Answered step by step

Verified Expert Solution

Question

1 Approved Answer

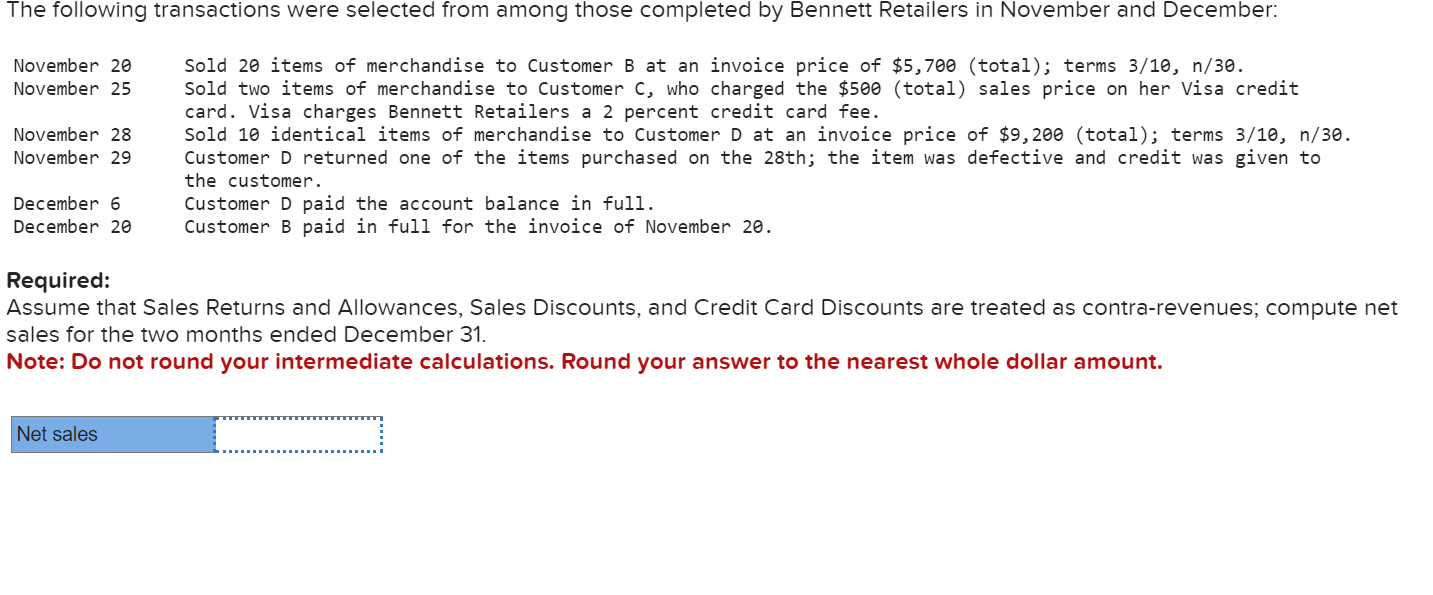

The following transactions were selected from among those completed by Bennett Retailers in November and December: November 20 November 25 November 28 November 29 December

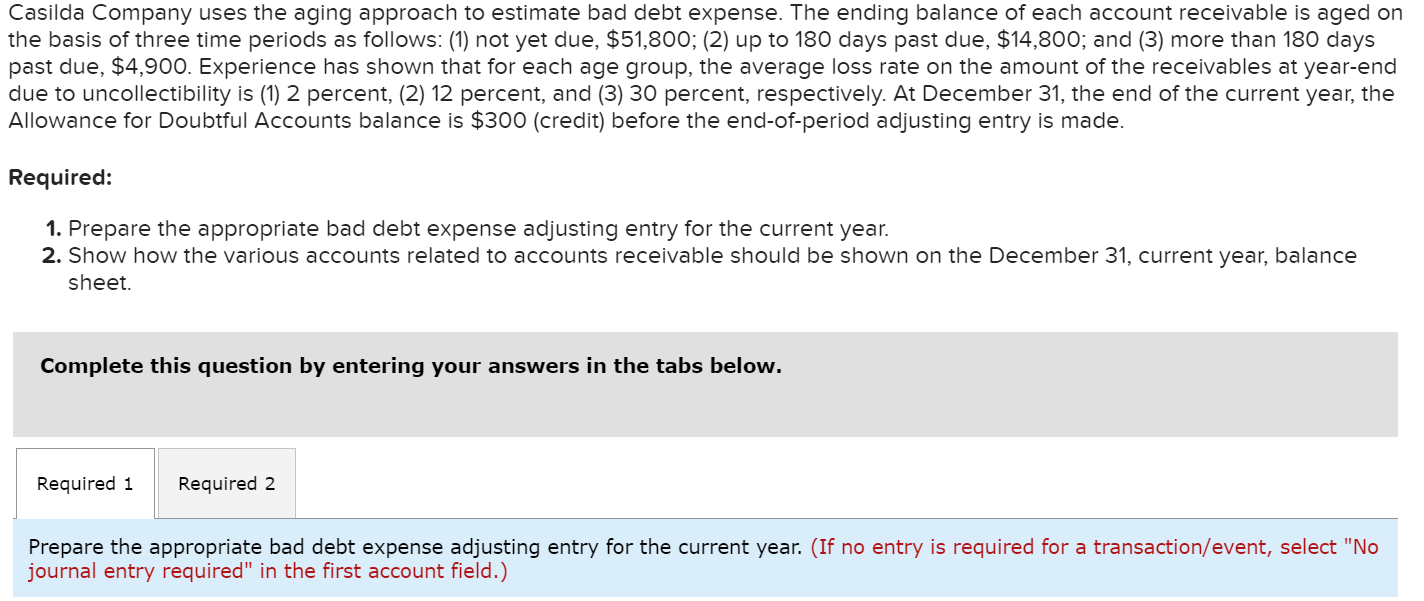

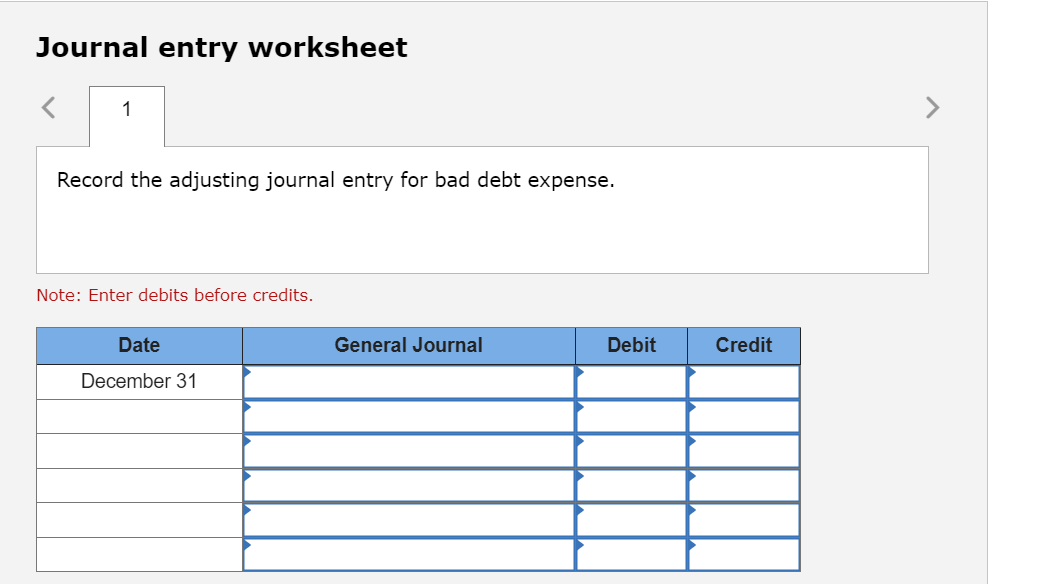

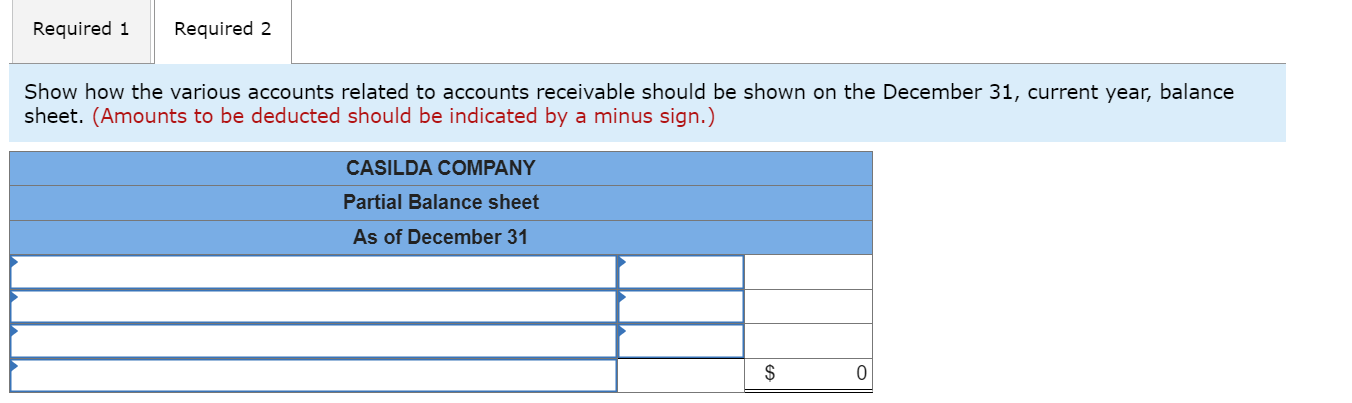

The following transactions were selected from among those completed by Bennett Retailers in November and December: November 20 November 25 November 28 November 29 December 6 December 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,700 (total); terms 3/10,n/30. Sold two items of merchandise to Customer C, who charged the $500 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 2 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,200 (total); terms 3/10,n/30. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. Customer D paid the account balance in full. Customer B paid in full for the invoice of November 20. Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your intermediate calculations. Round your answer to the nearest whole dollar amount. Journal entry worksheet Record the adjusting journal entry for bad debt expense. Note: Enter debits before credits. Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $51,800; (2) up to 180 days past due, $14,800; and (3) more than 180 days past due, $4,900. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 2 percent, (2) 12 percent, and (3) 30 percent, respectively. At December 31, the end of the current year, the Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the December 31, current year, balance sheet. Complete this question by entering your answers in the tabs below. Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show how the various accounts related to accounts receivable should be shown on the December 31 , current year, balance sheet. (Amounts to be deducted should be indicated by a minus sign.)

The following transactions were selected from among those completed by Bennett Retailers in November and December: November 20 November 25 November 28 November 29 December 6 December 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,700 (total); terms 3/10,n/30. Sold two items of merchandise to Customer C, who charged the $500 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 2 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,200 (total); terms 3/10,n/30. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. Customer D paid the account balance in full. Customer B paid in full for the invoice of November 20. Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your intermediate calculations. Round your answer to the nearest whole dollar amount. Journal entry worksheet Record the adjusting journal entry for bad debt expense. Note: Enter debits before credits. Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $51,800; (2) up to 180 days past due, $14,800; and (3) more than 180 days past due, $4,900. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 2 percent, (2) 12 percent, and (3) 30 percent, respectively. At December 31, the end of the current year, the Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the December 31, current year, balance sheet. Complete this question by entering your answers in the tabs below. Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show how the various accounts related to accounts receivable should be shown on the December 31 , current year, balance sheet. (Amounts to be deducted should be indicated by a minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started