Answered step by step

Verified Expert Solution

Question

1 Approved Answer

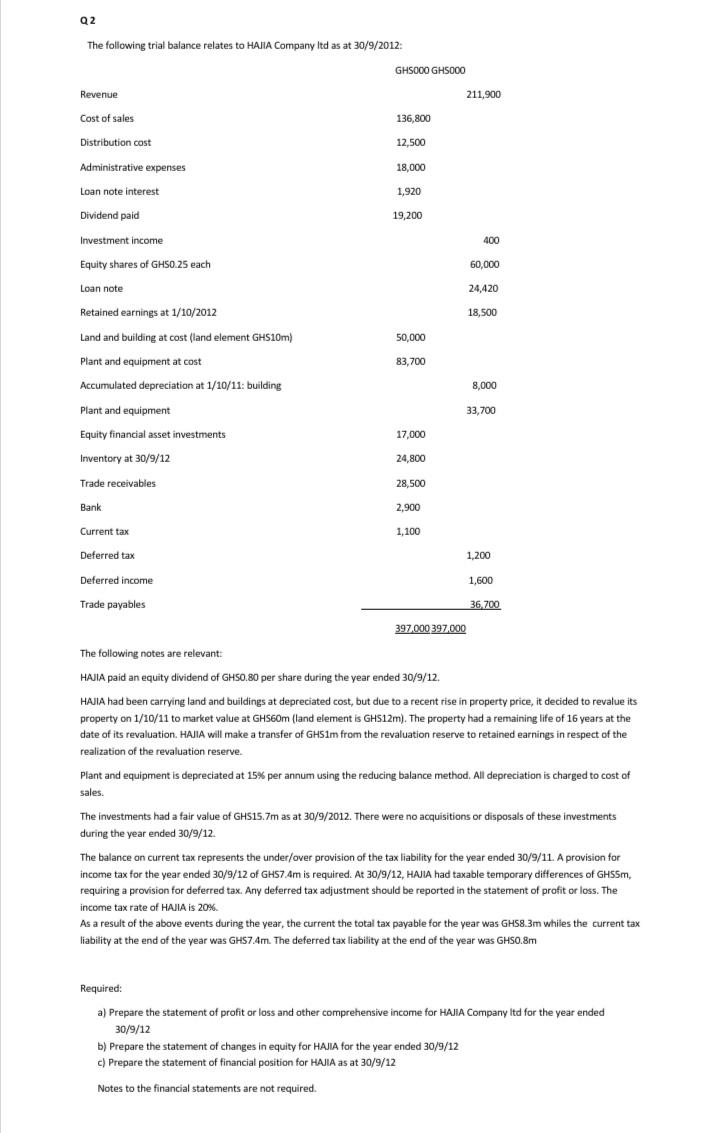

Q2 The following trial balance relates to HAJIA Company Itd as at 30/9/2012: GHSO00 GHSO00 Revenue 211,900 Cost of sales 136,800 Distribution cost 12,500

Q2 The following trial balance relates to HAJIA Company Itd as at 30/9/2012: GHSO00 GHSO00 Revenue 211,900 Cost of sales 136,800 Distribution cost 12,500 Administrative expenses 18,000 Loan note interest 1,920 Dividend paid 19,200 Investment income 400 Equity shares of GHSO.25 each 60,000 Loan note 24,420 Retained earnings at 1/10/2012 18,500 Land and building at cost (land element GHS10m) 50,000 Plant and equipment at cost 83,700 Accumulated depreciation at 1/10/11: building 8,000 Plant and equipment 33,700 Equity financial asset investments 17,000 Inventory at 30/9/12 24,800 Trade receivables 28,500 Bank 2,900 Current tax 1,100 Deferred tax 1,200 Deferred income 1,600 Trade payables 36,700 397.000 397,000 The following notes are relevant: HAJIA paid an equity dividend of GHSO.80 per share during the year ended 30/9/12. HAJIA had been carrying land and buildings at depreciated cost, but due to a recent rise in property price, it decided to revalue its property on 1/10/11 to market value at GHS60M (land element is GHS12)). The property had a remaining life of 16 years at the date of its revaluation. HAJIA will make a transfer of GHS1m from the revaluation reserve to retained earnings in respect of the realization of the revaluation reserve. Plant and equipment is depreciated at 15% per annum using the reducing balance method. All depreciation is charged to cost of sales. The investments had a fair value of GHS15.7m as at 30/9/2012. There were no acquisitions or disposals of these investments during the year ended 30/9/12. The balance on current tax represents the under/over provision of the tax liability for the year ended 30/9/11. A provision for income tax for the year ended 30/9/12 of GHS7.4m is required. At 30/9/12, HAJIA had taxable temporary differences of GHSSM, requiring a provision for deferred tax. Any deferred tax adjustment should be reported in the statement of profit or loss. The income tax rate of HAJIA is 20%. As a result of the above events during the year, the current the total tax payable for the year was GH58.3m whiles the current tax liability at the end of the year was GHS7.4m. The deferred tax liability at the end of the year was GHSO.8m Required: a) Prepare the statement of profit or loss and other comprehensive income for HAJIA Company Itd for the year ended 30/9/12 b) Prepare the statement of changes in equity for HAJIA for the year ended 30/9/12 c) Prepare the statement of financial position for HAJIA as at 30/9/12 Notes to the financial statements are not required.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Comprehensive income Revenue 211900 Investment Income 400 Deferred Income 1600 Total Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started