Question

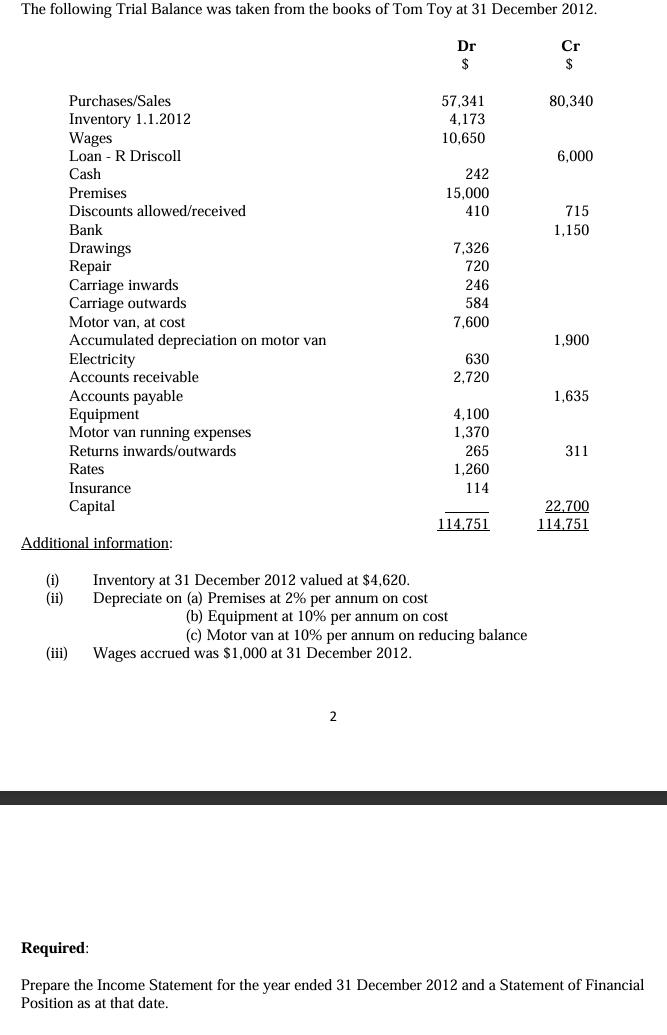

The following Trial Balance was taken from the books of Tom Toy at 31 December 2012. Purchases/Sales Inventory 1.1.2012 Wages Loan - R Driscoll

The following Trial Balance was taken from the books of Tom Toy at 31 December 2012. Purchases/Sales Inventory 1.1.2012 Wages Loan - R Driscoll Cash Premises ms Dr Cr $ 57,341 80,340 4,173 10,650 242 15,000 6,000 Discounts allowed/received 410 715 Bank 1,150 Drawings 7,326 Repair 720 Carriage inwards 246 Carriage outwards 584 Motor van, at cost 7,600 Accumulated depreciation on motor van 1,900 Electricity 630 Accounts receivable 2,720 Accounts payable 1,635 Equipment 4,100 Motor van running expenses 1,370 Returns inwards/outwards Rates Insurance 265 1,260 311 Capital Additional information: 114 22,700 114,751 114,751 (i) Inventory at 31 December 2012 valued at $4,620. (ii) Depreciate on (a) Premises at 2% per annum on cost (b) Equipment at 10% per annum on cost (iii) (c) Motor van at 10% per annum on reducing balance Wages accrued was $1,000 at 31 December 2012. 2 Required: Prepare the Income Statement for the year ended 31 December 2012 and a Statement of Financial Position as at that date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

how each part is calculated to prepare the Income Statement and the Statement of Financial Position as of December 31 2012 based on the provided trial ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started