Answered step by step

Verified Expert Solution

Question

1 Approved Answer

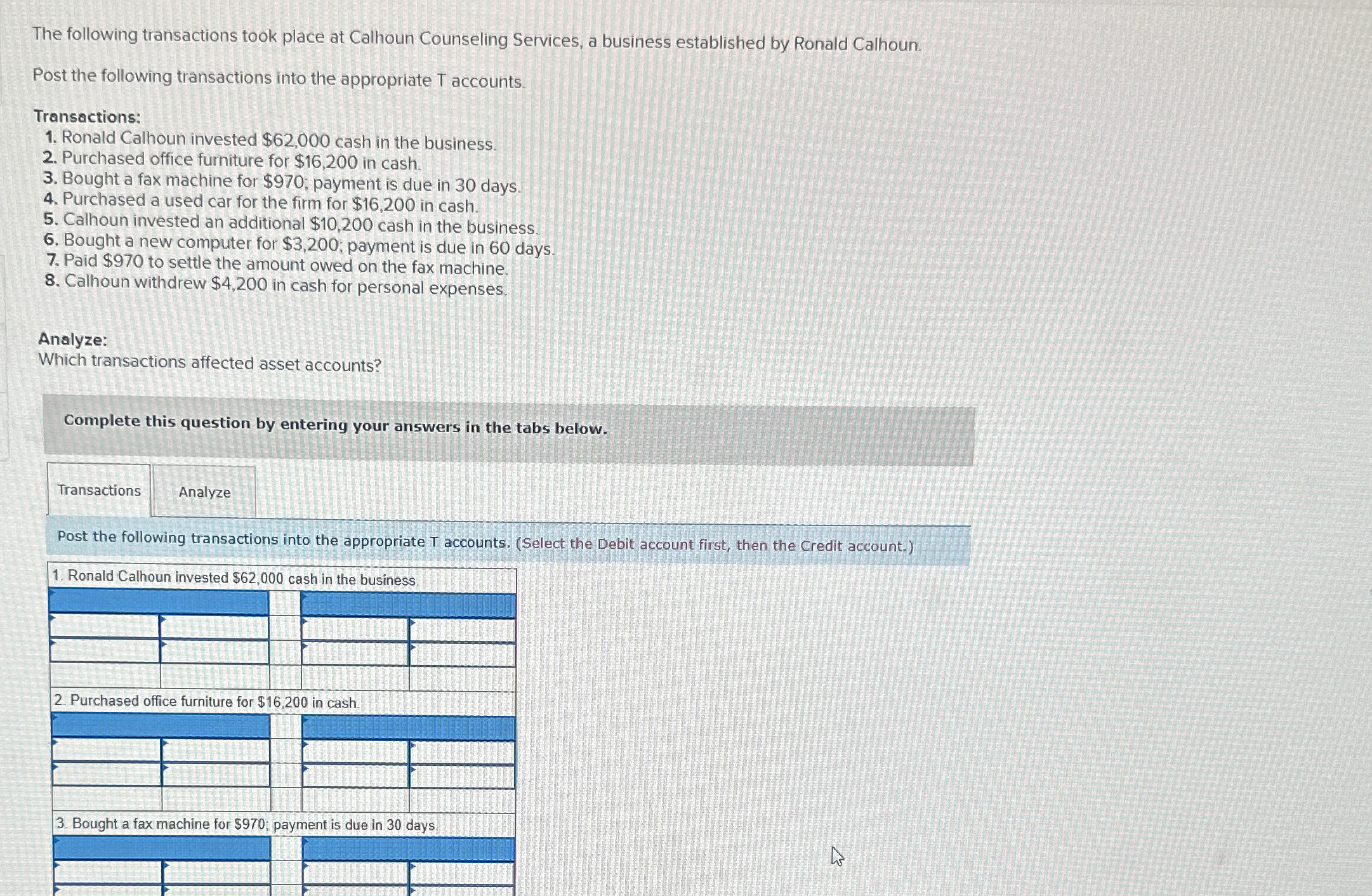

The following transactions took place at Calhoun Counseling Services, a business established by Ronald Calhoun. Post the following transactions into the appropriate T accounts. Transactions:

The following transactions took place at Calhoun Counseling Services, a business established by Ronald Calhoun.

Post the following transactions into the appropriate accounts.

Transactions:

Ronald Calhoun invested $ cash in the business.

Purchased office furniture for $ in cash.

Bought a fax machine for $; payment is due in days.

Purchased a used car for the firm for $ in cash.

Calhoun invested an additional $ cash in the business.

Bought a new computer for $; payment is due in days.

Paid $ to settle the amount owed on the fax machine.

Calhoun withdrew $ in cash for personal expenses.

Analyze:

Which transactions affected asset accounts?

Complete this question by entering your answers in the tabs below.

Analyze

Post the following transactions into the appropriate accounts. Select the Debit account first, then the Credit account.

table Ronald Calhoun invested $ cash in the business,,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started