Question

The following transactions took place during the month of February Feb 2 Performed services for $1,000 for a customer on account. Feb 3 Paid $800

The following transactions took place during the month of February

-

Feb 2 Performed services for $1,000 for a customer on account.

-

Feb 3 Paid $800 in rent for the month of February.

-

Feb 12 Received payment in full for the services performed on Feb 2

-

Feb 14 Paid wages of $1,000.

-

Feb 16 Performed services for $3,000 and received payment in cash immediately.

-

Feb 18 Paid utility bill of $375.

-

Feb 20 Performed services for $2,000 and received $500 in cash immediately, the rest was

on account.

-

Feb 21 Purchased supplies from a vendor on account for $550 (Hint these supplies wont

be used right away).

-

Feb 22 Purchased miscellaneous expenses in the amount of $400.

1

-

Feb 25 Received payment in the amount of $1,000 for the services performed on Feb 20.

-

Feb 28 The owner withdrew $500 from the business for personal use.

Adjustment Information for the end of February is provided below:

At the end of the month, a physical count revealed that there were $900 of supplies on hand as of February 29, 2020.

The Prepaid Insurance account is for a 12month policy that began on February 1, 2020. Please record the insurance used for the month ending February 29, 2020.

The Equipment was purchased January 1, 2019, has a 5year useful life, no salvage value, and has been depreciated under the StraightLine Method. The bookkeeper forgot to record the depreciation expense for the month of January, so youre responsible for recording depreciation for both January and February. Please record as one entry.

Salaries accrued, but not paid, totaled $1,650 for the month of February. Please record the accrued salaries for the month of February.

Assignment:

1. Record the transactions in the journal.

2. Post journal entries to the TAccounts.

3. Prepare the Trial Balance

4. Record the Adjusting Journal Entries

5. Prepare the Financial Statements (Income Statement, Balance Sheet, and Statement of Owners Equity)

6. Prepare the Closing Entries

7. Prepare the PostClosing Trial Balance

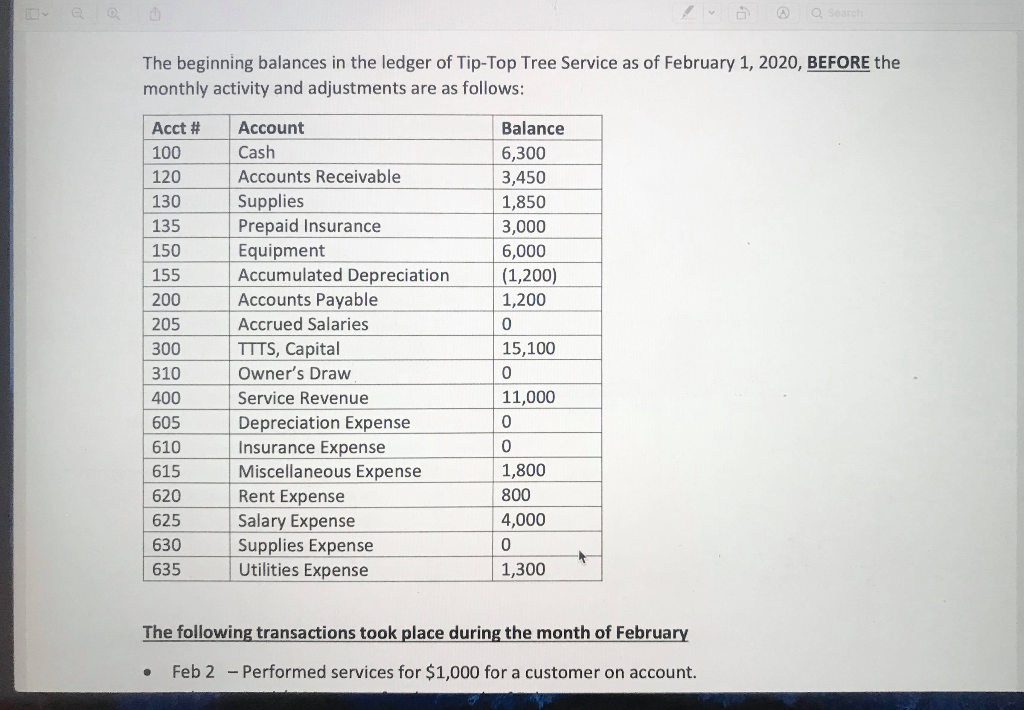

The beginning balances in the ledger of Tip-Top Tree Service as of February 1, 2020, BEFORE the monthly activity and adjustments are as follows: Acct # 100 120 130 135 150 155 200 205 300 310 400 605 610 615 620 625 630 635 Account Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Accrued Salaries TTTS, Capital Owner's Draw Service Revenue Depreciation Expense Insurance Expense Miscellaneous Expense Rent Expense Salary Expense Supplies Expense Utilities Expense Balance 6,300 3,450 1,850 3,000 6,000 (1,200) 1,200 0 15,100 0 11,000 0 0 1,800 800 4,000 0 1,300 The following transactions took place during the month of February Feb 2 - Performed services for $1,000 for a customer on account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started