Answered step by step

Verified Expert Solution

Question

1 Approved Answer

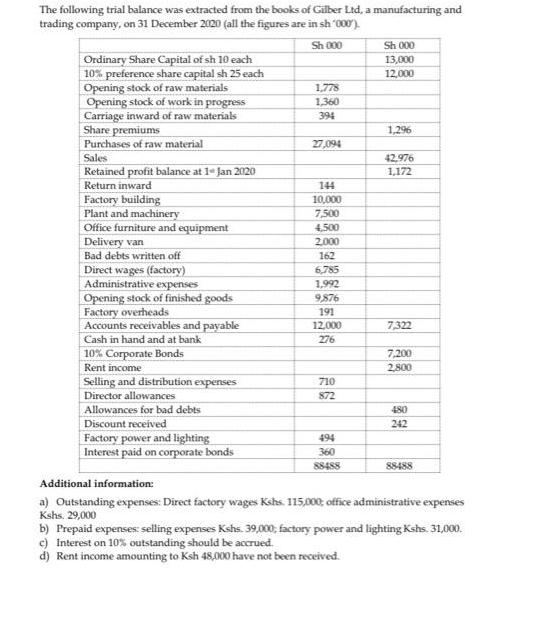

The following trial balance was extracted from the books of Gilber Ltd, a manufacturing and trading company, on 31 December 2020 (all the figures

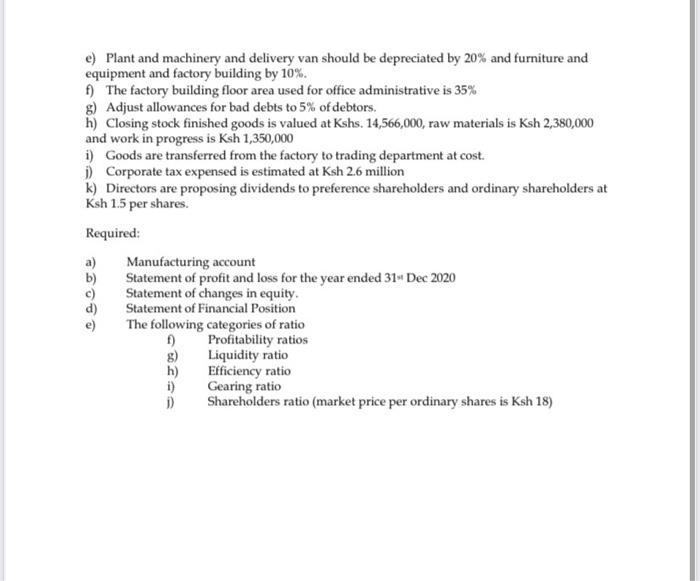

The following trial balance was extracted from the books of Gilber Ltd, a manufacturing and trading company, on 31 December 2020 (all the figures are in sh '000). Sh 000 Ordinary Share Capital of sh 10 each 10% preference share capital sh 25 each Opening stock of raw materials Opening stock of work in progress Carriage inward of raw materials Share premiums Purchases of raw material Sales Retained profit balance at 1 Jan 2020 Return inward Factory building Plant and machinery Office furniture and equipment Delivery van Bad debts written off Direct wages (factory) Administrative expenses Opening stock of finished goods Factory overheads Accounts receivables and payable Cash in hand and at bank 10% Corporate Bonds Rent income Selling and distribution expenses Director allowances Allowances for bad debts Discount received Factory power and lighting Interest paid on corporate bonds 1,778 1,360 394 27,094 144 10,000 7,500 4,500 2,000 162 6,785 1,992 9,876 191 12,000 276 710 872 494 360 88488 Sh 000 13,000 12,000 1,296 42,976 1,172 7,322 7,200 2,800 480 242 88488 Additional information: a) Outstanding expenses: Direct factory wages Kshs. 115,000, office administrative expenses Kshs. 29,000 b) Prepaid expenses: selling expenses Kshs. 39,000; factory power and lighting Kshs. 31,000. c) Interest on 10% outstanding should be accrued. d) Rent income amounting to Ksh 48,000 have not been received. e) Plant and machinery and delivery van should be depreciated by 20% and furniture and equipment and factory building by 10%. f) The factory building floor area used for office administrative is 35% g) Adjust allowances for bad debts to 5% of debtors. h) Closing stock finished goods is valued at Kshs. 14,566,000, raw materials is Ksh 2,380,000 and work in progress is Ksh 1,350,000 i) Goods are transferred from the factory to trading department at cost. i) Corporate tax expensed is estimated at Ksh 2.6 million k) Directors are proposing dividends to preference shareholders and ordinary shareholders at Ksh 1.5 per shares. Required: a) b) c) d) Manufacturing account Statement of profit and loss for the year ended 31 Dec 2020 Statement of changes in equity. Statement of Financial Position The following categories of ratio f) Profitability ratios Liquidity ratio Efficiency ratio Gearing ratio Shareholders ratio (market price per ordinary shares is Ksh 18) h) i) j)

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started