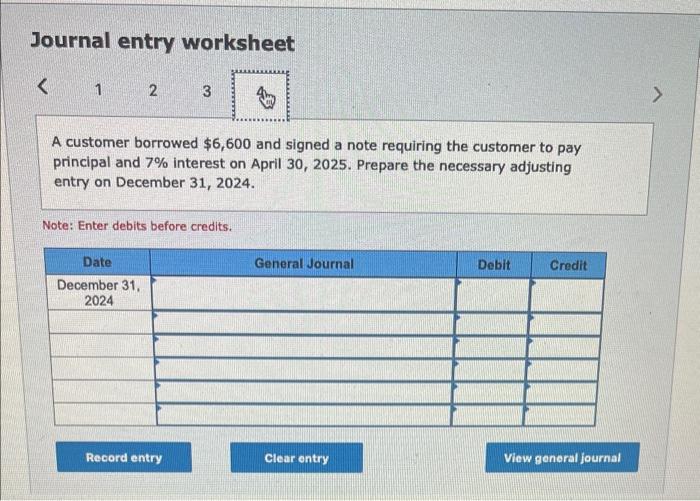

The following transactions occurred during 2024 for the Beehive Honey Corporation: February 1 Borrowed $14,000 from a bank and signed a note. Prineipal and interest at 98 will be paid on January 31 , 2025 April 1 Paid $4,000 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,000 on account. At the year-end on December 31 , 2024, supplies costing $1,350 remained on hand. November 1 A customer borrowed $6,600 and signed a note requiring the customer to pay prineipal and 78 interest on April 30,2025 Required: 1. Record each transaction in general journal form. 2. Prepare any necessary adjusting entries at the year-end on December 31, 2024. No adjusting entries were recorded during the year for any item. Complete this question by entering your answers in the tabs below. Prepare any necessary adjusting entries at the year-end on December 31,2024 . No adjusting entries were recorded during the year for any item. Note: Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Borrowed $14,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,2025 . Prepare the necessary adjusting entry on December 31,2024. Note: Enter debits before credits. Journal entry worksheet 1 Paid $4,000 to an insurance company for a two-year fire insurance policy. Prepare the necessary adjusting entry on December 31, 2024. Note: Enter debits before credits. Journal entry worksheet Purchased supplies costing $3,000 on account. At the year-end on December 31, 2024, supplies costing $1,350 remained on hand. Prepare the necessary adjusting entry on December 31,2024. Note: Enter debits before credits. Journal entry worksheet 1 A customer borrowed $6,600 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2025. Prepare the necessary adjusting entry on December 31,2024. Note: Enter debits before credits