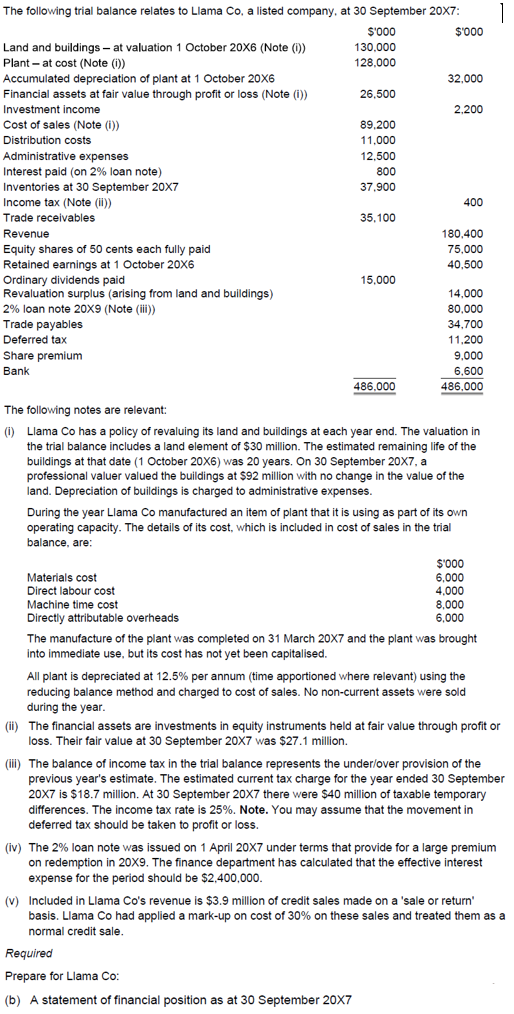

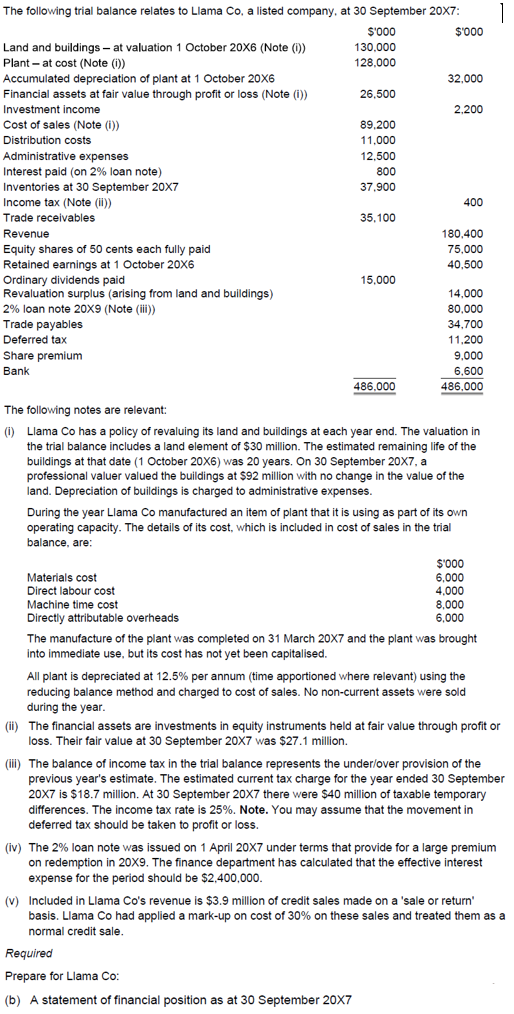

The following trial balance relates to Llama Co, a listed company, at 30 September 20X7: 1 $'000 $'000 Land and buildings - at valuation 1 October 20X6 (Note (0) 130.000 Plant - at cost (Note (0) 128.000 Accumulated depreciation of plant at 1 October 20X6 32.000 Financial assets at fair value through profit or loss (Note () 26.500 Investment income 2.200 Cost of sales (Note (0) ) 89.200 Distribution costs 11.000 Administrative expenses 12.500 Interest paid (on 2% loan note) 800 Inventories at 30 September 20X7 37.900 Income tax (Note (1) 400 Trade receivables 35,100 Revenue 180,400 Equity shares of 50 cents each fully paid 75.000 Retained earnings at 1 October 20X6 40.500 Ordinary dividends paid 15.000 Revaluation surplus (arising from land and buildings) 14.000 2% loan note 20x9 (Note (iii)) 80.000 Trade payables 34.700 Deferred tax 11.200 Share premium 9.000 Bank 6.600 486.000 486.000 The following notes are relevant: (0) Llama Co has a policy of revaluing its land and buildings at each year end. The valuation in the trial balance includes a land element of $30 million. The estimated remaining life of the buildings at that date (1 October 20X6) was 20 years. On 30 September 20X7, a professional valuer valued the buildings at $92 million with no change in the value of the land. Depreciation of buildings is charged to administrative expenses. During the year Llama Co manufactured an item of plant that it is using as part of its own operating capacity. The details of its cost, which is included in cost of sales in the trial balance, are: : $'000 Materials cost 6,000 Direct labour cost 4,000 Machine time cost 8,000 Directly attributable overheads 6.000 The manufacture of the plant was completed on 31 March 20X7 and the plant was brought Into immediate use, but its cost has not yet been capitalised. All plant is depreciated at 12.5% per annum (time apportioned where relevant) using the reducing balance method and charged to cost of sales. No non-current assets were sold during the year. (ii) The financial assets are investments in equity instruments held at fair value through profit or loss. Their fair value at 30 September 20X7 was $27.1 million. (iii) The balance of income tax in the trial balance represents the underlover provision of the previous year's estimate. The estimated current tax charge for the year ended 30 September 20x7 is $18.7 million. At 30 September 20X7 there were $40 million of taxable temporary differences. The income tax rate is 25%. Note. You may assume that the movement in deferred tax should be taken to profit or loss. (iv) The 2% loan note was issued on 1 April 20X7 under terms that provide for a large premium on redemption in 20X9. The finance department has calculated that the effective interest expense for the period should be $2,400,000. (v) Included in Llama Co's revenue is $3.9 million of credit sales made on a 'sale or return basis. Llama Co had applied a mark-up on cost of 30% on these sales and treated them as a normal credit sale. . Required Prepare for Llama Co: (b) A statement of financial position as at 30 September 20X7