Question

The following Trial Balance was extracted from the books of Hillside Plc at 31st March 2006: K000 K000 K1 000 ordinary shares 200 000 8%

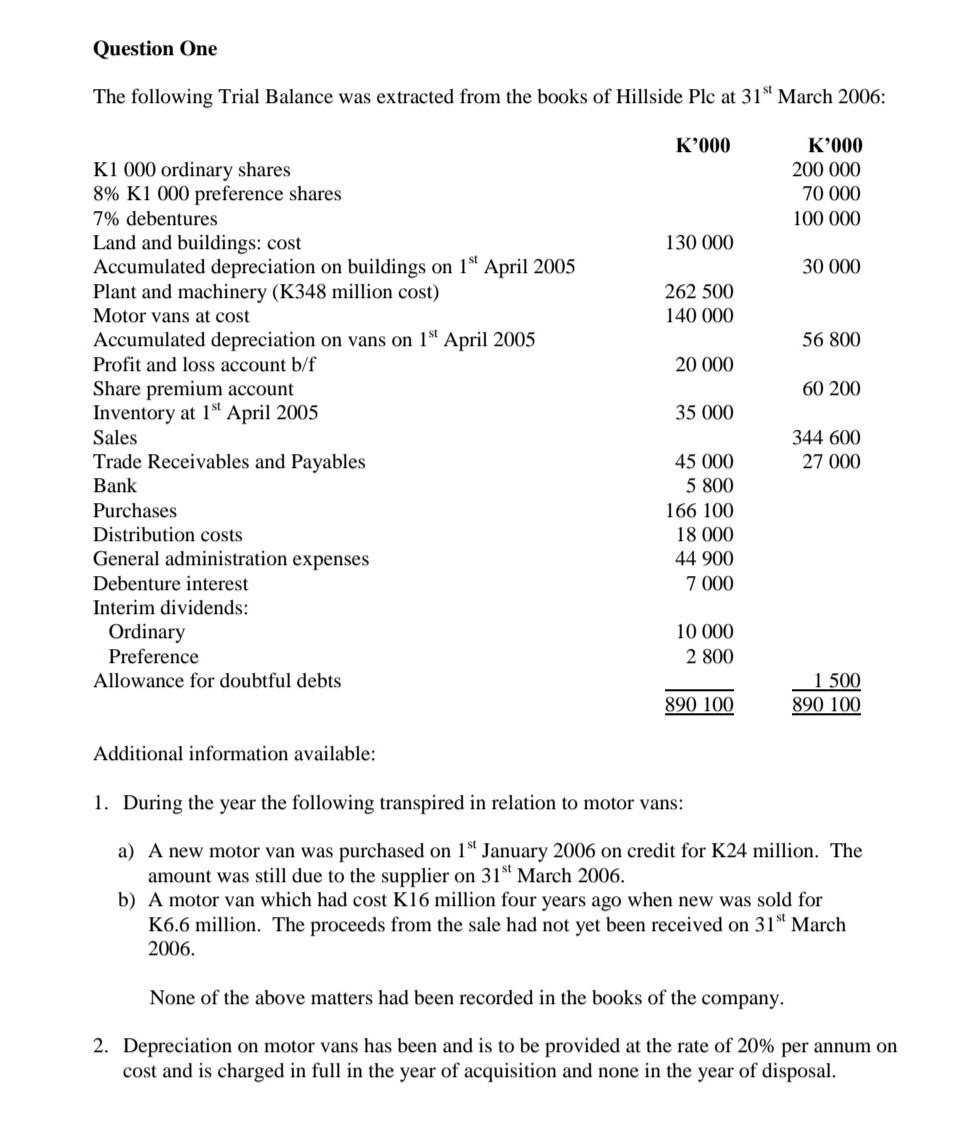

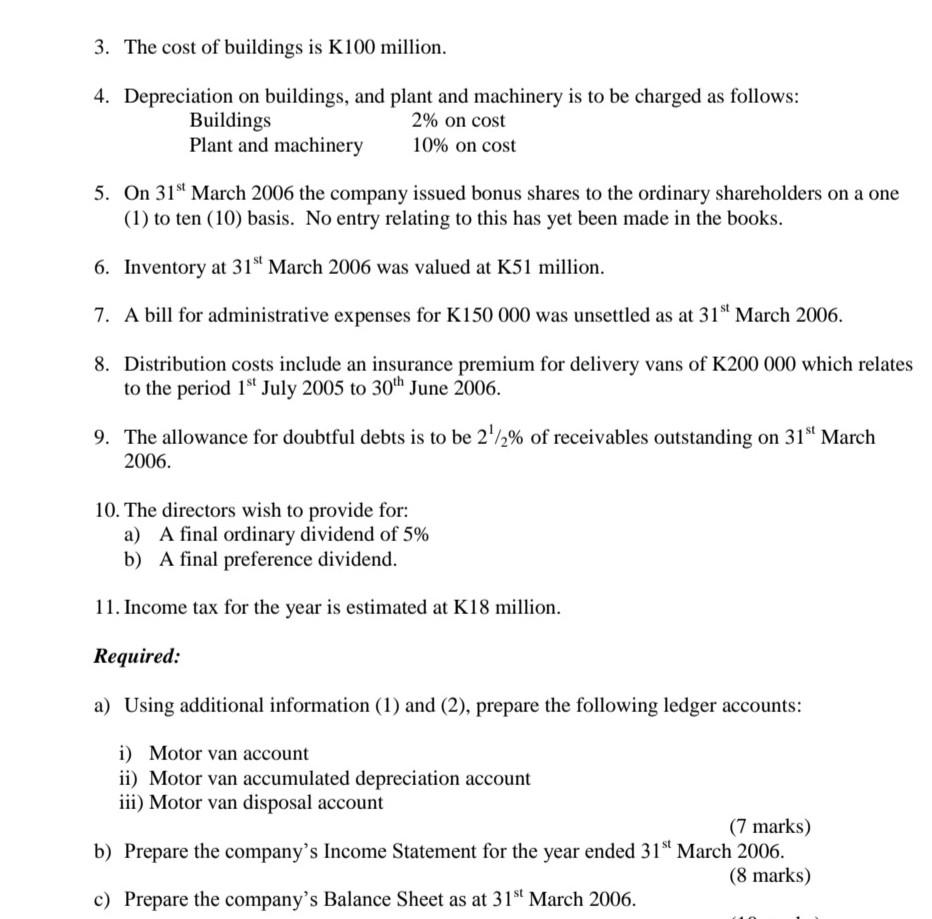

The following Trial Balance was extracted from the books of Hillside Plc at 31st March 2006: K000 K000 K1 000 ordinary shares 200 000 8% K1 000 preference shares 70 000 7% debentures 100 000 Land and buildings: cost 130 000 Accumulated depreciation on buildings on 1st April 2005 30 000 Plant and machinery (K348 million cost) 262 500 Motor vans at cost 140 000 Accumulated depreciation on vans on 1st April 2005 56 800 Profit and loss account b/f 20 000 Share premium account 60 200 Inventory at 1st April 2005 35 000 Sales 344 600 Trade Receivables and Payables 45 000 27 000 Bank 5 800 Purchases 166 100 Distribution costs 18 000 General administration expenses 44 900 Debenture interest 7 000 Interim dividends: Ordinary 10 000 Preference 2 800 Allowance for doubtful debts 1 500 890 100 890 100 Additional information available: 1. During the year the following transpired in relation to motor vans: a) A new motor van was purchased on 1st January 2006 on credit for K24 million. The amount was still due to the supplier on 31st March 2006. b) A motor van which had cost K16 million four years ago when new was sold for K6.6 million. The proceeds from the sale had not yet been received on 31st March 2006. None of the above matters had been recorded in the books of the company. 2. Depreciation on motor vans has been and is to be provided at the rate of 20% per annum on cost and is charged in full in the year of acquisition and none in the year of disposal.3. The cost of buildings is K100 million. 4. Depreciation on buildings, and plant and machinery is to be charged as follows: Buildings 2% on cost Plant and machinery 10% on cost 5. On 31st March 2006 the company issued bonus shares to the ordinary shareholders on a one (1) to ten (10) basis. No entry relating to this has yet been made in the books. 6. Inventory at 31st March 2006 was valued at K51 million. 7. A bill for administrative expenses for K150 000 was unsettled as at 31st March 2006. 8. Distribution costs include an insurance premium for delivery vans of K200 000 which relates to the period 1st July 2005 to 30th June 2006. 9. The allowance for doubtful debts is to be 21/2% of receivables outstanding on 31st March 2006. 10. The directors wish to provide for: a) A final ordinary dividend of 5% b) A final preference dividend. 11. Income tax for the year is estimated at K18 million. Required: a) Using additional information (1) and (2), prepare the following ledger accounts: i) Motor van account ii) Motor van accumulated depreciation account iii) Motor van disposal account (8 marks) b) Prepare the companys Income Statement for the year ended 31st March 2006. (12 marks) c) Prepare the companys Balance Sheet as at 31st March 2006. (15 marks)

Question One The following Trial Balance was extracted from the books of Hillside Plc at 31st March 2006: Additional information available: 1. During the year the following transpired in relation to motor vans: a) A new motor van was purchased on 1st January 2006 on credit for K24 million. The amount was still due to the supplier on 31st March 2006. b) A motor van which had cost K16 million four years ago when new was sold for K6.6 million. The proceeds from the sale had not yet been received on 31st March 2006. None of the above matters had been recorded in the books of the company. 2. Depreciation on motor vans has been and is to be provided at the rate of 20% per annum on cost and is charged in full in the year of acquisition and none in the year of disposal. 3. The cost of buildings is K100 million. 4. Depreciation on buildings, and plant and machinery is to be charged as follows: Buildings 2% on cost Plant and machinery 10% on cost 5. On 31st March 2006 the company issued bonus shares to the ordinary shareholders on a one (1) to ten (10) basis. No entry relating to this has yet been made in the books. 6. Inventory at 31st March 2006 was valued at K51 million. 7. A bill for administrative expenses for K150000 was unsettled as at 31st March 2006. 8. Distribution costs include an insurance premium for delivery vans of K200000 which relates to the period 1st July 2005 to 30th June 2006 . 9. The allowance for doubtful debts is to be 221% of receivables outstanding on 31st March 2006. 10. The directors wish to provide for: a) A final ordinary dividend of 5% b) A final preference dividend. 11. Income tax for the year is estimated at K18 million. Required: a) Using additional information (1) and (2), prepare the following ledger accounts: i) Motor van account ii) Motor van accumulated depreciation account iii) Motor van disposal account b) Prepare the company's Income Statement for the year ended 31st March 2006. c) Prepare the company's Balance Sheet as at 31st March 2006. (8 marks) Question One The following Trial Balance was extracted from the books of Hillside Plc at 31st March 2006: Additional information available: 1. During the year the following transpired in relation to motor vans: a) A new motor van was purchased on 1st January 2006 on credit for K24 million. The amount was still due to the supplier on 31st March 2006. b) A motor van which had cost K16 million four years ago when new was sold for K6.6 million. The proceeds from the sale had not yet been received on 31st March 2006. None of the above matters had been recorded in the books of the company. 2. Depreciation on motor vans has been and is to be provided at the rate of 20% per annum on cost and is charged in full in the year of acquisition and none in the year of disposal. 3. The cost of buildings is K100 million. 4. Depreciation on buildings, and plant and machinery is to be charged as follows: Buildings 2% on cost Plant and machinery 10% on cost 5. On 31st March 2006 the company issued bonus shares to the ordinary shareholders on a one (1) to ten (10) basis. No entry relating to this has yet been made in the books. 6. Inventory at 31st March 2006 was valued at K51 million. 7. A bill for administrative expenses for K150000 was unsettled as at 31st March 2006. 8. Distribution costs include an insurance premium for delivery vans of K200000 which relates to the period 1st July 2005 to 30th June 2006 . 9. The allowance for doubtful debts is to be 221% of receivables outstanding on 31st March 2006. 10. The directors wish to provide for: a) A final ordinary dividend of 5% b) A final preference dividend. 11. Income tax for the year is estimated at K18 million. Required: a) Using additional information (1) and (2), prepare the following ledger accounts: i) Motor van account ii) Motor van accumulated depreciation account iii) Motor van disposal account b) Prepare the company's Income Statement for the year ended 31st March 2006. c) Prepare the company's Balance Sheet as at 31st March 2006. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started