Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions occurred during December. Dec. 2 Purchased equipment for $25,600, plus sales taxes of $1,280 (paid in cash). 2 Sarasota sold for $5,600

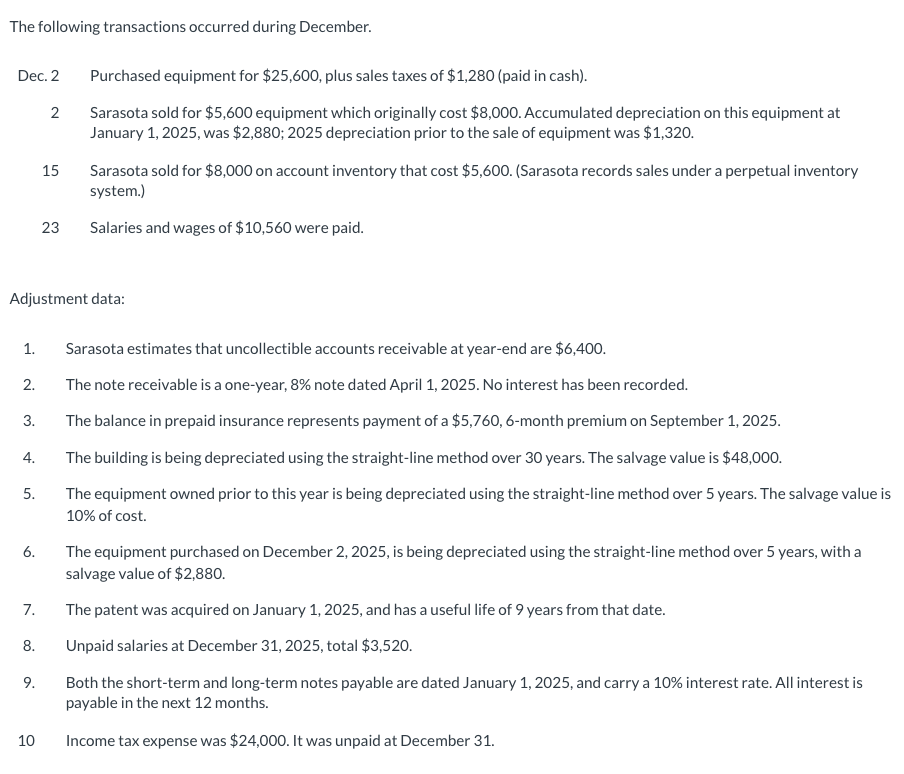

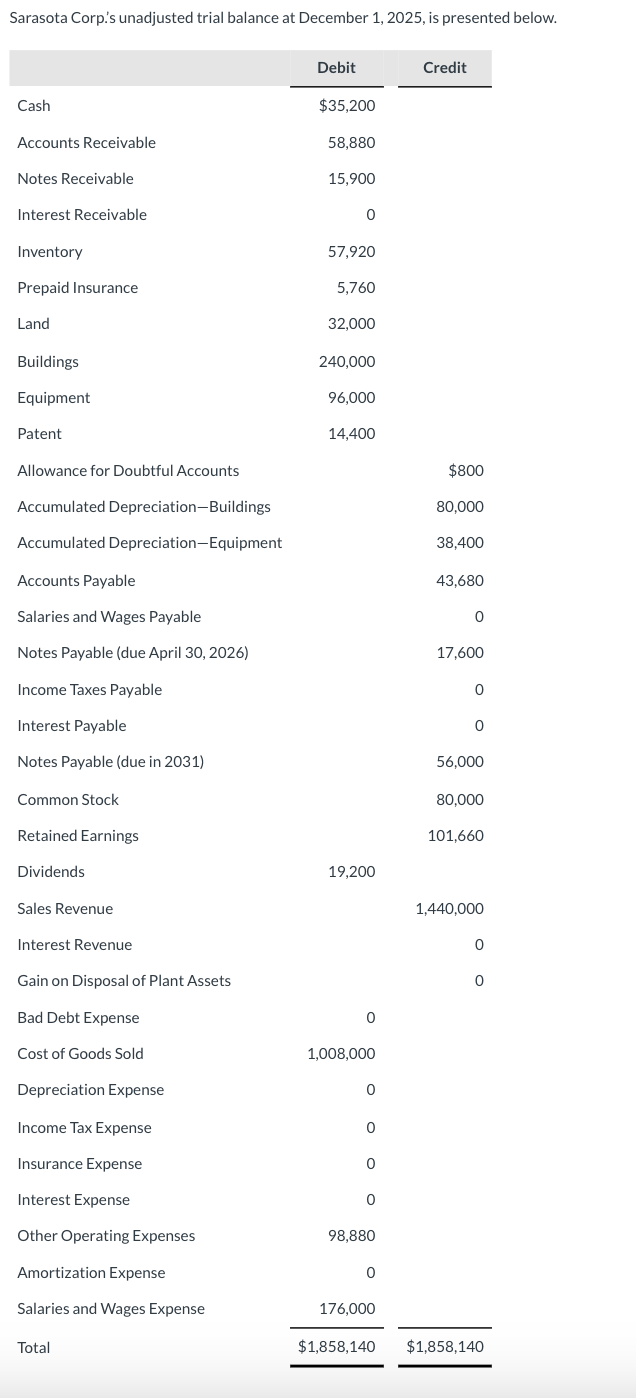

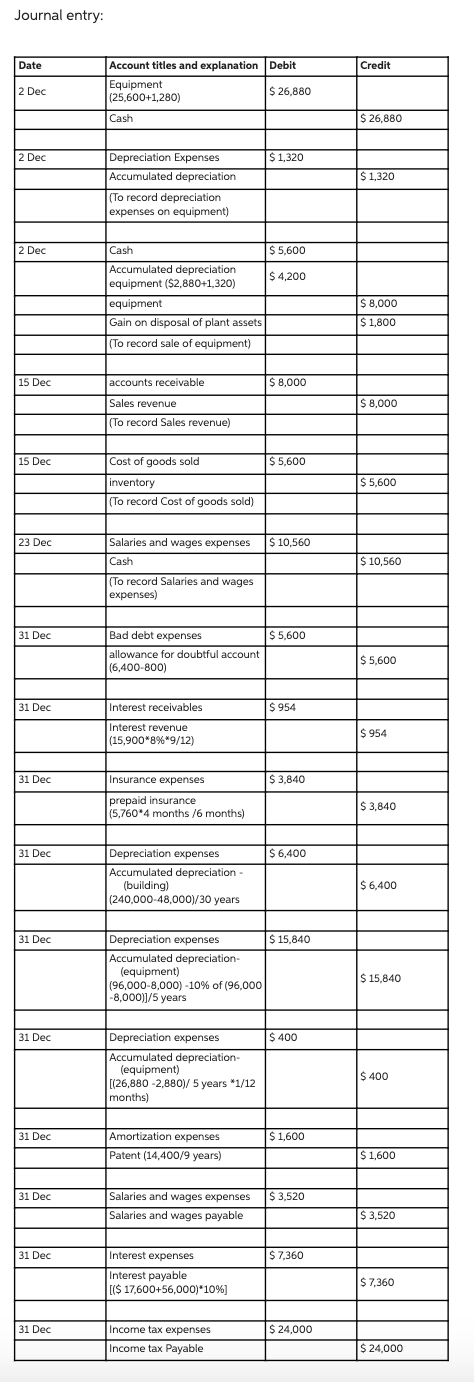

The following transactions occurred during December. Dec. 2 Purchased equipment for $25,600, plus sales taxes of $1,280 (paid in cash). 2 Sarasota sold for $5,600 equipment which originally cost $8,000. Accumulated depreciation on this equipment at January 1,2025 , was $2,880;2025 depreciation prior to the sale of equipment was $1,320. 15 Sarasota sold for $8,000 on account inventory that cost $5,600. (Sarasota records sales under a perpetual inventory system.) 23 Salaries and wages of $10,560 were paid. Adjustment data: 1. Sarasota estimates that uncollectible accounts receivable at year-end are $6,400. 2. The note receivable is a one-year, 8% note dated April 1,2025 . No interest has been recorded. 3. The balance in prepaid insurance represents payment of a \$5,760, 6-month premium on September 1, 2025. 4. The building is being depreciated using the straight-line method over 30 years. The salvage value is $48,000. 5. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The salvage value is 10% of cost. 6. The equipment purchased on December 2, 2025, is being depreciated using the straight-line method over 5 years, with a salvage value of $2,880. 7. The patent was acquired on January 1,2025 , and has a useful life of 9 years from that date. 8. Unpaid salaries at December 31,2025 , total $3,520. 9. Both the short-term and long-term notes payable are dated January 1,2025 , and carry a 10% interest rate. All interest is payable in the next 12 months. 10 Income tax expense was $24,000. It was unpaid at December 31. W. Journal entry

The following transactions occurred during December. Dec. 2 Purchased equipment for $25,600, plus sales taxes of $1,280 (paid in cash). 2 Sarasota sold for $5,600 equipment which originally cost $8,000. Accumulated depreciation on this equipment at January 1,2025 , was $2,880;2025 depreciation prior to the sale of equipment was $1,320. 15 Sarasota sold for $8,000 on account inventory that cost $5,600. (Sarasota records sales under a perpetual inventory system.) 23 Salaries and wages of $10,560 were paid. Adjustment data: 1. Sarasota estimates that uncollectible accounts receivable at year-end are $6,400. 2. The note receivable is a one-year, 8% note dated April 1,2025 . No interest has been recorded. 3. The balance in prepaid insurance represents payment of a \$5,760, 6-month premium on September 1, 2025. 4. The building is being depreciated using the straight-line method over 30 years. The salvage value is $48,000. 5. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The salvage value is 10% of cost. 6. The equipment purchased on December 2, 2025, is being depreciated using the straight-line method over 5 years, with a salvage value of $2,880. 7. The patent was acquired on January 1,2025 , and has a useful life of 9 years from that date. 8. Unpaid salaries at December 31,2025 , total $3,520. 9. Both the short-term and long-term notes payable are dated January 1,2025 , and carry a 10% interest rate. All interest is payable in the next 12 months. 10 Income tax expense was $24,000. It was unpaid at December 31. W. Journal entry Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started