Question

The following transactions occurred during August 2017: The owner contributed an additional $2,000 cash and equipment valued at $5,000 to the business. Purchased land for

The following transactions occurred during August 2017:

The owner contributed an additional $2,000 cash and equipment valued at $5,000 to the business.

Purchased land for $260,000 by arranging a mortgage with the bank.

Paid $1,500 cash to purchase a computer for the business.

Purchased a motor vehicle for $36,000 by arranging a promissory note with a lender.

Paid $3,000 to creditor (Accounts Payable) for goods previously purchased in July.

Paid $150 for a telephone bill that related to charges incurred during July. An adjusting entry for $150 was made at the end of July to accrue this telephone expense.

Performed consulting services for a customer and received $6,000 cash.

Billed (invoiced) a client $9,000 for consulting services performed during August.

Received $4,000 cash from customers who had previously been billed (invoiced) for services performed during July.

Received and paid an invoice for $2,000 relating to Augusts advertising expense.

Distributed $7,000 cash dividends to the owner of the business.

Received $1,000 cash for consulting services to be performed in September. The cash receipt was recorded as a liability.

Received $2,000 cash for consulting services to be performed in September. The cash receipt was recorded as revenue.

Purchased supplies on credit $700. The supplies purchased were recorded as an asset.

Paid $1,200 for a 12-month insurance policy. The insurance was recorded as an asset.

Paid $6,000 cash for rent for August, September and October. The business recorded the rent as an expense.

Required: A. Record the above transactions inageneral journal using only the ledger accounts given.

B. Post to the ledger,(rememberingfirsttoentertheopeningbalances).

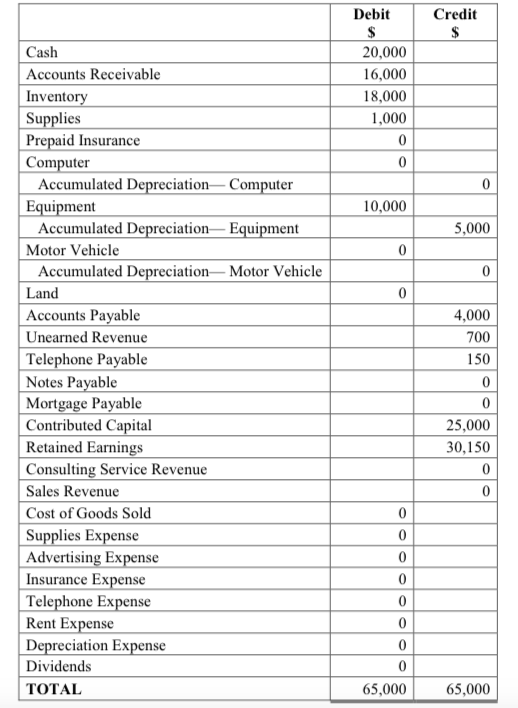

Debit Credit Cash Accounts Receivable Invento Supplies Prepaid Insurance Computer 20,000 16,000 18,000 1,000 Accumulated DepreciationComputer Equipment 10,000 5,000 Accumulated DepreciationEquipment Motor Vehicle Accumulated Depreciation-Motor Vehicle Land Accounts Payable Unearned Kevenue 4,000 700 150 Tel ephone Payable Notes Payable Mortgage Payable Contributed Capital Retained Earnings Consulting Service Revenue Sales Revenue Cost of Goods Sold Supplies Expense Advertising Expense Insurance Expense Telephone Expense Rent Expense Depreciation Expense Dividends TOTAL 25,000 30,150 65,000 65,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started