Answered step by step

Verified Expert Solution

Question

1 Approved Answer

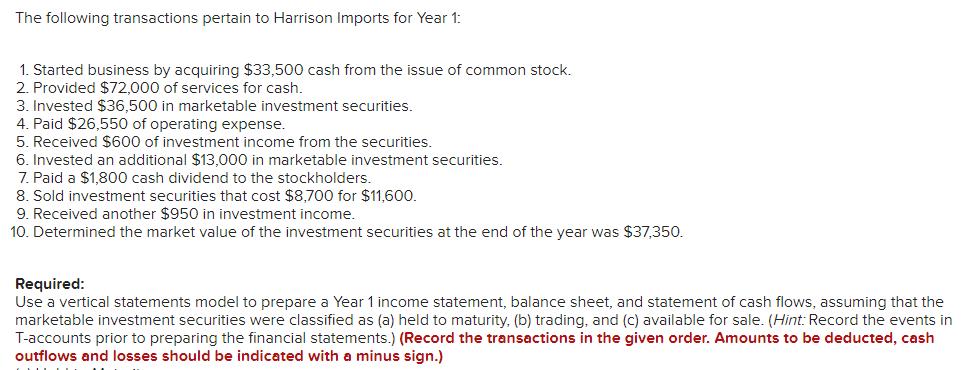

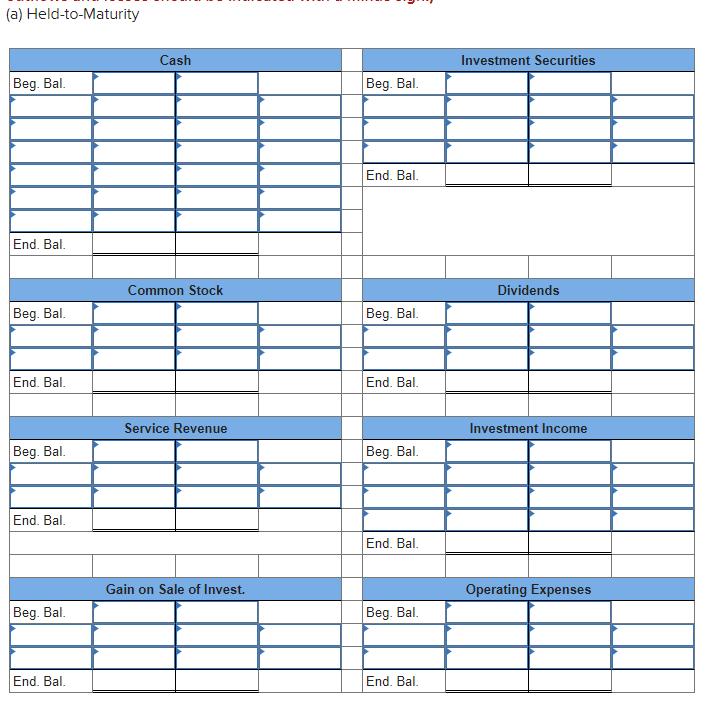

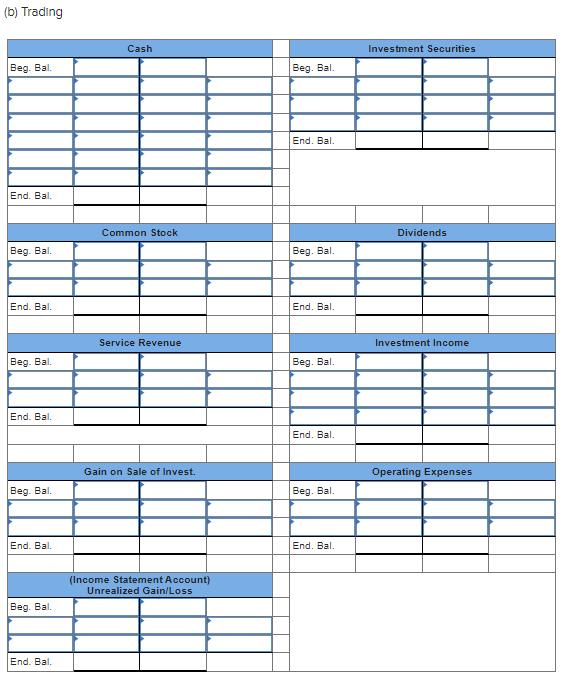

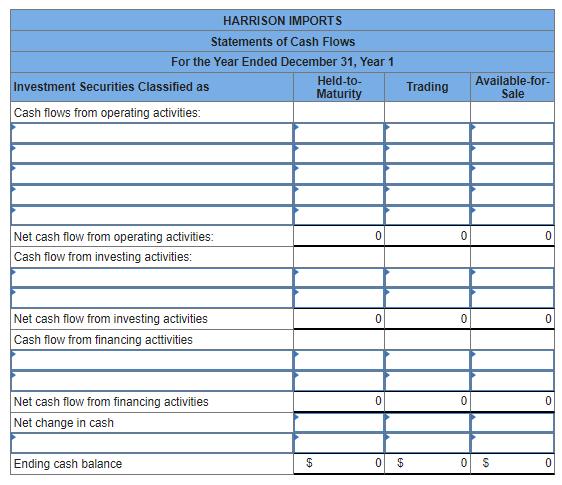

The following transactions pertain to Harrison Imports for Year 1: 1. Started business by acquiring $33,500 cash from the issue of common stock. 2.

The following transactions pertain to Harrison Imports for Year 1: 1. Started business by acquiring $33,500 cash from the issue of common stock. 2. Provided $72,000 of services for cash. 3. Invested $36,500 in marketable investment securities. 4. Paid $26,550 of operating expense. 5. Received $600 of investment income from the securities. 6. Invested an additional $13,000 in marketable investment securities. 7. Paid a $1,800 cash dividend to the stockholders. 8. Sold investment securities that cost $8,700 for $11,600. 9. Received another $950 in investment income. 10. Determined the market value of the investment securities at the end of the year was $37,350. Required: Use a vertical statements model to prepare a Year 1 income statement, balance sheet, and statement of cash flows, assuming that the marketable investment securities were classified as (a) held to maturity, (b) trading, and (c) available for sale. (Hint: Record the events in T-accounts prior to preparing the financial statements.) (Record the transactions in the given order. Amounts to be deducted, cash outflows and losses should be indicated with a minus sign.) (a) Held-to-Maturity Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (b) Trading Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. (Income Statement Account) Unrealized Gain/Loss Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (c) Available-for-Sale Beg. Bal. End. Bal. Beg. Bal. End. Bal.. Beg. Bal. End. Bal.. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Accum. Other Comp. Income Unrealized Gain/Loss Investment Income Operating Expenses Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Service Revenue Gain on Sale of Invest. HARRISON IMPORTS Statements of Cash Flows For the Year Ended December 31, Year 1 Held-to- Maturity Investment Securities Classified as Cash flows from operating activities: Net cash flow from operating activities: Cash flow from investing activities: Net cash flow from investing activities Cash flow from financing acttivities Net cash flow from financing activities Net change in cash Ending cash balance 0 0 0 $ Trading 0 0 0 Available-for- Sale $ 0 Investment Securities Classified as HARRISON IMPORTS Income Statements For the Year Ended Year 1 Investment Securities Classified as Assets Total Assets Stockholders' Equity Total Stockholders' Equity Held-to- Maturity S 0 0 $ Trading HARRISON IMPORTS Balance Sheets As of December 31, Year 1 Held-to- Maturity $ $ 0 Available- for-Sale 0 $ 0 $ 69 Trading 0 0 Available-for- Sale 0 $ 0 $ 0 0 The following transactions pertain to Harrison Imports for Year 1: 1. Started business by acquiring $33,500 cash from the issue of common stock. 2. Provided $72,000 of services for cash. 3. Invested $36,500 in marketable investment securities. 4. Paid $26,550 of operating expense. 5. Received $600 of investment income from the securities. 6. Invested an additional $13,000 in marketable investment securities. 7. Paid a $1,800 cash dividend to the stockholders. 8. Sold investment securities that cost $8,700 for $11,600. 9. Received another $950 in investment income. 10. Determined the market value of the investment securities at the end of the year was $37,350. Required: Use a vertical statements model to prepare a Year 1 income statement, balance sheet, and statement of cash flows, assuming that the marketable investment securities were classified as (a) held to maturity, (b) trading, and (c) available for sale. (Hint: Record the events in T-accounts prior to preparing the financial statements.) (Record the transactions in the given order. Amounts to be deducted, cash outflows and losses should be indicated with a minus sign.) (a) Held-to-Maturity Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (b) Trading Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. (Income Statement Account) Unrealized Gain/Loss Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (c) Available-for-Sale Beg. Bal. End. Bal. Beg. Bal. End. Bal.. Beg. Bal. End. Bal.. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Accum. Other Comp. Income Unrealized Gain/Loss Investment Income Operating Expenses Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Service Revenue Gain on Sale of Invest. HARRISON IMPORTS Statements of Cash Flows For the Year Ended December 31, Year 1 Held-to- Maturity Investment Securities Classified as Cash flows from operating activities: Net cash flow from operating activities: Cash flow from investing activities: Net cash flow from investing activities Cash flow from financing acttivities Net cash flow from financing activities Net change in cash Ending cash balance 0 0 0 $ Trading 0 0 0 Available-for- Sale $ 0 Investment Securities Classified as HARRISON IMPORTS Income Statements For the Year Ended Year 1 Investment Securities Classified as Assets Total Assets Stockholders' Equity Total Stockholders' Equity Held-to- Maturity S 0 0 $ Trading HARRISON IMPORTS Balance Sheets As of December 31, Year 1 Held-to- Maturity $ $ 0 Available- for-Sale 0 $ 0 $ 69 Trading 0 0 Available-for- Sale 0 $ 0 $ 0 0 The following transactions pertain to Harrison Imports for Year 1: 1. Started business by acquiring $33,500 cash from the issue of common stock. 2. Provided $72,000 of services for cash. 3. Invested $36,500 in marketable investment securities. 4. Paid $26,550 of operating expense. 5. Received $600 of investment income from the securities. 6. Invested an additional $13,000 in marketable investment securities. 7. Paid a $1,800 cash dividend to the stockholders. 8. Sold investment securities that cost $8,700 for $11,600. 9. Received another $950 in investment income. 10. Determined the market value of the investment securities at the end of the year was $37,350. Required: Use a vertical statements model to prepare a Year 1 income statement, balance sheet, and statement of cash flows, assuming that the marketable investment securities were classified as (a) held to maturity, (b) trading, and (c) available for sale. (Hint: Record the events in T-accounts prior to preparing the financial statements.) (Record the transactions in the given order. Amounts to be deducted, cash outflows and losses should be indicated with a minus sign.) (a) Held-to-Maturity Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (b) Trading Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. (Income Statement Account) Unrealized Gain/Loss Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (c) Available-for-Sale Beg. Bal. End. Bal. Beg. Bal. End. Bal.. Beg. Bal. End. Bal.. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Accum. Other Comp. Income Unrealized Gain/Loss Investment Income Operating Expenses Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Service Revenue Gain on Sale of Invest. HARRISON IMPORTS Statements of Cash Flows For the Year Ended December 31, Year 1 Held-to- Maturity Investment Securities Classified as Cash flows from operating activities: Net cash flow from operating activities: Cash flow from investing activities: Net cash flow from investing activities Cash flow from financing acttivities Net cash flow from financing activities Net change in cash Ending cash balance 0 0 0 $ Trading 0 0 0 Available-for- Sale $ 0 Investment Securities Classified as HARRISON IMPORTS Income Statements For the Year Ended Year 1 Investment Securities Classified as Assets Total Assets Stockholders' Equity Total Stockholders' Equity Held-to- Maturity S 0 0 $ Trading HARRISON IMPORTS Balance Sheets As of December 31, Year 1 Held-to- Maturity $ $ 0 Available- for-Sale 0 $ 0 $ 69 Trading 0 0 Available-for- Sale 0 $ 0 $ 0 0 The following transactions pertain to Harrison Imports for Year 1: 1. Started business by acquiring $33,500 cash from the issue of common stock. 2. Provided $72,000 of services for cash. 3. Invested $36,500 in marketable investment securities. 4. Paid $26,550 of operating expense. 5. Received $600 of investment income from the securities. 6. Invested an additional $13,000 in marketable investment securities. 7. Paid a $1,800 cash dividend to the stockholders. 8. Sold investment securities that cost $8,700 for $11,600. 9. Received another $950 in investment income. 10. Determined the market value of the investment securities at the end of the year was $37,350. Required: Use a vertical statements model to prepare a Year 1 income statement, balance sheet, and statement of cash flows, assuming that the marketable investment securities were classified as (a) held to maturity, (b) trading, and (c) available for sale. (Hint: Record the events in T-accounts prior to preparing the financial statements.) (Record the transactions in the given order. Amounts to be deducted, cash outflows and losses should be indicated with a minus sign.) (a) Held-to-Maturity Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (b) Trading Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Service Revenue Gain on Sale of Invest. (Income Statement Account) Unrealized Gain/Loss Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Investment Income Operating Expenses (c) Available-for-Sale Beg. Bal. End. Bal. Beg. Bal. End. Bal.. Beg. Bal. End. Bal.. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Cash Common Stock Accum. Other Comp. Income Unrealized Gain/Loss Investment Income Operating Expenses Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Beg. Bal. End. Bal. Investment Securities Dividends Service Revenue Gain on Sale of Invest. HARRISON IMPORTS Statements of Cash Flows For the Year Ended December 31, Year 1 Held-to- Maturity Investment Securities Classified as Cash flows from operating activities: Net cash flow from operating activities: Cash flow from investing activities: Net cash flow from investing activities Cash flow from financing acttivities Net cash flow from financing activities Net change in cash Ending cash balance 0 0 0 $ Trading 0 0 0 Available-for- Sale $ 0 Investment Securities Classified as HARRISON IMPORTS Income Statements For the Year Ended Year 1 Investment Securities Classified as Assets Total Assets Stockholders' Equity Total Stockholders' Equity Held-to- Maturity S 0 0 $ Trading HARRISON IMPORTS Balance Sheets As of December 31, Year 1 Held-to- Maturity $ $ 0 Available- for-Sale 0 $ 0 $ 69 Trading 0 0 Available-for- Sale 0 $ 0 $ 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

TAccounts Held to Maturity 1 2 5 8 9 Balance TAccounts Trading 1 5 8 Balance TAccounts Available for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started