Answered step by step

Verified Expert Solution

Question

1 Approved Answer

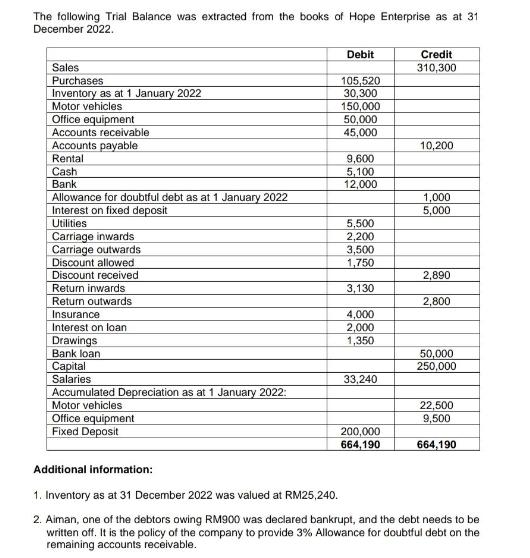

The following Trial Balance was extracted from the books of Hope Enterprise as at 31 December 2022. Sales Purchases Inventory as at 1 January

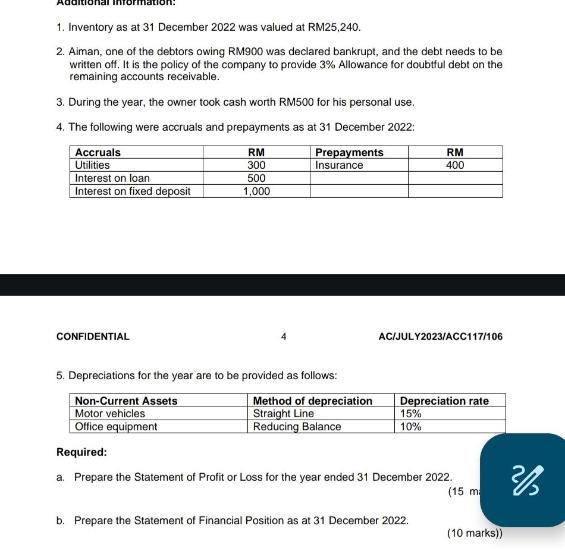

The following Trial Balance was extracted from the books of Hope Enterprise as at 31 December 2022. Sales Purchases Inventory as at 1 January 2022 Motor vehicles Office equipment Accounts receivable Accounts payable Rental Cash Bank Allowance for doubtful debt as at 1 January 2022 Interest on fixed deposit Utilities Carriage inwards Carriage outwards Discount allowed Discount received Return inwards Return outwards Insurance Interest on loan Drawings Bank loan Capital Salaries Accumulated Depreciation as at 1 January 2022: Motor vehicles Office equipment Fixed Deposit Debit 105,520 30,300 150,000 50,000 45,000 9,600 5,100 12,000 5,500 2,200 3,500 1,750 3,130 4,000 2,000 1,350 33,240 200,000 664,190 Credit 310,300 10,200 1,000 5,000 2,890 2,800 50,000 250,000 22,500 9,500 664,190 Additional information: 1. Inventory as at 31 December 2022 was valued at RM25,240. 2. Aiman, one of the debtors owing RM900 was declared bankrupt, and the debt needs to be written off. It is the policy of the company to provide 3% Allowance for doubtful debt on the remaining accounts receivable. 1. Inventory as at 31 December 2022 was valued at RM25,240. 2. Aiman, one of the debtors owing RM900 was declared bankrupt, and the debt needs to be written off. It is the policy of the company to provide 3% Allowance for doubtful debt on the remaining accounts receivable. 3. During the year, the owner took cash worth RM500 for his personal use. 4. The following were accruals and prepayments as at 31 December 2022: RM 300 500 1,000 Accruals Utilities Interest on loan Interest on fixed deposit CONFIDENTIAL Prepayments Insurance 5. Depreciations for the year are to be provided as follows: Non-Current Assets Motor vehicles Office equipment Method of depreciation Straight Line Reducing Balance AC/JULY2023/ACC117/106 RM 400 Depreciation rate 15% 10% Required: a. Prepare the Statement of Profit or Loss for the year ended 31 December 2022. (15 m b. Prepare the Statement of Financial Position as at 31 December 2022. (10 marks)) 3%

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Profit or Loss for the year ended 31 December 2022 Sales Less Return inwards Net Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started