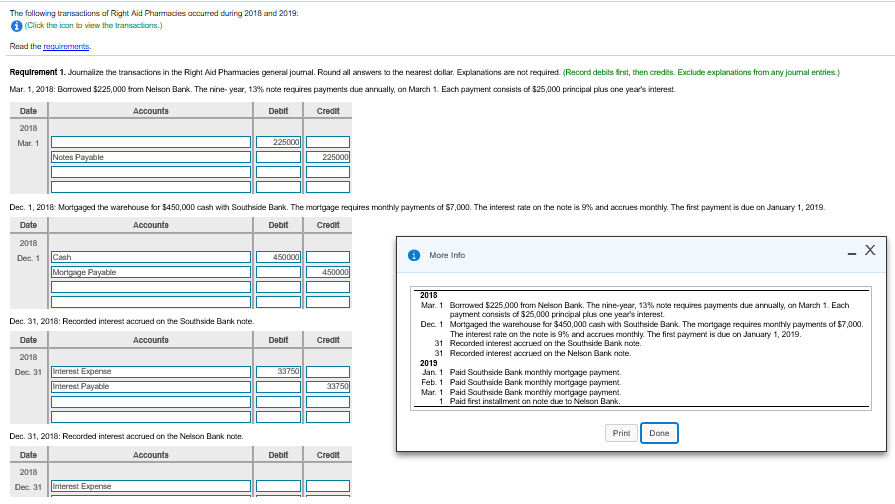

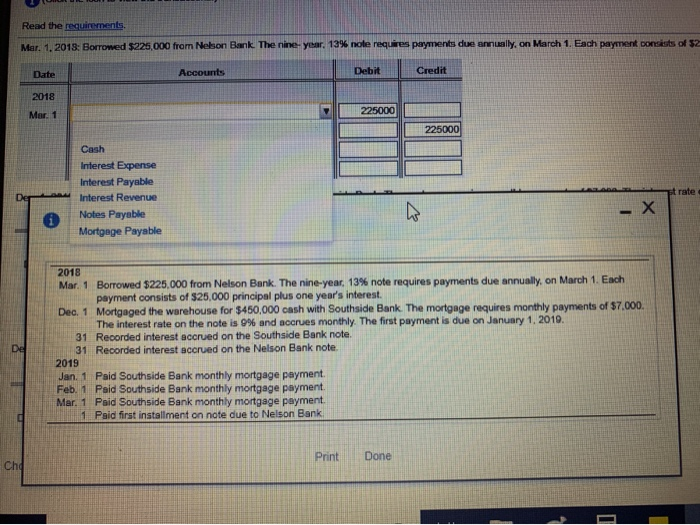

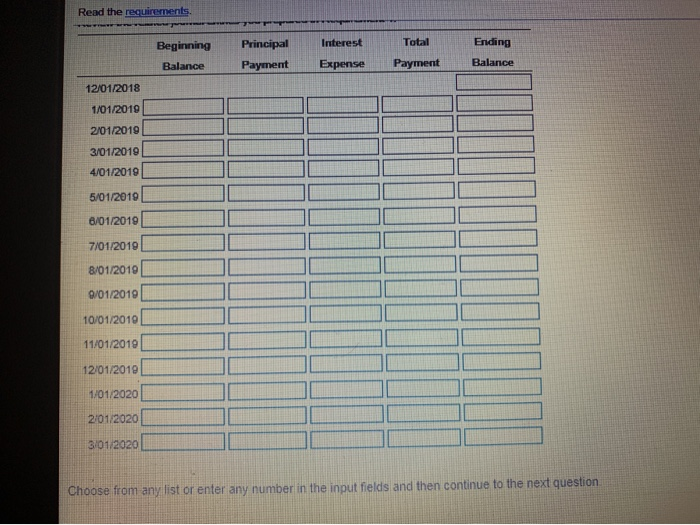

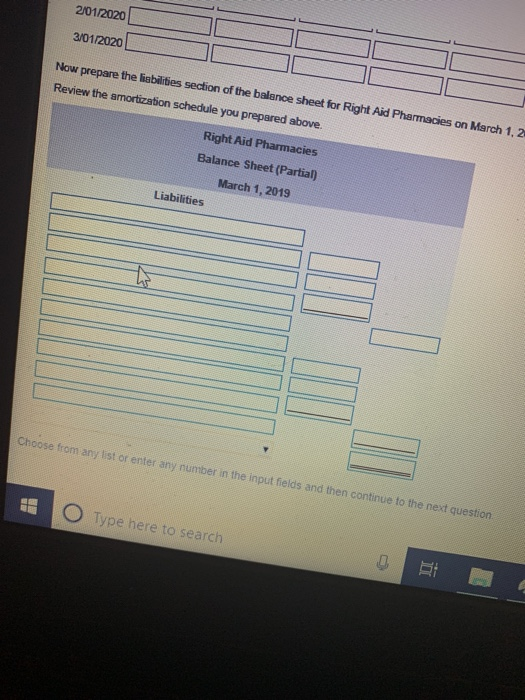

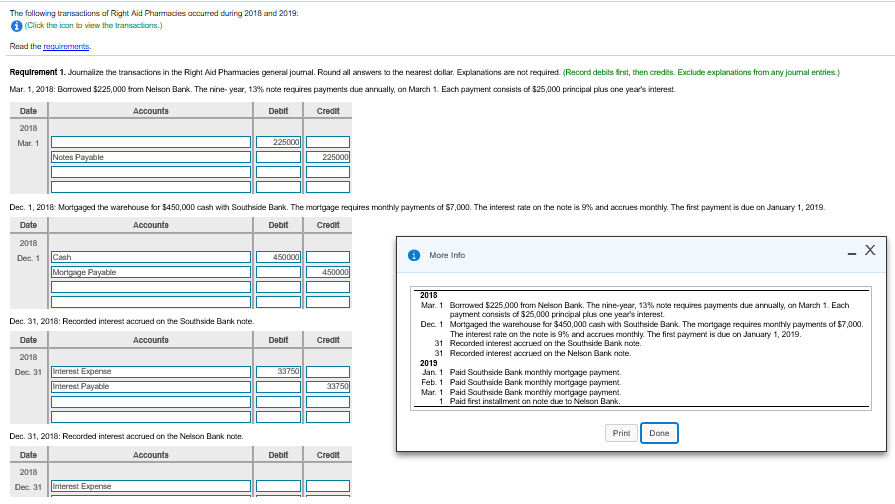

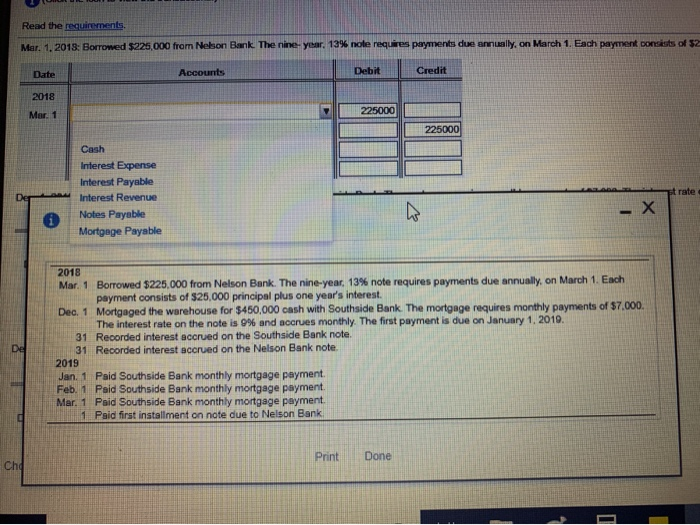

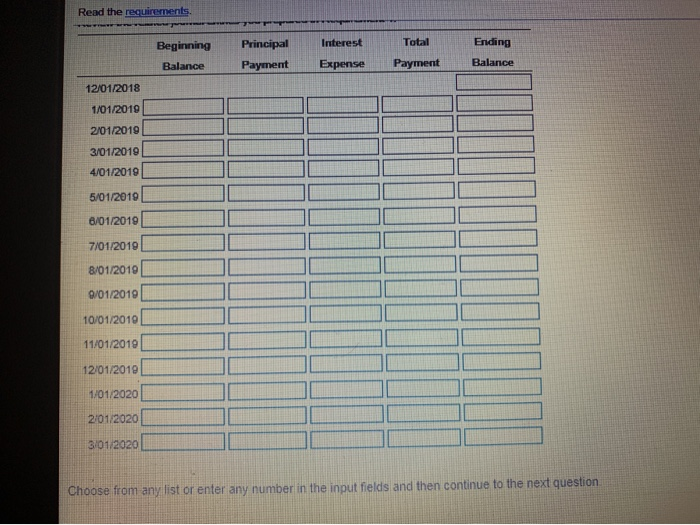

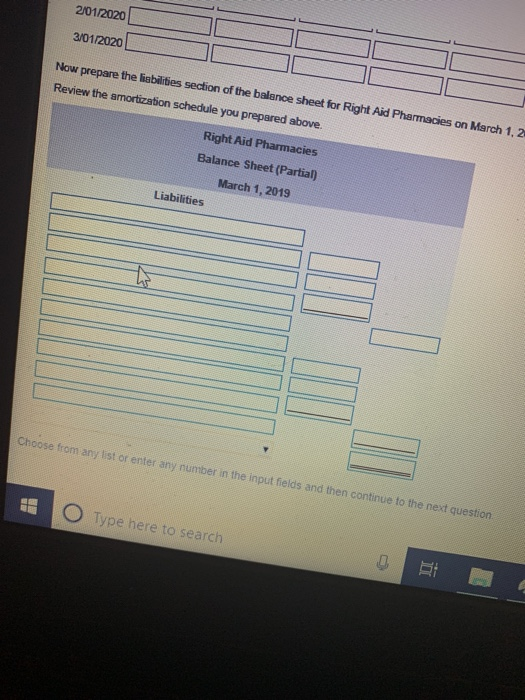

The following transactions of Right Aid Pharmacies accurred during 2018 and 2019 i (Click the ioan to view the transactions.) Read the requirements Requirement 1. Journalize the transactions in the Right Aid Phamacies general joumal. Round all answers to the nearest dollar. Explanasions are not required. (Record debits first, then credits. Exclude explanations from any joumal entries) Mar. 1, 2018: Barrowed $225,000 from Nelson Bank. The nine year, 13 % note requires payments due annually, on March 1. Each payment consists of $25,000 principal plus one year's interest Date Accounts Debit Credit 2018 225000 Mar. 1 Notes Payable 225000 Dec. 1, 2018: Mortgaged the warehouse for $4550,000 cash with Southeide Bank. The mortgage requires manthly payments af S7,000. The interest rate on the nate is 9 % and accrues monthly. The first payment is due an January 1, 2019 Date Accounts Deblt Credit 2018 - X Cash More Info 460000 Dec. 1 Morigage Payable 450000 2013 Mar. 1 Borrowed $225,000 froam Nelson Bank. The nine-year, 13 % note requires payments due annually, an March 1. Each payment cansists of $25,000 principal plus one year's interest Dec. 31, 2018: Recorded interest accrued on the Southside Bank nate. Dec. 1 Mortgaged the warehouse far $450,000 cash with Southside Bank. The morigage requires monthily payments of $7,000. The interest rate an the nate is 9 % and accrues monthly. The first payment is due on January 1, 2019 31 Recorded interest accrued on the Southside Bank note. 31 Recorded interest accrued on the Nelson Bank note. Date Accounts Debit Credit 2018 2019 Jan 1 Paid Southside Bank monthly mortgage payment Feb. 1 Paid Southside Bank monthly mortgage payment Mar. 1 Paid Southside Bank monthly mortgage payment 1 Paid first instalment an note due to Nelson Bank Interest Expense 33750 Dec. 31 Interest Payable 33750 Print Done Dec. 31, 2018: Recorded interest accrued on the Nelson Bank note. Date Accounta Deblt Credit 2018 Interest Expense Dec. 31 Read the requirements. Total Ending Interest Principal Beginning Balance Expense Payment Payment Balance 12/01/2018 1/01/2019 2/01/2019 3/01/2019 4/01/2019 5/01/2019 6/01/2019 7/01/2019 8/01/2019 9/01/2019 10/01/2010 11/01/2019 12/01/2019 1/01/2020 2/01/2020 3/01/2020 Choose from any list or enter any number in the input fields and then continue to the next question 2/01/2020 3/01/2020 Now prepare the liabilities section of the balance sheet for Right Aid Pharmacies on March 1, 2 Review the amortization schedule you prepared above. Right Aid Pharmacies Balance Sheet (Partial) March 1, 2019 Liabilities Choose fronm any list or enter any number in the input fields and then continue to the next question Type here to search