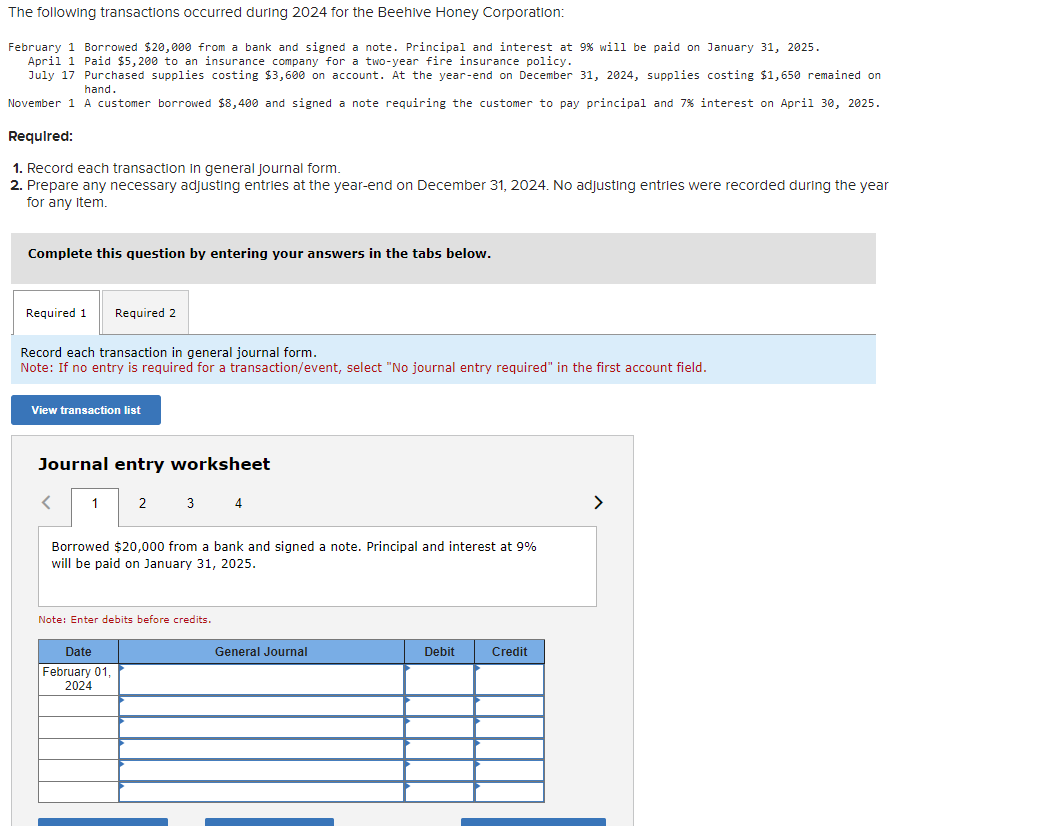

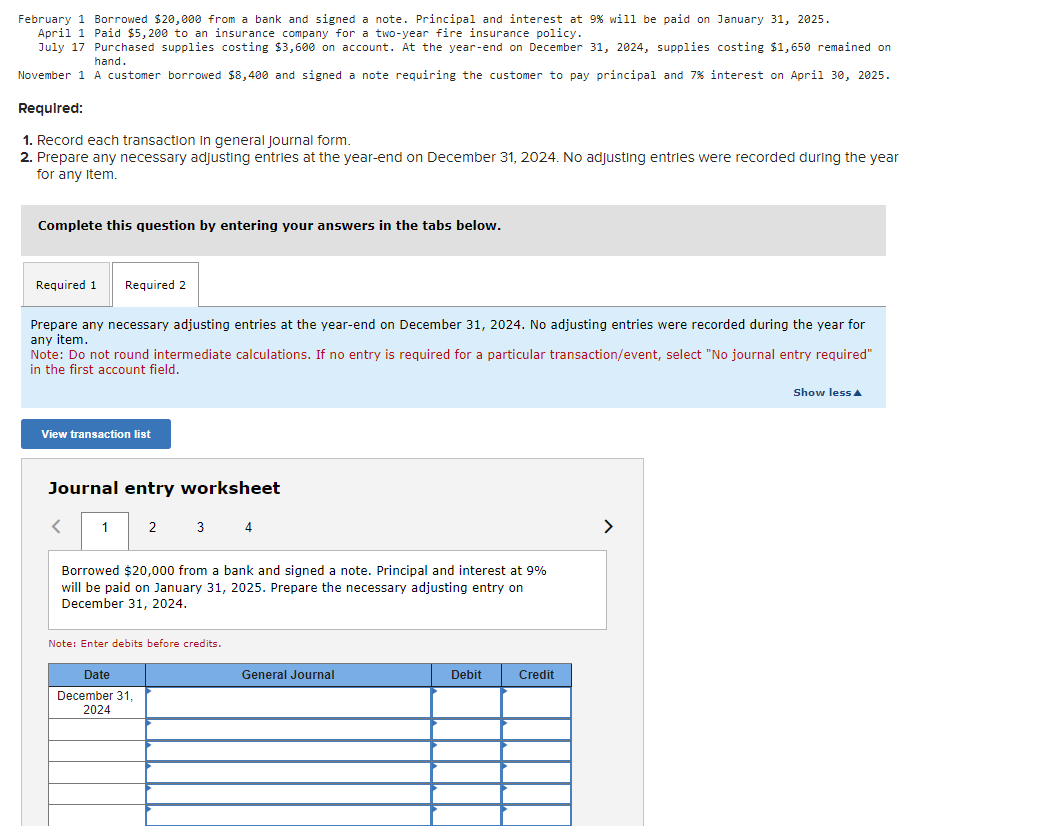

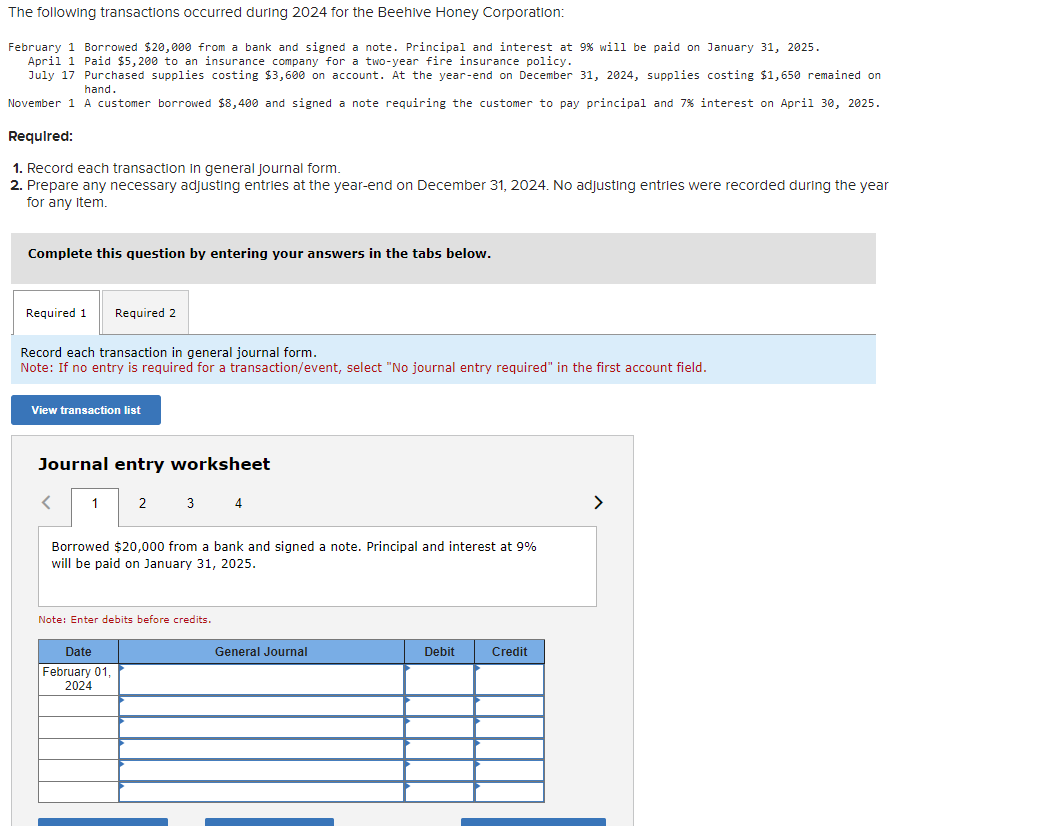

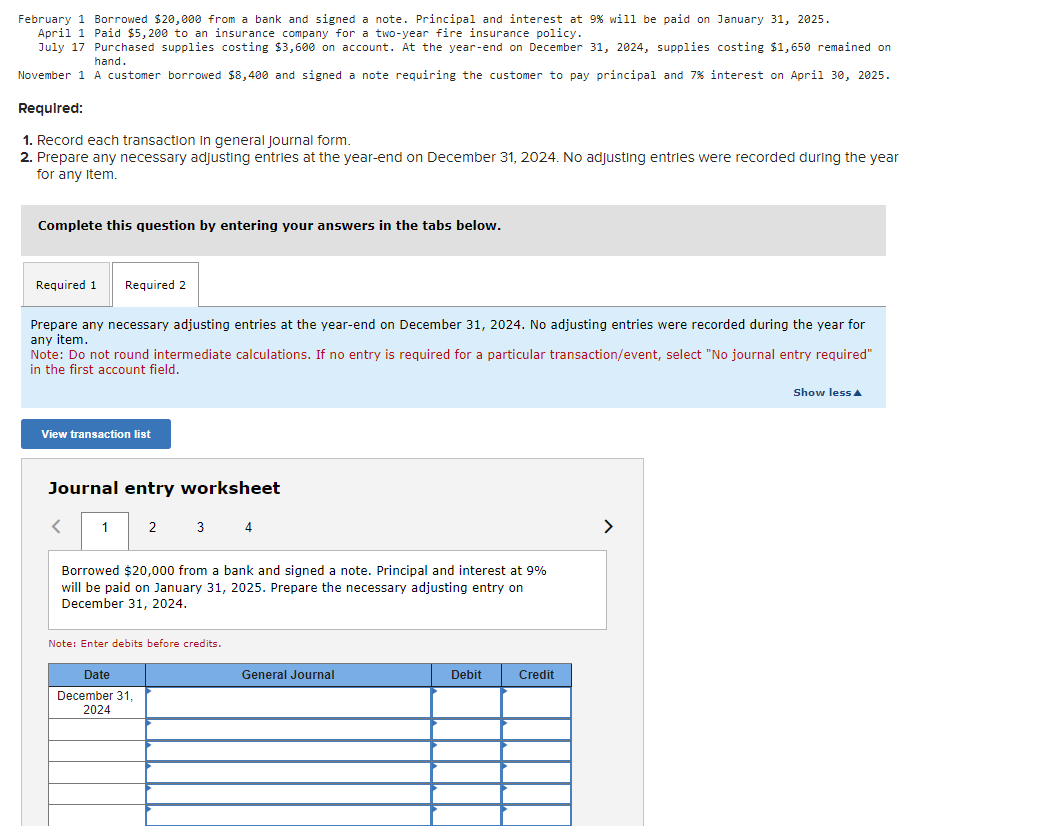

The following transactions occurred during 2024 for the Beehive Honey Corporation: February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31 , 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31,2024 , supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30 , 2025. Required: 1. Record each transaction in general journal form. 2. Prepare any necessary adjusting entries at the year-end on December 31,2024 . No adjusting entries were recorded during the year for any item. Complete this question by entering your answers in the tabs below. Record each transaction in general journal form. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 4 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,2025. Note: Enter debits before credits. February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31 , 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31,2024 , supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30 , 2025 . Required: 1. Record each transaction in general journal form. 2. Prepare any necessary adjusting entries at the year-end on December 31,2024 . No adjusting entries were recorded during the year for any Item. Complete this question by entering your answers in the tabs below. Prepare any necessary adjusting entries at the year-end on December 31,2024 . No adjusting entries were recorded during the year for any item. Note: Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Show less A Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,2025 . Prepare the necessary adjusting entry on December 31,2024. Note: Enter debits before credits