Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following two-step binomial tree depicts the yearly price path of an underlying share. The length of each time step is one year and

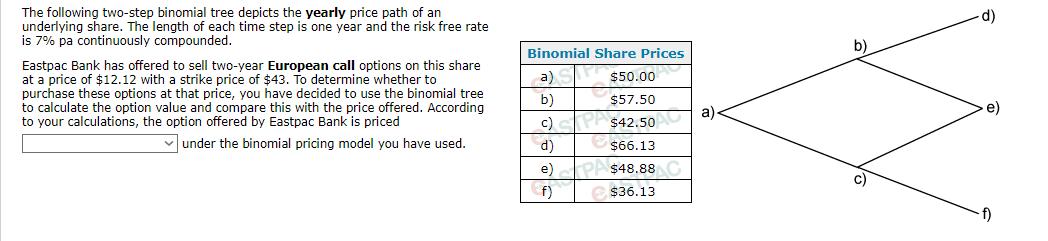

The following two-step binomial tree depicts the yearly price path of an underlying share. The length of each time step is one year and the risk free rate is 7% pa continuously compounded. Eastpac Bank has offered to sell two-year European call options on this share at a price of $12.12 with a strike price of $43. To determine whether to purchase these options at that price, you have decided to use the binomial tree to calculate the option value and compare this with the price offered. According to your calculations, the option offered by Eastpac Bank is priced under the binomial pricing model you have used. Binomial Share Prices a) b) c) d) e) f) $50.00 $57.50 $42.50 $66.13 $48.88 C $36.13 b) d) >e) -f)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer The binomial tree represents the possible price paths of the underlying share over two years with the riskfree rate of 7 per annum The tree has ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started