Question

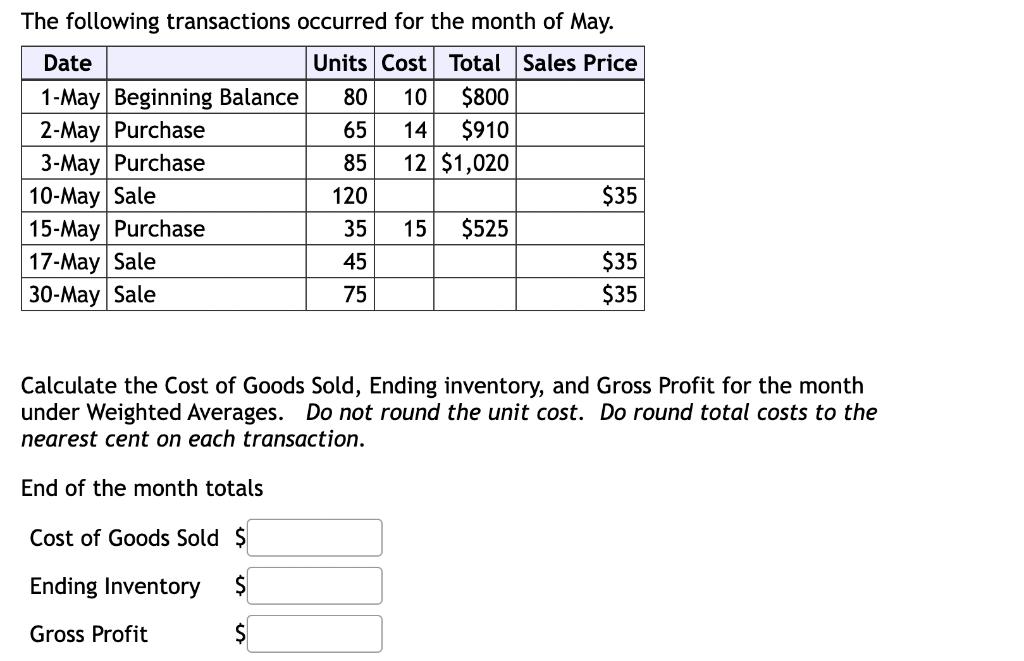

The following transactions occurred for the month of May. Units Cost Total Sales Price $800 14 $910 12 $1,020 Date 1-May Beginning Balance 80

The following transactions occurred for the month of May. Units Cost Total Sales Price $800 14 $910 12 $1,020 Date 1-May Beginning Balance 80 10 2-May Purchase 65 3-May Purchase 85 120 10-May Sale 15-May Purchase 17-May Sale 30-May Sale 35 45 75 15 $525 $35 $35 $35 Calculate the Cost of Goods Sold, Ending inventory, and Gross Profit for the month under Weighted Averages. Do not round the unit cost. Do round total costs to the nearest cent on each transaction. End of the month totals Cost of Goods Sold $ Ending Inventory Gross Profit

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Total cost of units available for sale Beginning balance 80 units x 10 per unit 800 Purchases 65 uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App