Answered step by step

Verified Expert Solution

Question

1 Approved Answer

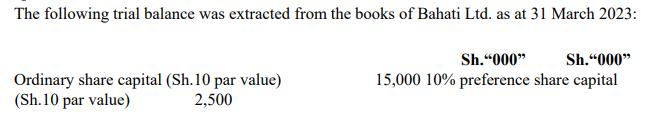

The following trial balance was extracted from the books of Bahati Ltd. as at 31 March 2023: Ordinary share capital (Sh. 10 par value)

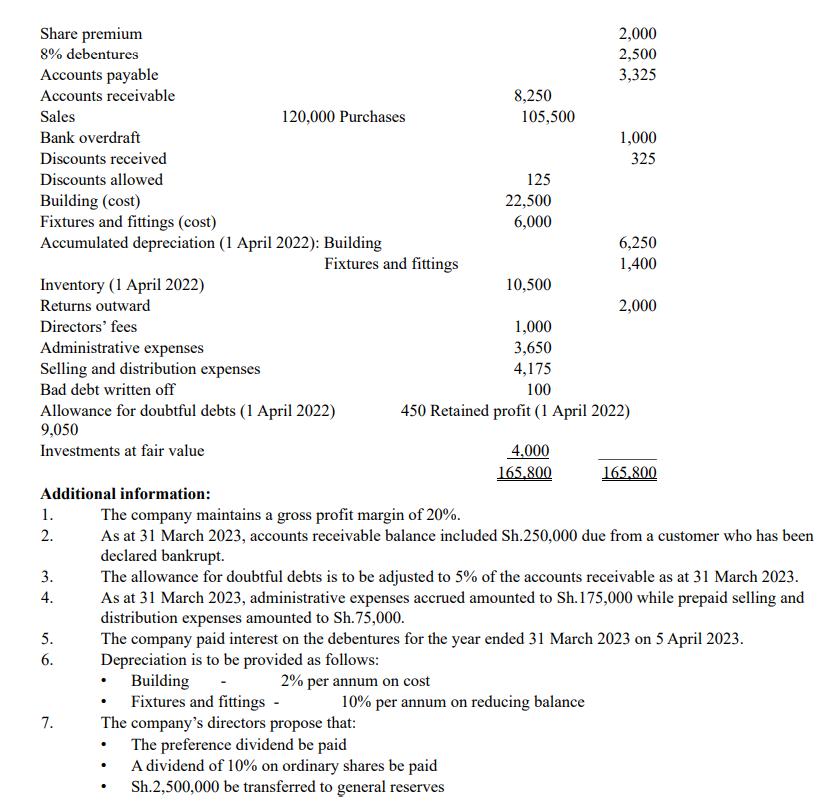

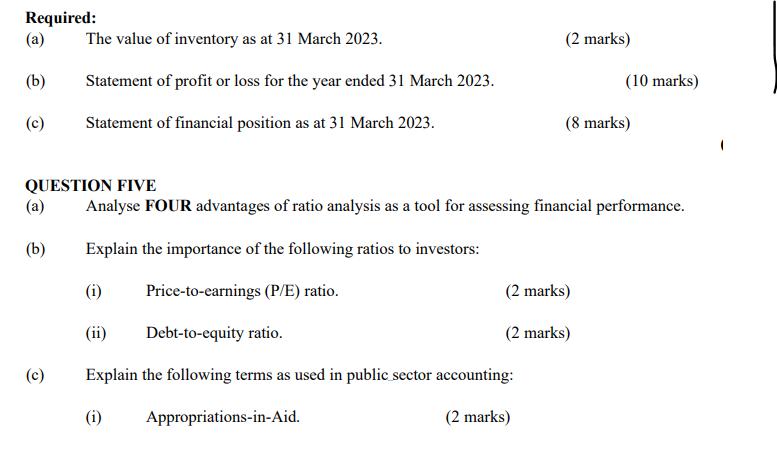

The following trial balance was extracted from the books of Bahati Ltd. as at 31 March 2023: Ordinary share capital (Sh. 10 par value) (Sh. 10 par value) 2,500 Sh."000" Sh."000" 15,000 10% preference share capital Share premium 8% debentures 2,000 2,500 Accounts payable 3,325 Accounts receivable 8,250 Sales 120,000 Purchases 105,500 Bank overdraft 1,000 Discounts received 325 Discounts allowed 125 Building (cost) 22,500 Fixtures and fittings (cost) 6,000 Accumulated depreciation (1 April 2022): Building 6,250 Fixtures and fittings 1,400 Inventory (1 April 2022) 10,500 Returns outward 2,000 Administrative expenses Directors' fees Selling and distribution expenses Bad debt written off Allowance for doubtful debts (1 April 2022) 9,050 Investments at fair value Additional information: 450 Retained profit (1 April 2022) 4,000 165,800 165.800 1,000 3,650 4,175 100 1. 2. 34 3. 4. 56 5. 6. 7. The company maintains a gross profit margin of 20%. As at 31 March 2023, accounts receivable balance included Sh.250,000 due from a customer who has been declared bankrupt. The allowance for doubtful debts is to be adjusted to 5% of the accounts receivable as at 31 March 2023. As at 31 March 2023, administrative expenses accrued amounted to Sh.175,000 while prepaid selling and distribution expenses amounted to Sh.75,000. The company paid interest on the debentures for the year ended 31 March 2023 on 5 April 2023. Depreciation is to be provided as follows: Building 2% per annum on cost Fixtures and fittings - 10% per annum on reducing balance The company's directors propose that: . The preference dividend be paid A dividend of 10% on ordinary shares be paid Sh.2,500,000 be transferred to general reserves Required: (a) The value of inventory as at 31 March 2023. (2 marks) (b) Statement of profit or loss for the year ended 31 March 2023. (10 marks) (c) Statement of financial position as at 31 March 2023. (8 marks) QUESTION FIVE (a) Analyse FOUR advantages of ratio analysis as a tool for assessing financial performance. (b) Explain the importance of the following ratios to investors: (i) Price-to-earnings (P/E) ratio. (2 marks) (ii) Debt-to-equity ratio. (2 marks) (c) (i) Explain the following terms as used in public sector accounting: Appropriations-in-Aid. (2 marks) (ii) Consolidated fund. (2 marks) (d) Describe FOUR benefits of adopting International Financial Reporting Standards (IFRSS).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started