Answered step by step

Verified Expert Solution

Question

1 Approved Answer

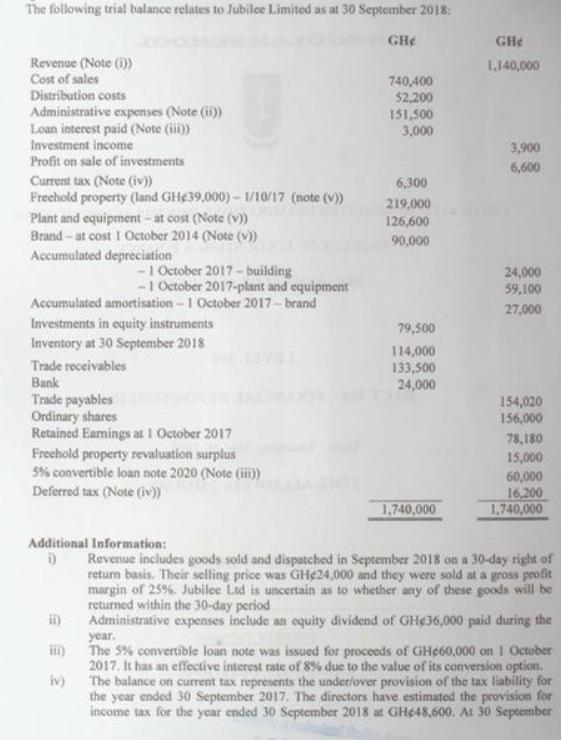

The following trial balance relates to Jubilce Limited as at 30 September 2018: GHe GHe Revenue (Note ()) Cost of sales 1,140,000 740,400 $2,200

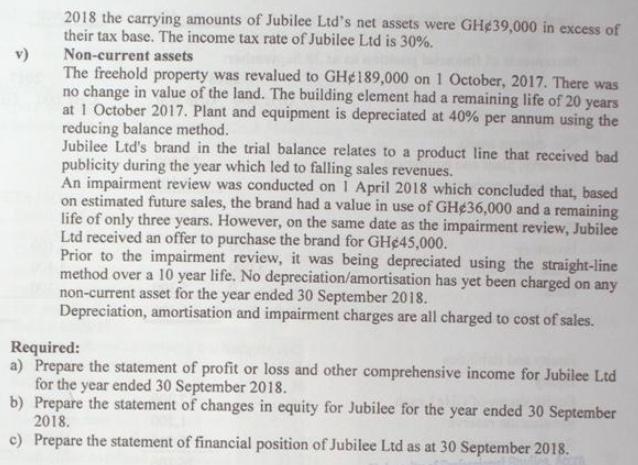

The following trial balance relates to Jubilce Limited as at 30 September 2018: GHe GHe Revenue (Note ()) Cost of sales 1,140,000 740,400 $2,200 151,500 3,000 Distribution costs Administrative expenses (Note (ii)) Loan interest paid (Note (ii)) Investment income 3,900 Profit on sale of investments 6,600 Current tax (Note (iv) Frechold property (land GH39,000) 1/10/17 (note (v) Plant and equipment - at cost (Note (v) Brand-at cost 1 October 2014 (Note (v) Accumulated depreciation 6,300 219,000 126,600 90,000 -1 October 2017 - building -1 October 2017-plant and equipment Accumulated amortisation - 1 October 2017 - brand 24,000 59,100 27,000 Investments in equity instruments Inventory at 30 September 2018 79,500 114,000 133,500 24,000 Trade receivables Bank Trade payables Ordinary shares Retained Earnings at 1 October 2017 154,020 156,000 78,180 Freehold property revaluation surplus 5% convertible loan note 2020 (Note (ii) Deferred tax (Note (iv) 15,000 60,000 16,200 1,740,000 1,740,000 Additional Information: i) Revenue includes goods sold and dispateched in September 2018 on a 30-day right of return basis. Their selling price was GH24,000 and they were sold at a gross profit margin of 25%. Jubilee Ltd is uncertain as to whether any of these goods will be returned within the 30-day period ii) Administrative expenses include an equity dividend of GH36,000 paid during the year. The 5% convertible loan note was issued for proceeds of GH60,000 on I October 2017. It has an effective interest rate of 8% due to the value of its conversion option. iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2017. The directors have estimated the provision for income tax for the year ended 30 September 2018 at GH48,600. At 30 September 2018 the carrying amounts of Jubilee Ltd's net assets were GH39,000 in excess of their tax base. The income tax rate of Jubilee Ltd is 30%. Non-current assets v) The freehold property was revalued to GH189,000 on 1 October, 2017. There was no change in value of the land. The building element had a remaining life of 20 years at 1 October 2017. Plant and equipment is depreciated at 40% per annum using the reducing balance method. Jubilee Ltd's brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2018 which concluded that, based on estimated future sales, the brand had a value in use of GH36,000 and a remaining life of only three years. However, on the same date as the impairment review, Jubilee Ltd received an offer to purchase the brand for GH45,000. Prior to the impairment review, it was being depreciated using the straight-line method over a 10 year life. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September 2018. Depreciation, amortisation and impairment charges are all charged to cost of sales. Required: a) Prepare the statement of profit or loss and other comprehensive income for Jubilee Ltd for the year ended 30 September 2018. b) Prepare the statement of changes in equity for Jubilee for the year ended 30 September 2018. c) Prepare the statement of financial position of Jubilee Ltd as at 30 September 2018.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Income statement for the year ended 31 Dec 2007 Cost of sales 89200 Revenue 180400 Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started