Answered step by step

Verified Expert Solution

Question

1 Approved Answer

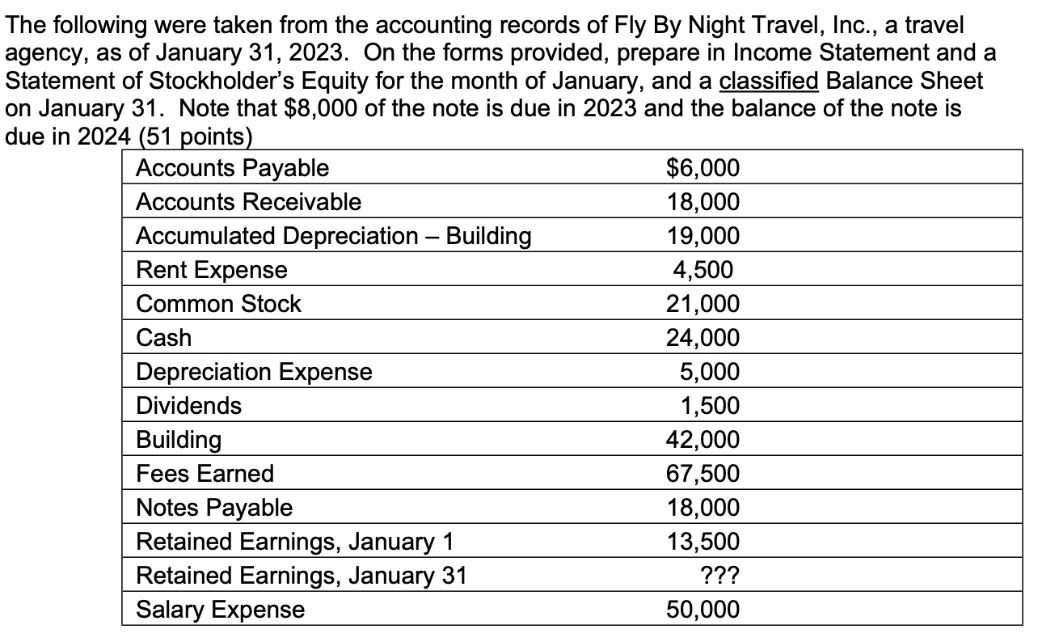

The following were taken from the accounting records of Fly By Night Travel, Inc., a travel agency, as of January 31, 2023. On the

The following were taken from the accounting records of Fly By Night Travel, Inc., a travel agency, as of January 31, 2023. On the forms provided, prepare in Income Statement and a Statement of Stockholder's Equity for the month of January, and a classified Balance Sheet on January 31. Note that $8,000 of the note is due in 2023 and the balance of the note is due in 2024 (51 points) Accounts Payable Accounts Receivable Accumulated Depreciation - Building Rent Expense Common Stock Cash Depreciation Expense Dividends Building Fees Earned Notes Payable Retained Earnings, January 1 Retained Earnings, January 31 Salary Expense $6,000 18,000 19,000 4,500 21,000 24,000 5,000 1,500 42,000 67,500 18,000 13,500 ??? 50,000

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the requested financial statements for Fly By Night Travel Inc well start with the Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started