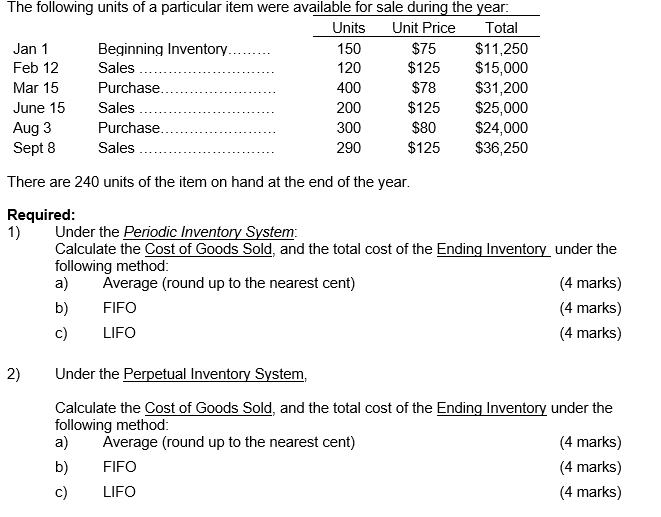

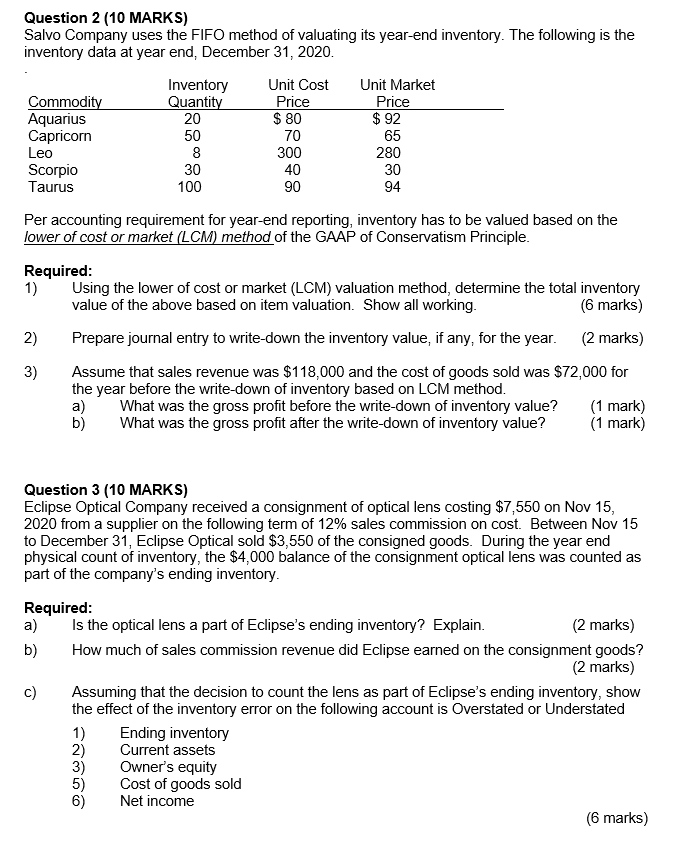

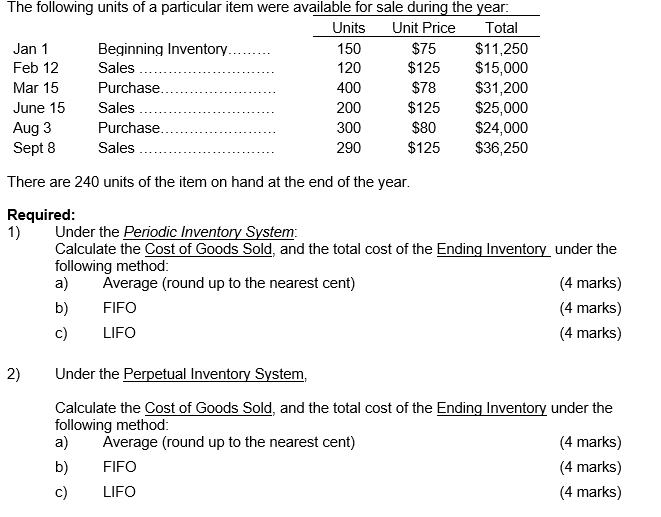

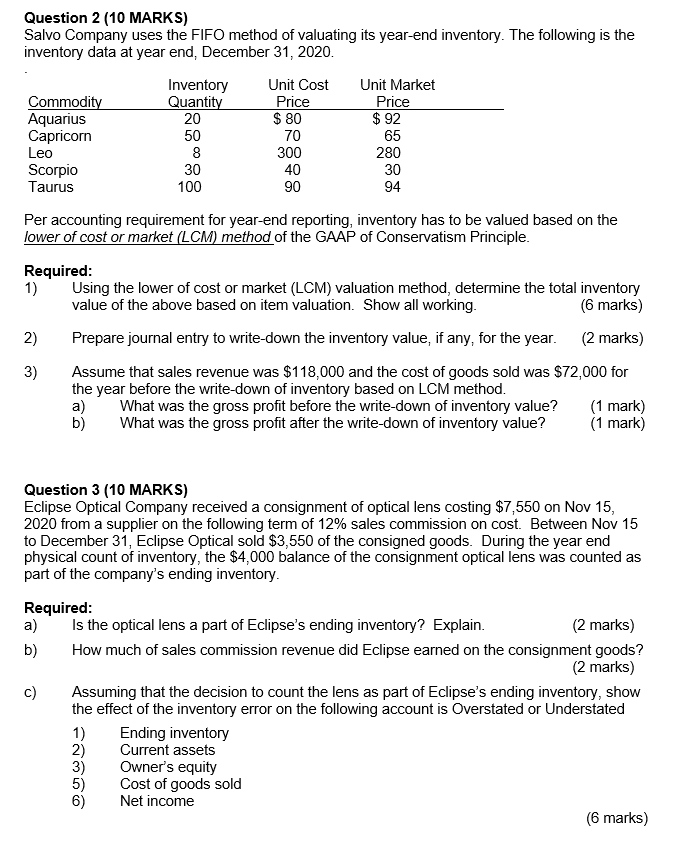

The following units of a particular item were available for sale during the year Units Unit Price Total Jan 1 Beginning Inventory.. 150 $75 $11,250 Feb 12 Sales 120 $125 $15,000 Mar 15 Purchase. 400 $78 $31,200 June 15 Sales 200 $125 $25,000 Aug 3 Purchase. 300 $80 $24,000 Sept 8 Sales 290 $125 $36,250 There are 240 units of the item on hand at the end of the year. Required: 1) Under the Periodic Inventory System: Calculate the cost of Goods Sold, and the total cost of the Ending Inventory under the following method: a) Average (round up to the nearest cent) (4 marks) b) FIFO (4 marks) c) LIFO (4 marks) 2) Under the Perpetual Inventory System, Calculate the cost of Goods Sold, and the total cost of the Ending Inventory under the following method: a) Average (round up to the nearest cent) (4 marks) b) FIFO (4 marks) c) LIFO (4 marks) Question 2 (10 MARKS) Salvo Company uses the FIFO method of valuating its year-end inventory. The following is the inventory data at year end, December 31, 2020. Inventory Unit Cost Unit Market Commodity Quantity Price Price Aquarius 20 $ 80 $92 Capricorn 50 70 65 Leo 8 300 280 Scorpio 30 40 30 Taurus 100 90 94 Per accounting requirement for year-end reporting, inventory has to be valued based on the lower of cost or market (LCM) method of the GAAP of Conservatism Principle. Required: 1) Using the lower of cost or market (LCM) valuation method, determine the total inventory value of the above based on item valuation. Show all working. (6 marks) 2) Prepare journal entry to write down the inventory value, if any, for the year. (2 marks) 3) Assume that sales revenue was $118,000 and the cost of goods sold was $72,000 for the year before the write-down of inventory based on LCM method. a) What was the gross profit before the write-down of inventory value? (1 mark) b) What was the gross profit after the write-down of inventory value? (1 mark) Question 3 (10 MARKS) Eclipse Optical Company received a consignment of optical lens costing $7,550 on Nov 15, 2020 from a supplier on the following term of 12% sales commission on cost. Between Nov 15 to December 31, Eclipse Optical sold $3,550 of the consigned goods. During the year end physical count of inventory, the $4,000 balance of the consignment optical lens was counted as part of the company's ending inventory. Required: a) Is the optical lens a part of Eclipse's ending inventory? Explain. (2 marks) b) How much of sales commission revenue did Eclipse earned on the consignment goods? (2 marks) c) Assuming that the decision to count the lens as part of Eclipse's ending inventory, show the effect of the inventory error on the following account is Overstated or Understated 1) Ending inventory 2) Current assets 3) Owner's equity 5) Cost of goods sold 6) Net income (6 marks)