Question

The following transactions occurred during November:(a)?Purchased materials on account, P80,000.(b)?Requisitioned P60,000 of materials from inventory: P15,000 applied to Job#180, P25,000 to Job#181, and P16,000 to

The following transactions occurred during November:(a)?Purchased materials on account, P80,000.(b)?Requisitioned P60,000 of materials from inventory: P15,000 applied to Job#180, P25,000 to Job#181, and P16,000 to Job#182, a new order; the balance was for indirect materials.(c)?Recorded the liability for the payroll and the labor cost distribution in a single entry: total payroll, P208,750. Of the payroll cost, 10% applied to Job#179, 20% to Job#180, 35% to IJob#181, 30% to Job#182, and the remainder to indirect labor.(d)?Paid the payroll.(e)?Applied factory overhead at the rate of 150% of direct labor cost.(f)?Completed Job#179 and Job#180.(g)?Sold Job#175, Job#177, and Job#180 at 50% over manufacturing costs. Required: 1. Determine the cost of goods sold2. Determine the cost of goods manufactured3. Determine the total manufacturing cost

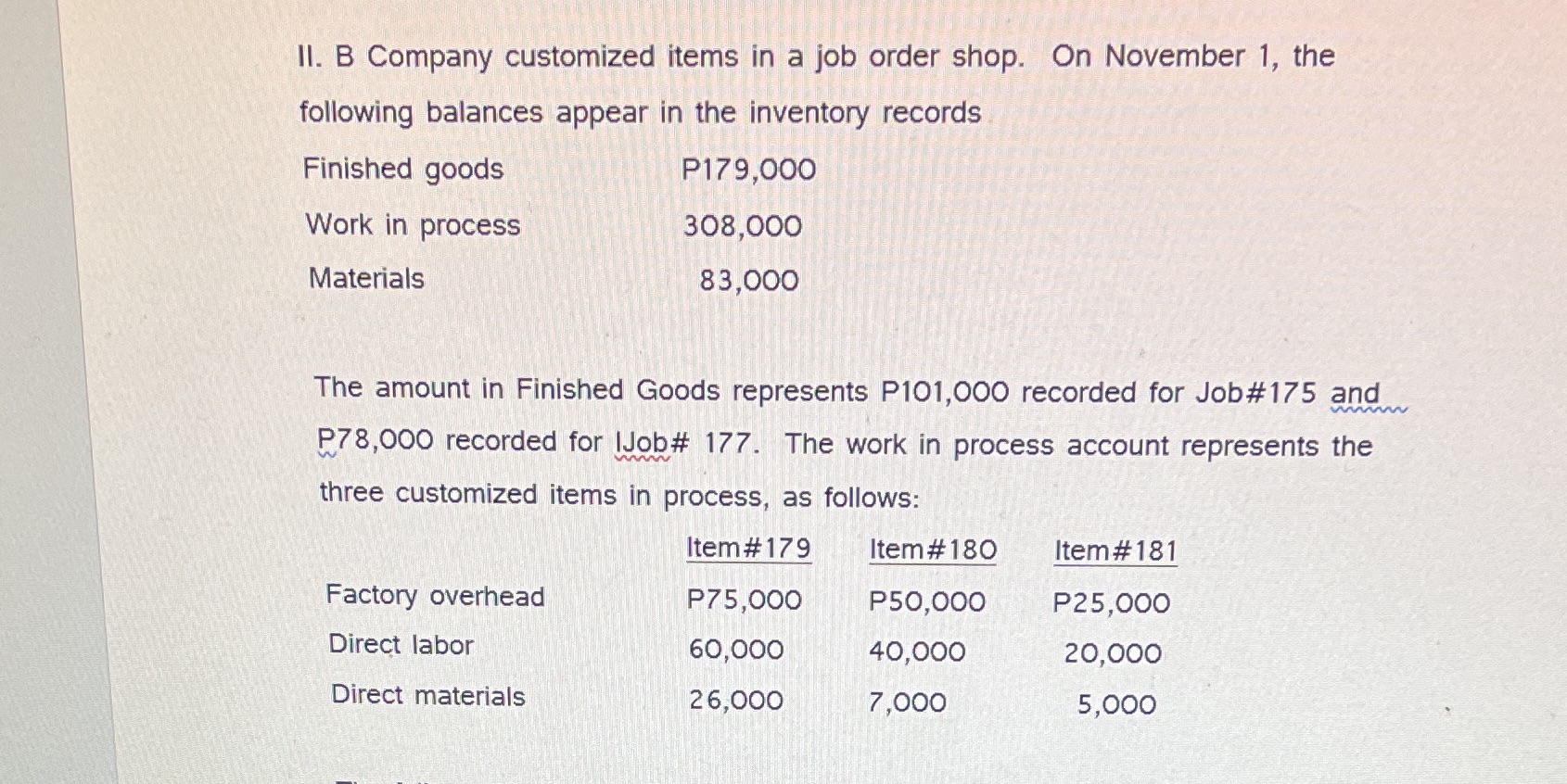

II. B Company customized items in a job order shop. On November 1, the following balances appear in the inventory records Finished goods Work in process Materials P179,000 308,000 83,000 The amount in Finished Goods represents P101,000 recorded for Job #175 and wwwww P78,000 recorded for IJob # 177. The work in process account represents the www three customized items in process, as follows: Item #179 Item #180 Item #181 Factory overhead P75,000 P50,000 P25,000 Direct labor 60,000 40,000 20,000 Direct materials 26,000 7,000 5,000

Step by Step Solution

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

I Solving the Transactions a Purchased materials on account P80000 b Requisitioned materials from in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started