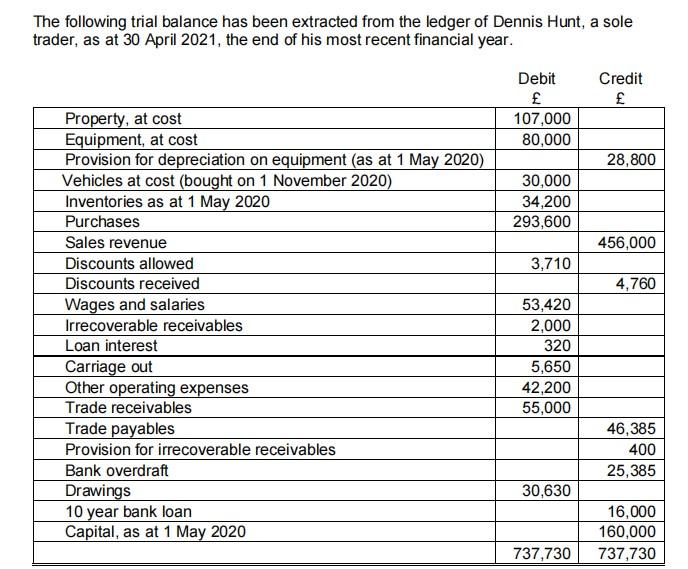

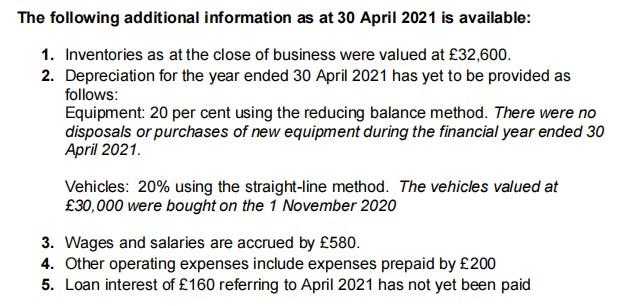

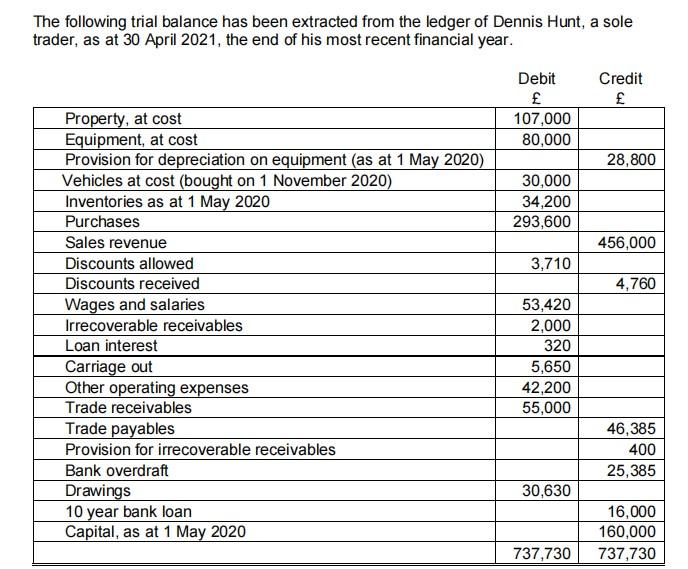

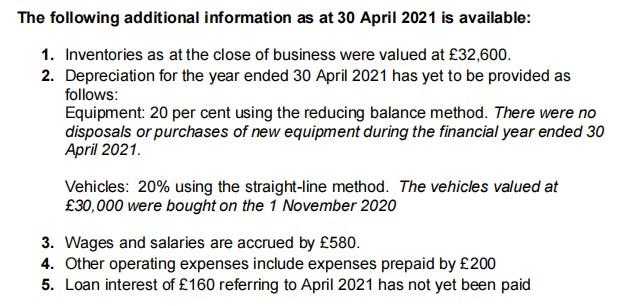

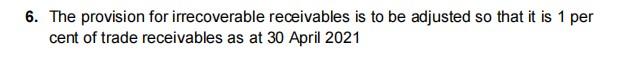

The following trial balance has been extracted from the ledger of Dennis Hunt, a sole trader, as at 30 April 2021, the end of his most recent financial year. Credit Debit 107,000 80,000 28,800 30,000 34,200 293,600 456,000 3,710 4,760 Property, at cost Equipment, at cost Provision for depreciation on equipment (as at 1 May 2020) Vehicles at cost (bought on 1 November 2020) Inventories as at 1 May 2020 Purchases Sales revenue Discounts allowed Discounts received Wages and salaries Irrecoverable receivables Loan interest Carriage out Other operating expenses Trade receivables Trade payables Provision for irrecoverable receivables Bank overdraft Drawings 10 year bank loan Capital, as at 1 May 2020 53,420 2,000 320 5,650 42,200 55,000 46,385 400 25,385 30,630 16,000 160,000 737,730 737,730 The following additional information as at 30 April 2021 is available: 1. Inventories as at the close of business were valued at 32,600. 2. Depreciation for the year ended 30 April 2021 has yet to be provided as follows: Equipment: 20 per cent using the reducing balance method. There were no disposals or purchases of new equipment during the financial year ended 30 April 2021. Vehicles: 20% using the straight-line method. The vehicles valued at 30,000 were bought on the 1 November 2020 3. Wages and salaries are accrued by 580. 4. Other operating expenses include expenses prepaid by 200 5. Loan interest of 160 referring to April 2021 has not yet been paid 6. The provision for irrecoverable receivables is to be adjusted so that it is 1 per cent of trade receivables as at 30 April 2021 1a) Prepare the following financial statements for Dennis Hunt: ii. Statement of financial position for Dennis Hunt as at 30 April 2021 The following trial balance has been extracted from the ledger of Dennis Hunt, a sole trader, as at 30 April 2021, the end of his most recent financial year. Credit Debit 107,000 80,000 28,800 30,000 34,200 293,600 456,000 3,710 4,760 Property, at cost Equipment, at cost Provision for depreciation on equipment (as at 1 May 2020) Vehicles at cost (bought on 1 November 2020) Inventories as at 1 May 2020 Purchases Sales revenue Discounts allowed Discounts received Wages and salaries Irrecoverable receivables Loan interest Carriage out Other operating expenses Trade receivables Trade payables Provision for irrecoverable receivables Bank overdraft Drawings 10 year bank loan Capital, as at 1 May 2020 53,420 2,000 320 5,650 42,200 55,000 46,385 400 25,385 30,630 16,000 160,000 737,730 737,730 The following additional information as at 30 April 2021 is available: 1. Inventories as at the close of business were valued at 32,600. 2. Depreciation for the year ended 30 April 2021 has yet to be provided as follows: Equipment: 20 per cent using the reducing balance method. There were no disposals or purchases of new equipment during the financial year ended 30 April 2021. Vehicles: 20% using the straight-line method. The vehicles valued at 30,000 were bought on the 1 November 2020 3. Wages and salaries are accrued by 580. 4. Other operating expenses include expenses prepaid by 200 5. Loan interest of 160 referring to April 2021 has not yet been paid 6. The provision for irrecoverable receivables is to be adjusted so that it is 1 per cent of trade receivables as at 30 April 2021 1a) Prepare the following financial statements for Dennis Hunt: ii. Statement of financial position for Dennis Hunt as at 30 April 2021