Answered step by step

Verified Expert Solution

Question

1 Approved Answer

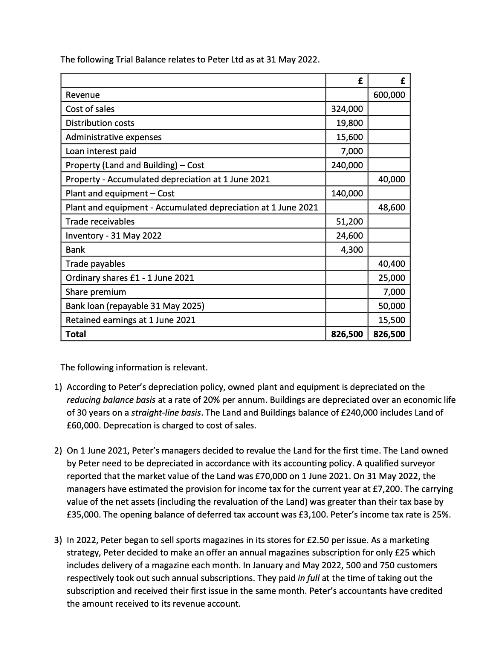

The following Trial Balance relates to Peter Ltd as at 31 May 2022. Revenue Cost of sales Distribution costs Administrative expenses Loan interest paid

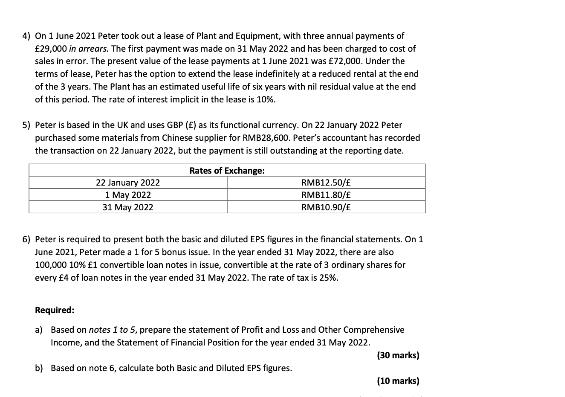

The following Trial Balance relates to Peter Ltd as at 31 May 2022. Revenue Cost of sales Distribution costs Administrative expenses Loan interest paid Property (Land and Building) -Cost Property Accumulated depreciation at 1 June 2021 Plant and equipment - Cost Plant and equipment Accumulated depreciation at 1 June 2021 Trade receivables Inventory - 31 May 2022 Bank Trade payables Ordinary shares 1-1 June 2021 Share premium Bank loan (repayable 31 May 2025) Retained earnings at 1 June 2021 Total 324,000 19,800 15,600 7,000 240,000 140,000 51,200 24,600 4,300 600,000 40,000 48,600 40,400 25,000 7,000 50,000 15,500 826,500 826,500 The following information is relevant. 1) According to Peter's depreciation policy, owned plant and equipment is depreciated on the reducing balance basis at a rate of 20% per annum. Buildings are depreciated over an economic life of 30 years on a straight-line basis. The Land and Buildings balance of 240,000 includes Land of 60,000. Deprecation is charged to cost of sales. 2) On 1 June 2021, Peter's managers decided to revalue the Land for the first time. The Land owned by Peter need to be depreciated in accordance with its accounting policy. A qualified surveyor reported that the market value of the Land was 70,000 on 1 June 2021. On 31 May 2022, the managers have estimated the provision for income tax for the current year at 7,200. The carrying value of the net assets (including the revaluation of the Land) was greater than their tax base by 35,000. The opening balance of deferred tax account was 3,100. Peter's income tax rate is 25%. 3) In 2022, Peter began to sell sports magazines in its stores for 2.50 per issue. As a marketing strategy, Peter decided to make an offer an annual magazines subscription for only 25 which includes delivery of a magazine each month. In January and May 2022, 500 and 750 customers respectively took out such annual subscriptions. They paid in full at the time of taking out the subscription and received their first issue in the same month. Peter's accountants have credited the amount received to its revenue account. 4) On 1 June 2021 Peter took out a lease of Plant and Equipment, with three annual payments of 29,000 in arrears. The first payment was made on 31 May 2022 and has been charged to cost of sales in error. The present value of the lease payments at 1 June 2021 was 72,000. Under the terms of lease, Peter has the option to extend the lease indefinitely at a reduced rental at the end of the 3 years. The Plant has an estimated useful life of six years with nil residual value at the end of this period. The rate of interest implicit in the lease is 10%. 5) Peter is based in the UK and uses GBP () as its functional currency. On 22 January 2022 Peter purchased some materials from Chinese supplier for RMB28,600. Peter's accountant has recorded the transaction on 22 January 2022, but the payment is still outstanding at the reporting date. Rates of Exchange: 22 January 2022 1 May 2022 31 May 2022 RMB12.50/E RMB11.80/E RMB10.90/E 6) Peter is required to present both the basic and diluted EPS figures in the financial statements. On 1 June 2021, Peter made a 1 for 5 bonus issue. In the year ended 31 May 2022, there are also 100,000 10 % 1 convertible loan notes in issue, convertible at the rate of 3 ordinary shares for every 4 of loan notes in the year ended 31 May 2022. The rate of tax is 25%. Required: a) Based on notes 1 to 5, prepare the statement of Profit and Loss and Other Comprehensive Income, and the Statement of Financial Position for the year ended 31 May 2022. (30 marks) b) Based on note 6, calculate both Basic and Diluted EPS figures. (10 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Permanent account balances Assets Property Land and Building Cost 240000 Property Accumulated deprec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started