Answered step by step

Verified Expert Solution

Question

1 Approved Answer

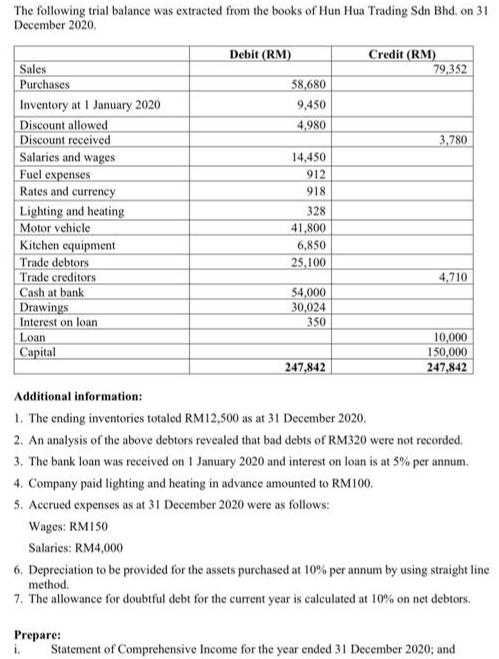

The following trial balance was extracted from the books of Hun Hua Trading Sdn Bhd. on 31 December 2020. Debit (RM) Credit (RM) Sales

The following trial balance was extracted from the books of Hun Hua Trading Sdn Bhd. on 31 December 2020. Debit (RM) Credit (RM) Sales 79,352 Purchases 58,680 Inventory at 1 January 2020 9,450 Discount allowed 4,980 Discount received 3,780 14,450 Salaries and wages Fuel expenses Rates and currency 912 918 Lighting and heating 328 Motor vehicle 41,800 Kitchen equipment 6,850 Trade debtors 25,100 Trade creditors 4,710 Cash at bank 54,000 30,024 Drawings Interest on loan 350 Loan 10,000 150,000 Capital 247,842 247,842 Additional information: 1. The ending inventories totaled RM12,500 as at 31 December 2020. 2. An analysis of the above debtors revealed that bad debts of RM320 were not recorded. 3. The bank loan was received on 1 January 2020 and interest on loan is at 5% per annum. 4. Company paid lighting and heating in advance amounted to RM100. 5. Accrued expenses as at 31 December 2020 were as follows: Wages: RM150 Salaries: RM4,000 6. Depreciation to be provided for the assets purchased at 10% per annum by using straight line method. 7. The allowance for doubtful debt for the current year is calculated at 10% on net debtors. Prepare: i. Statement of Comprehensive Income for the year ended 31 December 2020; and ii. Statement of Financial Position as at 31 December 2020. (10 marks) (15 marks) [Total: 25 marks]

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Income Statement For the Year Ended December 31 2020 Description Amount Amount Revenue Sales 79352 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started