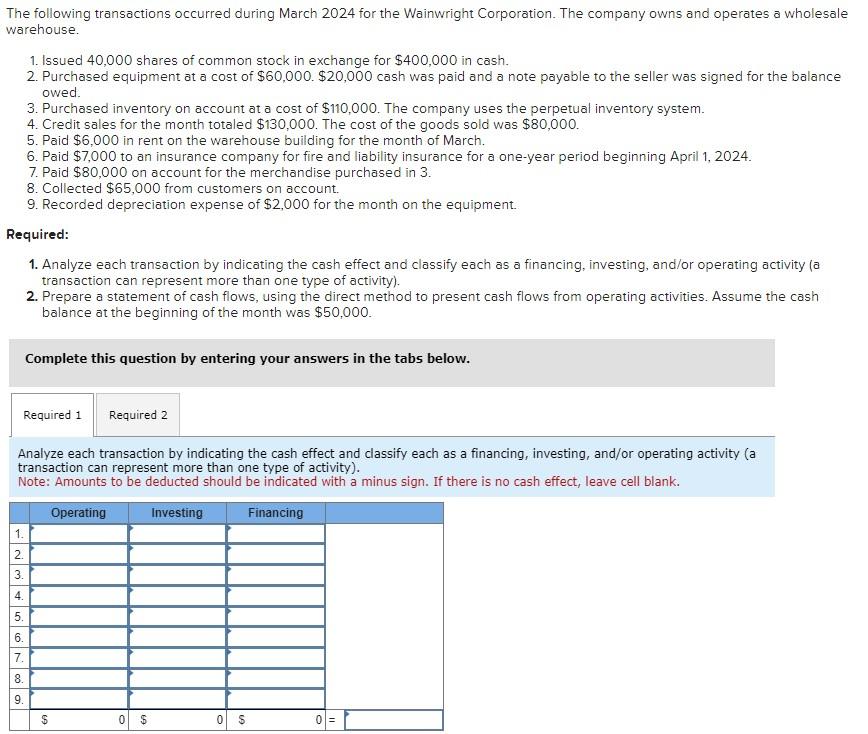

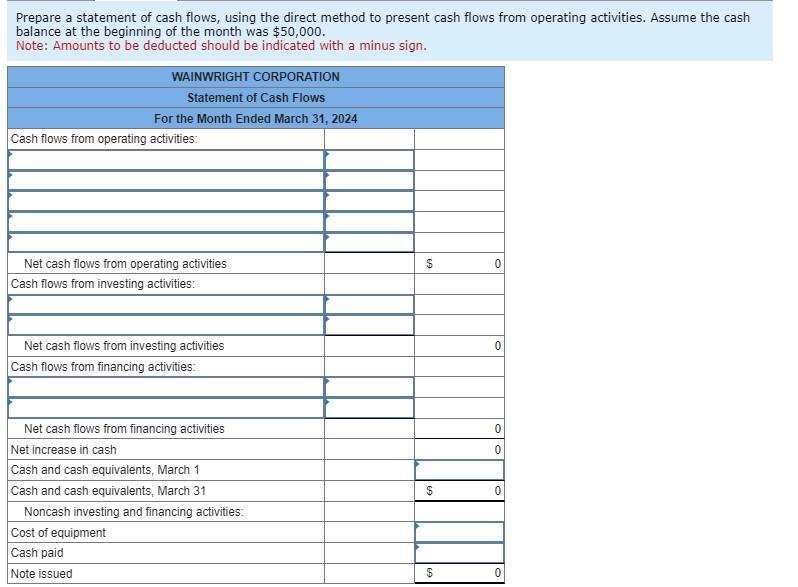

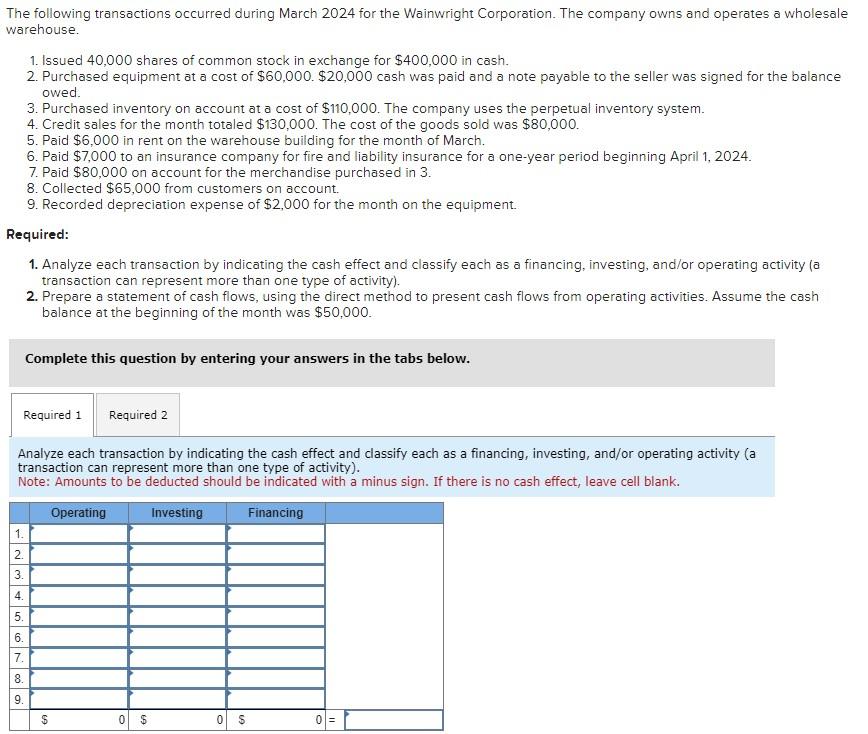

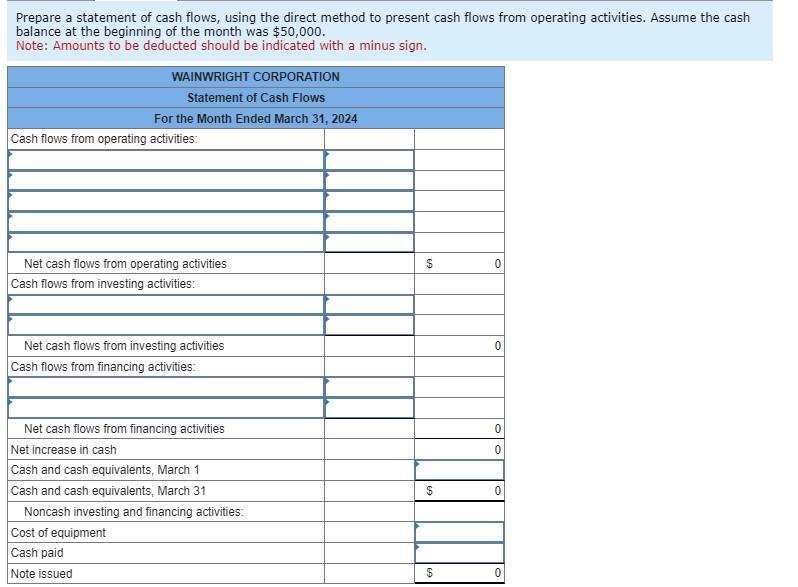

The following transactions occurred during March 2024 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 40,000 shares of common stock in exchange for $400,000 in cash. 2. Purchased equipment at a cost of $60,000.$20,000 cash was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $110,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $130,000. The cost of the goods sold was $80,000. 5. Paid $6,000 in rent on the warehouse building for the month of March. 6. Paid $7,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $80,000 on account for the merchandise purchased in 3 . 8. Collected $65,000 from customers on account. 9. Recorded depreciation expense of $2,000 for the month on the equipment. Required: 1. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). 2. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $50,000. Complete this question by entering your answers in the tabs below. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). Note: Amounts to be deducted should be indicated with a minus sign. If there is no cash effect, leave cell blank. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $50,000. The following transactions occurred during March 2024 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 40,000 shares of common stock in exchange for $400,000 in cash. 2. Purchased equipment at a cost of $60,000.$20,000 cash was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $110,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $130,000. The cost of the goods sold was $80,000. 5. Paid $6,000 in rent on the warehouse building for the month of March. 6. Paid $7,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $80,000 on account for the merchandise purchased in 3 . 8. Collected $65,000 from customers on account. 9. Recorded depreciation expense of $2,000 for the month on the equipment. Required: 1. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). 2. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $50,000. Complete this question by entering your answers in the tabs below. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). Note: Amounts to be deducted should be indicated with a minus sign. If there is no cash effect, leave cell blank. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $50,000