Answered step by step

Verified Expert Solution

Question

1 Approved Answer

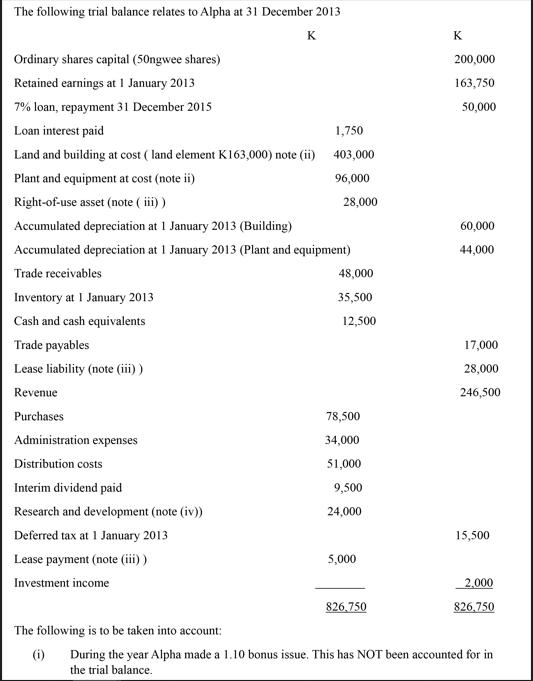

The following trial balance relates to Alpha at 31 December 2013 K Ordinary shares capital (50ngwee shares) Retained earnings at 1 January 2013 7%

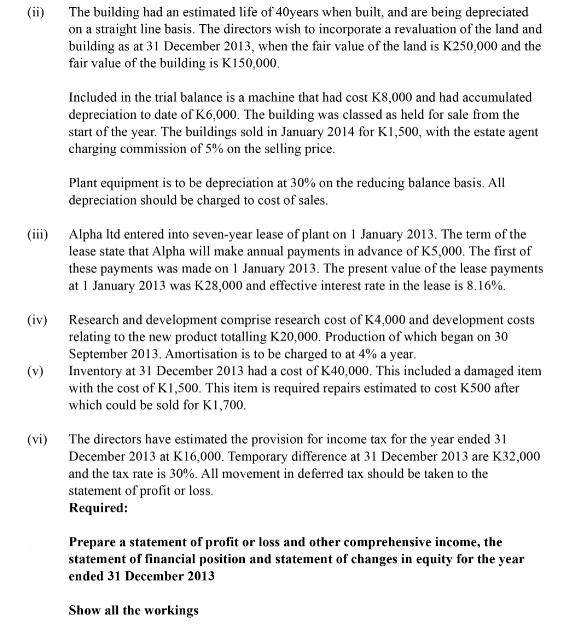

The following trial balance relates to Alpha at 31 December 2013 K Ordinary shares capital (50ngwee shares) Retained earnings at 1 January 2013 7% loan, repayment 31 December 2015 Loan interest paid 1,750 Land and building at cost ( land element K163,000) note (ii) 403,000 Plant and equipment at cost (note ii) 96,000 Right-of-use asset (note (iii)) Accumulated depreciation at 1 January 2013 (Building) Accumulated depreciation at 1 January 2013 (Plant and equipment) Trade receivables Inventory at 1 January 2013 Cash and cash equivalents Trade payables Lease liability (note (iii)) Revenue Purchases Administration expenses Distribution costs Interim dividend paid Research and development (note (iv)) Deferred tax at 1 January 2013 Lease payment (note (iii)) Investment income The following is to be taken into account: (i) 28,000 48,000 35,500 12,500 78,500 34,000 51,000 9,500 24,000 5,000 826,750 K 200,000 163,750 50,000 60,000 44,000 17,000 28,000 246,500 15,500 2,000 826,750 During the year Alpha made a 1.10 bonus issue. This has NOT been accounted for in the trial balance. (ii) (iv) The building had an estimated life of 40years when built, and are being depreciated on a straight line basis. The directors wish to incorporate a revaluation of the land and building as at 31 December 2013, when the fair value of the land is K250,000 and the fair value of the building is K150,000. (v) Included in the trial balance is a machine that had cost K8,000 and had accumulated depreciation to date of K6,000. The building was classed as held for sale from the start of the year. The buildings sold in January 2014 for K1,500, with the estate agent charging commission of 5% on the selling price. (iii) Alpha Itd entered into seven-year lease of plant on 1 January 2013. The term of the lease state that Alpha will make annual payments in advance of K5,000. The first of these payments was made on 1 January 2013. The present value of the lease payments at 1 January 2013 was K28,000 and effective interest rate in the lease is 8.16%. Plant equipment is to be depreciation at 30% on the reducing balance basis. All depreciation should be charged to cost of sales. Research and development comprise research cost of K4,000 and development costs relating to the new product totalling K20,000. Production of which began on 30 September 2013. Amortisation is to be charged to at 4% a year. Inventory at 31 December 2013 had a cost of K40,000. This included a damaged item with the cost of K1,500. This item is required repairs estimated to cost K500 after which could be sold for K1,700. (vi) The directors have estimated the provision for income tax for the year ended 31 December 2013 at K16,000. Temporary difference at 31 December 2013 are K32,000 and the tax rate is 30%. All movement in deferred tax should be taken to the statement of profit or loss. Required: Prepare a statement of profit or loss and other comprehensive income, the statement of financial position and statement of changes in equity for the year ended 31 December 2013 Show all the workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss and Other Comprehensive Income Gross Profit Revenue Cost of Goods Sold 246500 78500 168000 Operating Profit Gross Profit A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started