Question

The following transactions pertain to year 1, the first-year operations of Gibson Company. All inventory was started and completed during year 1. Assume that all

The following transactions pertain to year 1, the first-year operations of Gibson Company. All inventory was started and completed during year 1. Assume that all transactions are cash transactions.

-

Acquired $12,000 cash by issuing common stock.

-

Paid $4,700 for materials used to produce inventory.

-

Paid $2,400 to production workers.

-

Paid $900 rental fee for production equipment.

-

Paid $350 to administrative employees.

-

Paid $400 rental fee for administrative office equipment.

-

Produced 400 units of inventory of which 360 units were sold at a price of $25 each.

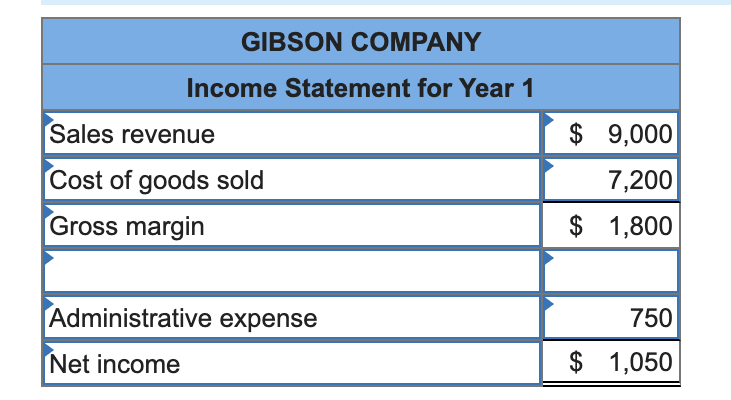

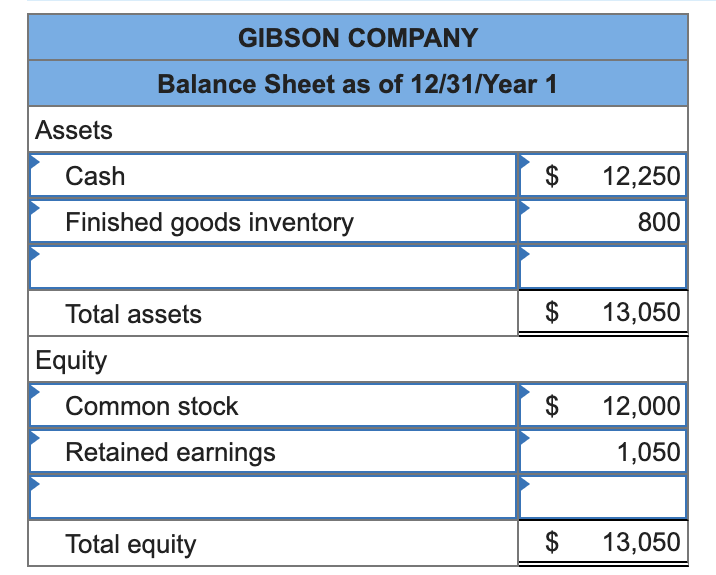

Required Prepare an income statement and a balance sheet in accordance with GAAP.

***Missing something, need help identifying what I'm missing***

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started