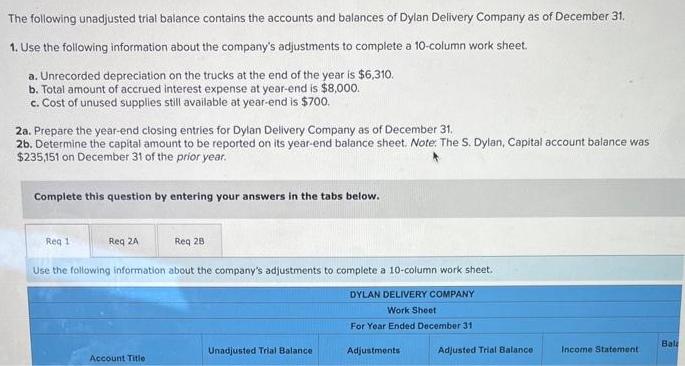

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about

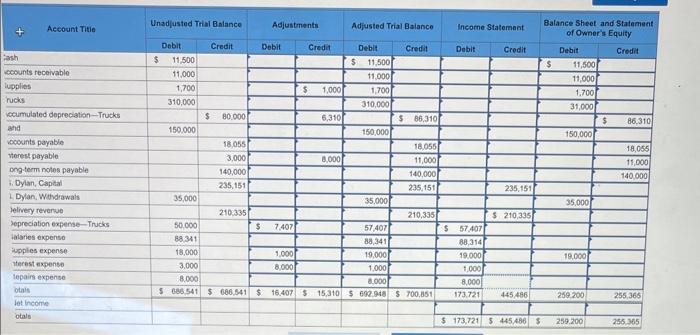

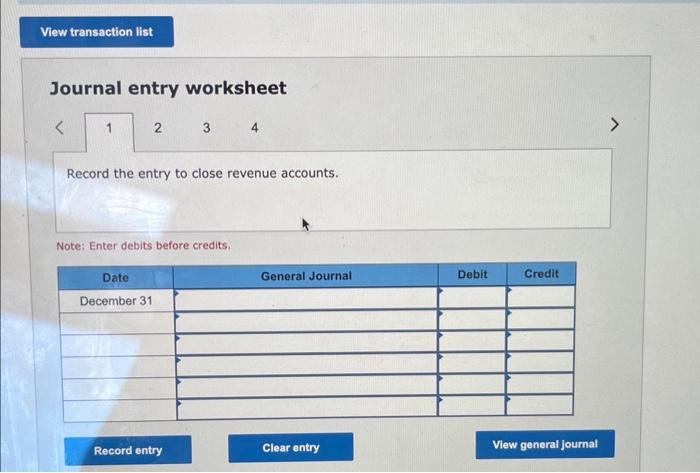

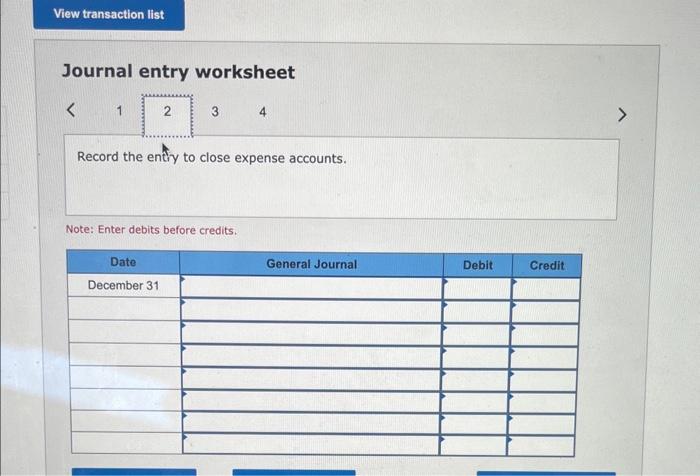

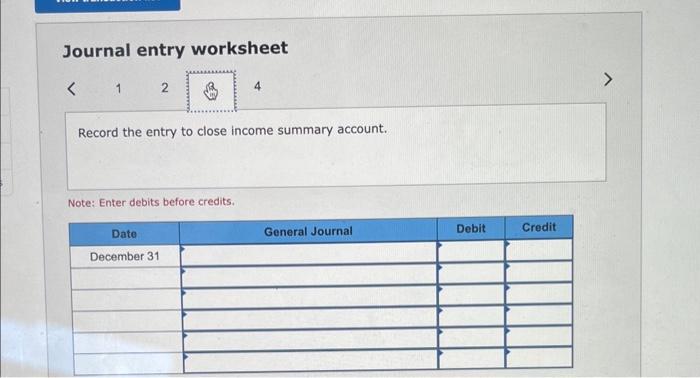

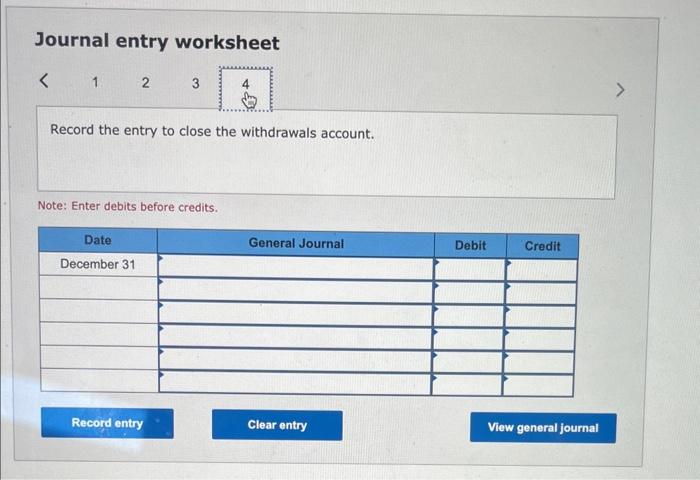

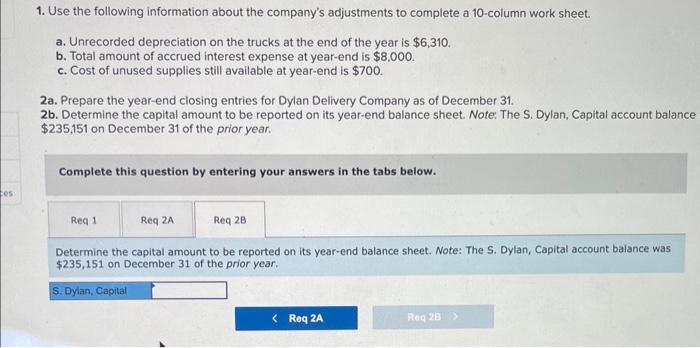

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about the company's adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $6,310. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $700. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $235,151 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 28 Use the following information about the company's adjustments to complete a 10-column work sheet. DYLAN DELIVERY COMPANY Work Sheet For Year Ended December 31 Account Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance - Income Statement Balz Account Title Fash ccounts receivable lupplies rucks ccumulated depreciation-Trucks and ccounts payable terest payable ong-term notes payable Dylan, Capital LDylan, Withdrawals Jelivery revenue Depreciation expense-Trucks lalaries expense upplies expense terest expense tepairs expense otals let Income otals Unadjusted Trial Balance Debit $ 11,500 11,000 1,700 310,000 150.000 35,000 50.000 88,341 18,000 Credit $ 80,000 18,055 3,000 140,000 235,151 210,335 Adjustments 3,000 8,000 5 086,541 $ 686,541 $ Debit $ 7,407 Credit 1,000 8.000 $ 1,000 6,310 8,000 Adjusted Trial Balance Debit $ 11,500 11,000 1,700 310,000 150,000 35,000 Credit $ 86,310 18,055 11,000 140,000 235,151 57,407 88,341 19,000 1,000 8,000 16.407 $ 15,310 $ 602.948 $ 700,851 210,335 Income Statement Debit $ 57,407 88,314 19,000 1,000 8,000 173.721 Credit 235,151 $ 210,335 445,486 $ 173,721 $ 445,486 $ Balance Sheet and Statement of Owner's Equity Debit Credit $ 11,500 11,000 1,700 31,000 150,000 35,000 19,000 259.200 259.200 $ 86,310 18,055 11,000 140,000 255,366 255,365 View transaction list Journal entry worksheet < 1 2 Date December 31 3 Record the entry to close revenue accounts. Note: Enter debits before credits. Record entry 4 General Journal Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 3 Record the entry to close expense accounts. Date December 31 Note: Enter debits before credits. General Journal Debit Credit Journal entry worksheet < 1 2 Record the entry to close income summary account. Note: Enter debits before credits. 4 Date December 31 General Journal Debit Credit Journal entry worksheet 1 2 3 < Record the entry to close the withdrawals account. Note: Enter debits before credits. Date December 31 +4 Record entry General Journal Clear entry Debit Credit View general journal cos 1. Use the following information about the company's adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $6,310. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $700. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance $235,151 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 28 Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $235,151 on December 31 of the prior year. S. Dylan, Capital < Req 2A Req 28 >

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

It seems like youre asking for assistance with recording closing entries for Dylan Delivery Company as of December 31 To make these entries we should ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started