Answered step by step

Verified Expert Solution

Question

1 Approved Answer

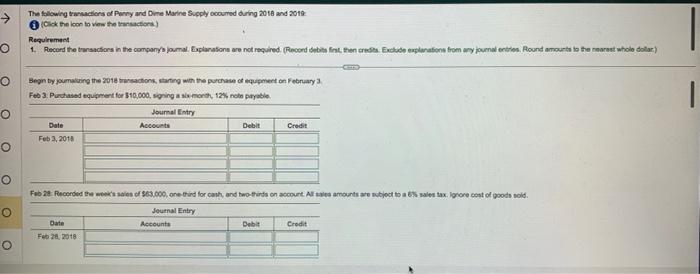

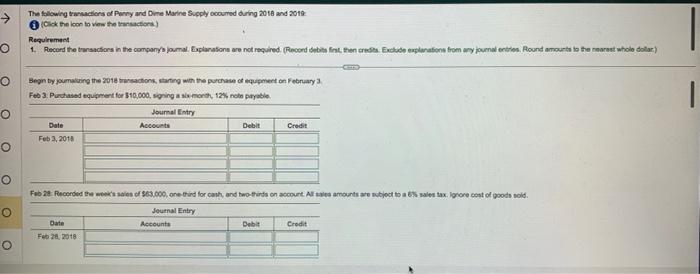

The following transactions of Penny and Dime Marine Supply occurred during 2018 and 2019: Iff (Cick the inon to vire the neiscied diata) Fond the

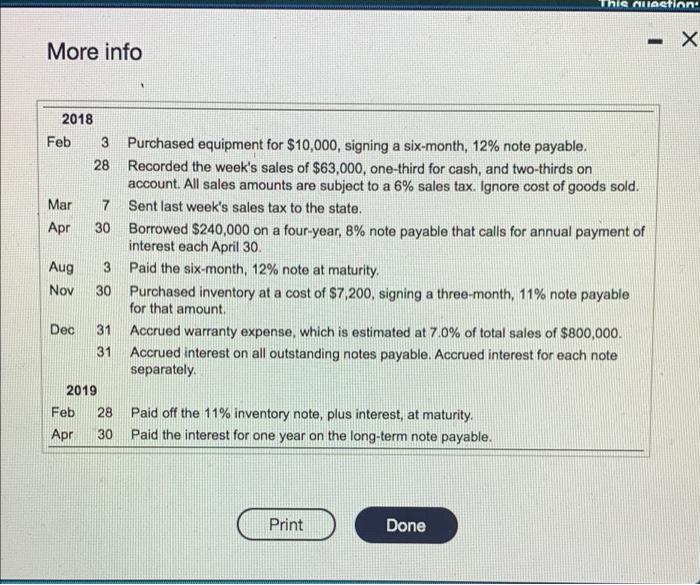

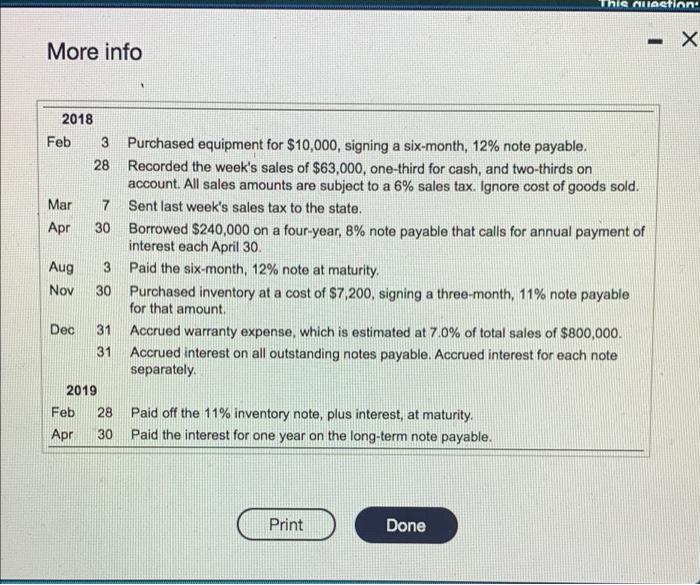

The following transactions of Penny and Dime Marine Supply occurred during 2018 and 2019:

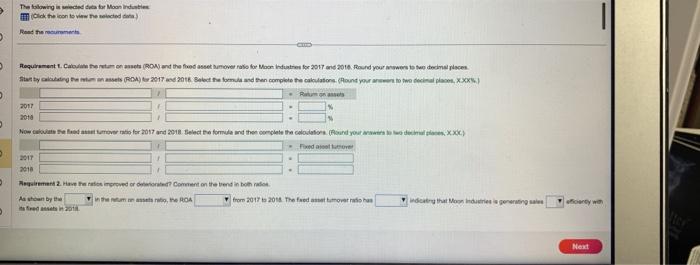

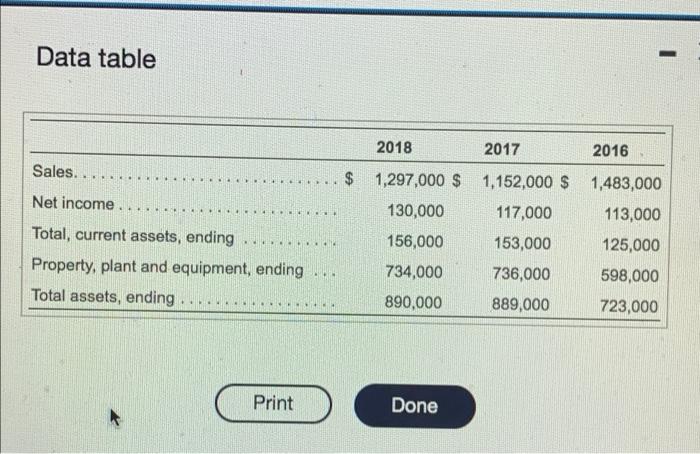

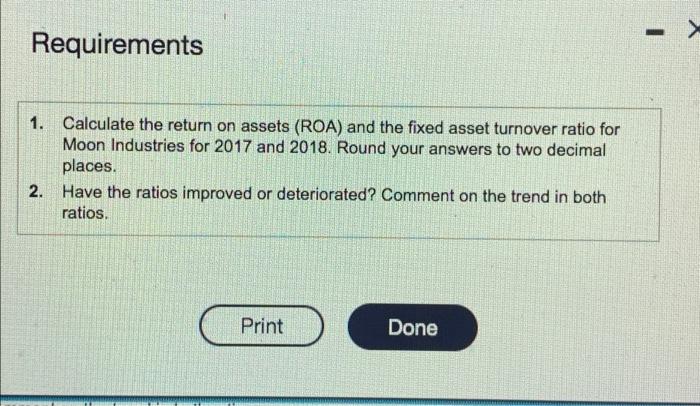

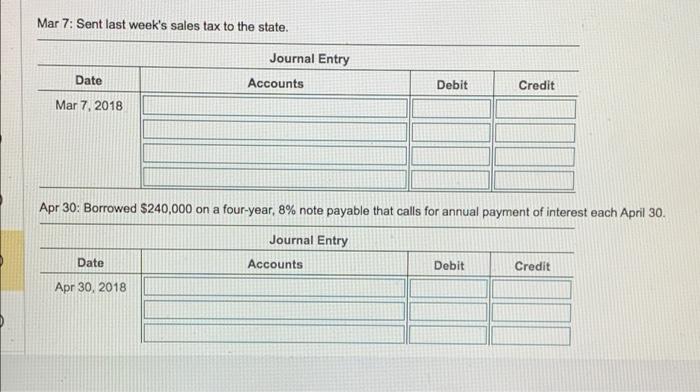

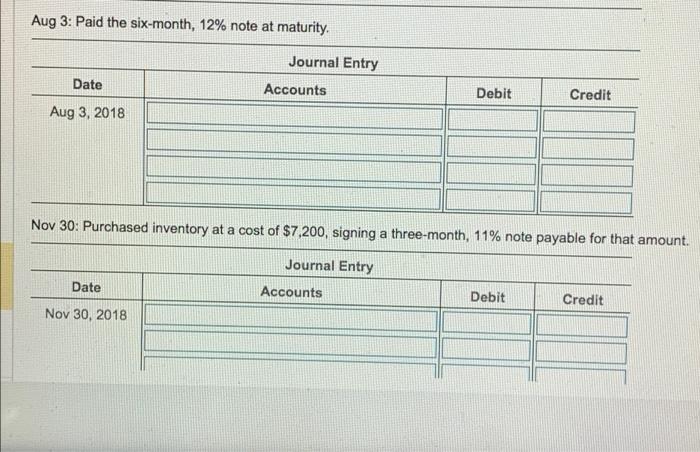

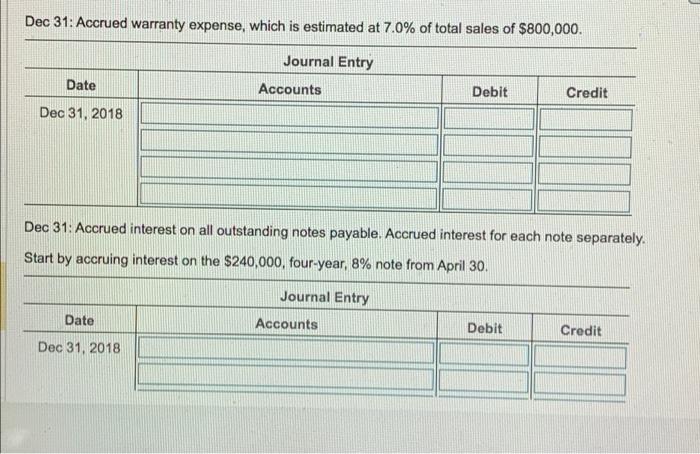

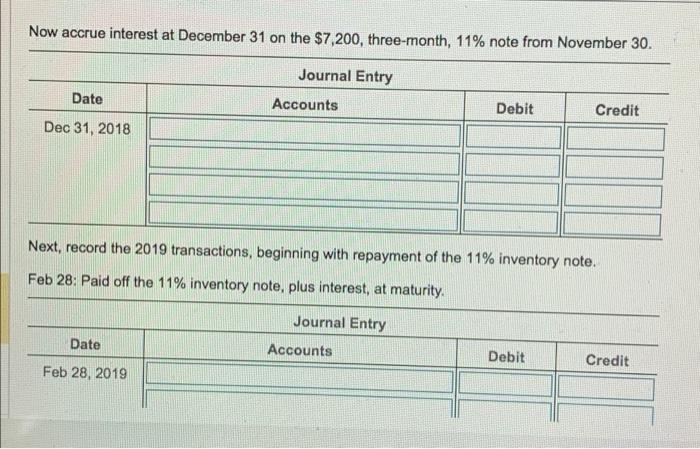

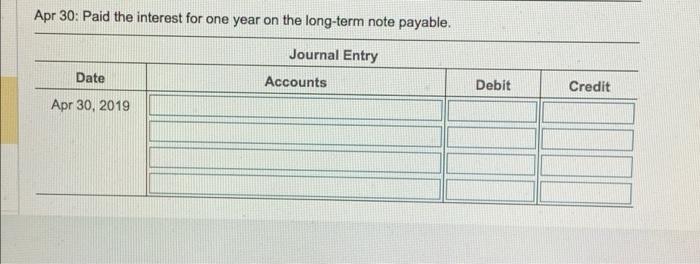

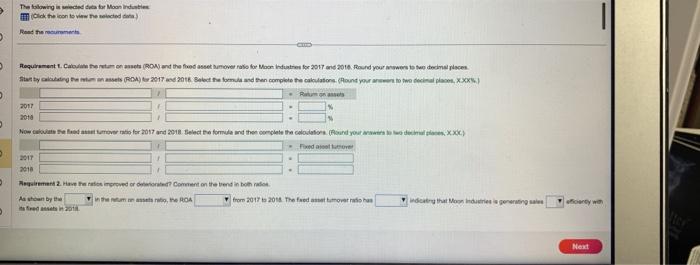

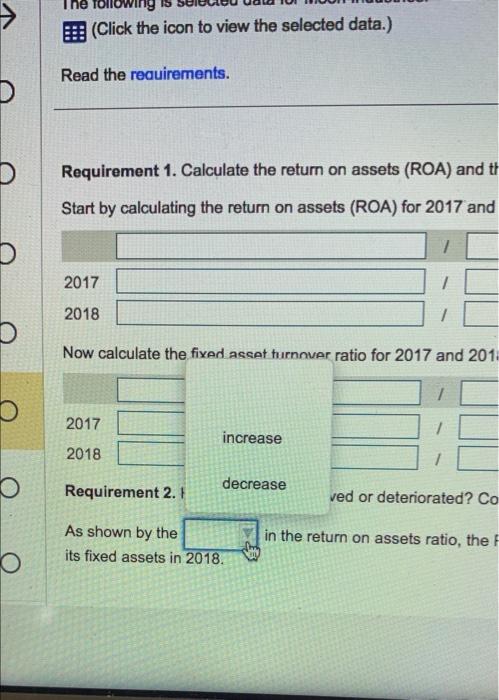

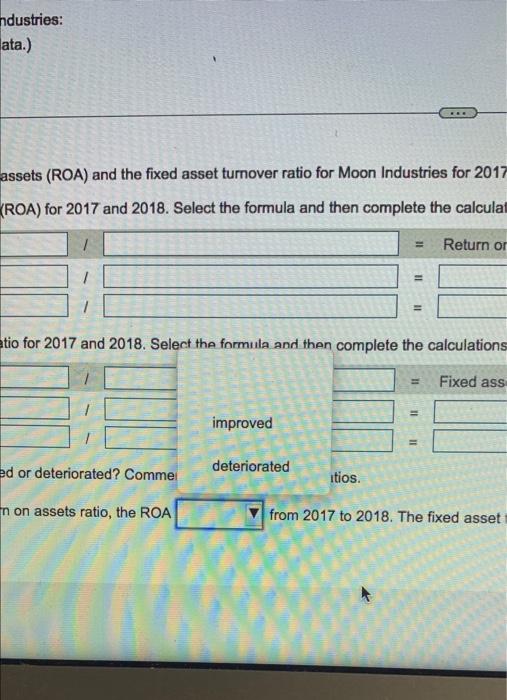

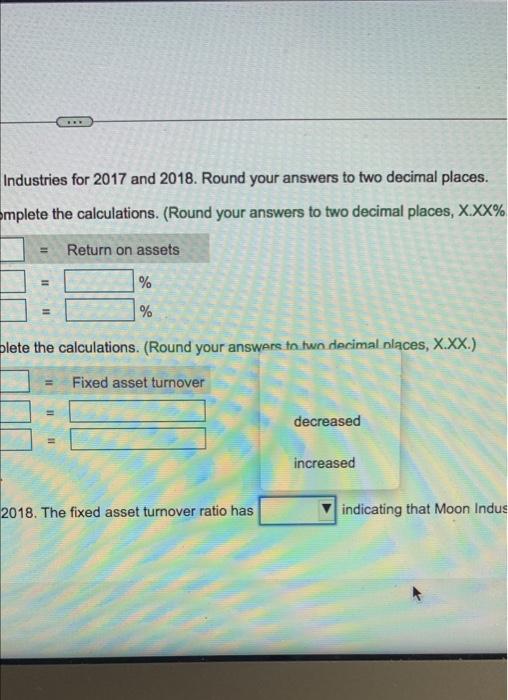

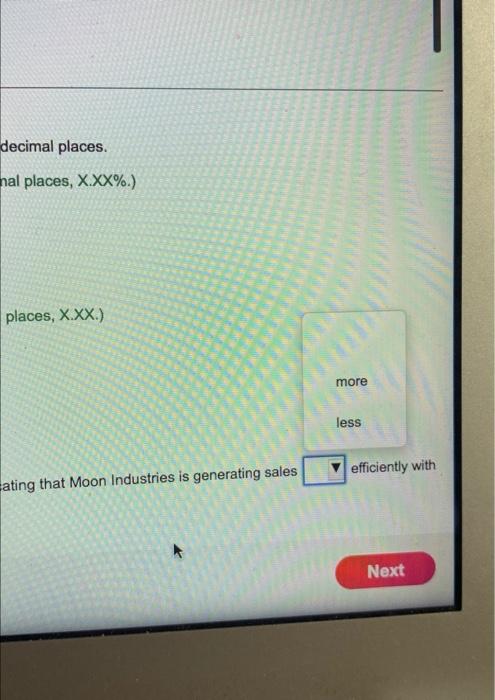

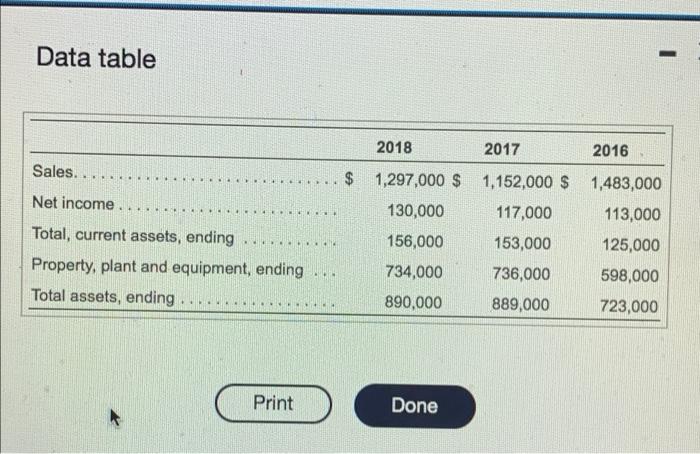

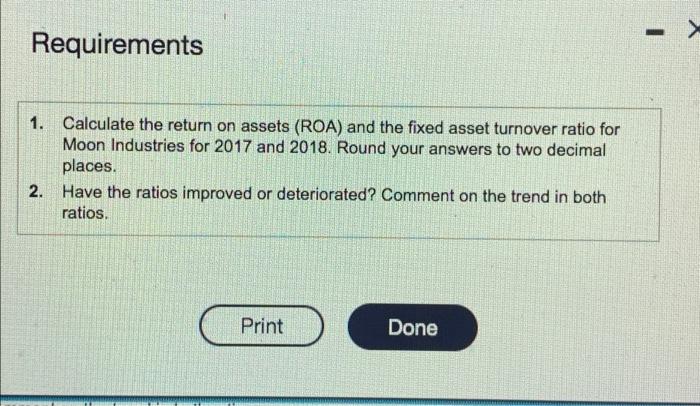

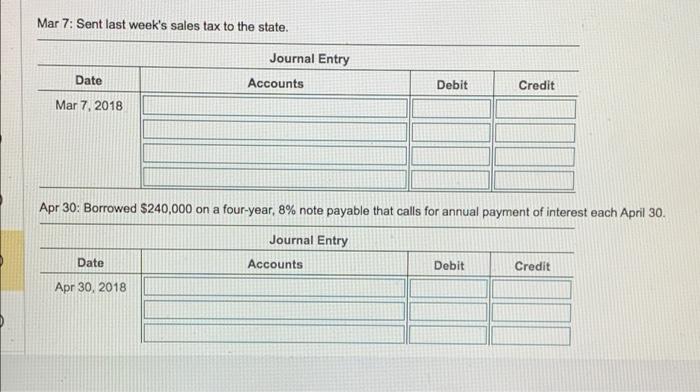

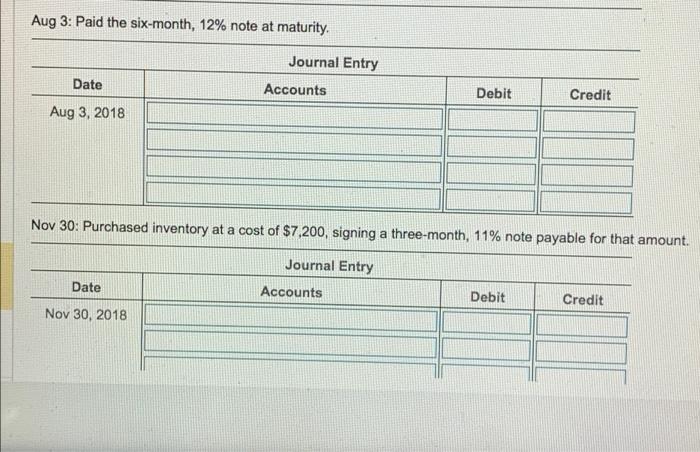

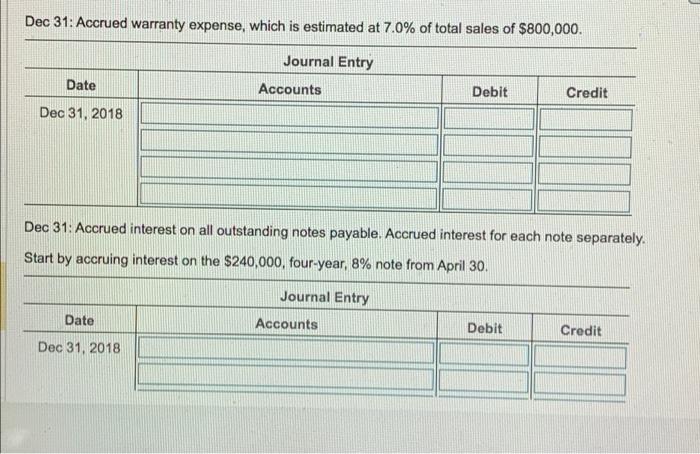

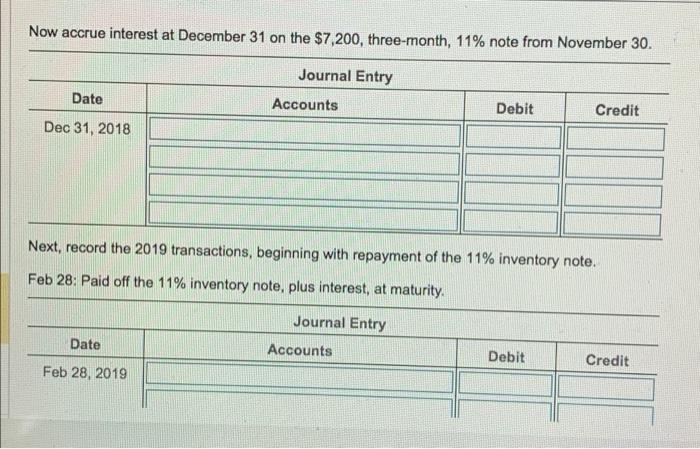

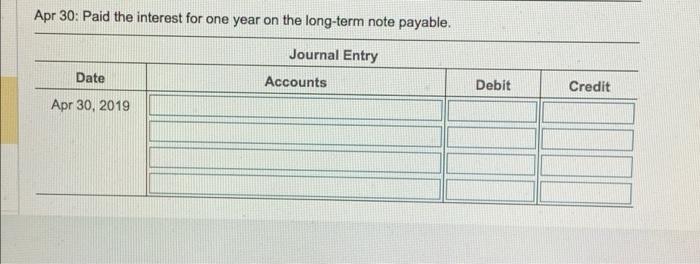

Iff (Cick the inon to vire the neiscied diata) Fond the nacionerests (Click the icon to view the selected data.) Read the reauirements. Requirement 1. Calculate the return on assets (ROA) and th Start by calculating the return on assets (ROA) for 2017 and Now calculate the fixad ascat turnnuar ratio for 2017 and 201 , As shown by the in the return on assets ratio, the its fixed assets in 2018. assets (ROA) and the fixed asset turnover ratio for Moon Industries for 2017 (ROA) for 2017 and 2018. Select the formula and then complete the calculat tio for 2017 and 2018. Select tha formula and then complete the calculations n on assets ratio, the ROA from 2017 to 2018 . The fixed asset Industries for 2017 and 2018. Round your answers to two decimal places. mplete the calculations. (Round your answers to two decimal places, XXXX% plete the calculations. (Round your answars in twn decimal nlaces, X.X.X.) 2018. The fixed asset turnover ratio has indicating that Moon Indus places, X.XX.) Data table Requirements 1. Calculate the return on assets (ROA) and the fixed asset turnover ratio for Moon Industries for 2017 and 2018 . Round your answers to two decimal places. 2. Have the ratios improved or deteriorated? Comment on the trend in both ratios. The folcwing twishetions of Purry and Dire Marine Supply ocourod during 20t and 2010 (Ciok the ioon to wew the thingetioral) Rerulrement Feb 3. Purchassd equpment for B10.000, signing a sia month, i2es noln paytie. Mar 7: Sent last week's sales tax to the state. Aug 3: Paid the six-month, 12% note at maturity. Nov 30: Purchased inventory at a cost of $7,200, signing a three-month, 11% note payable for that ar Dec 31: Accrued warranty expense, which is estimated at 7.0% of total sales of $800,000. Dec 31: Accrued interest on all outstanding notes payable. Accrued interest for each note separately. Start by accruing interest on the $240,000, four-year, 8% note from April 30 . Now accrue interest at December 31 on the $7,200, three-month, 11% note from November 30 . Next, record the 2019 transactions, beginning with repayment of the 11% inventory note. Feb 28: Paid off the 11% inventory note, plus interest, at maturity. Apr 30: Paid the interest for one year on the long-term note payable. More info

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started