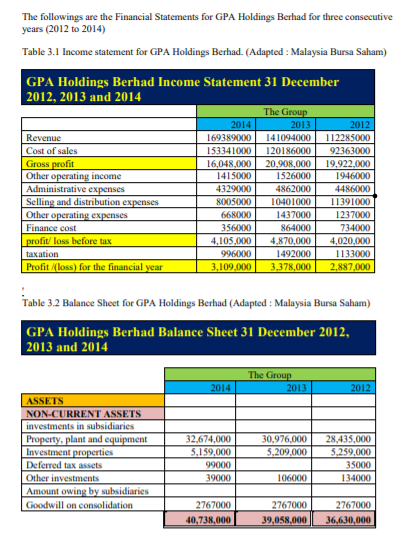

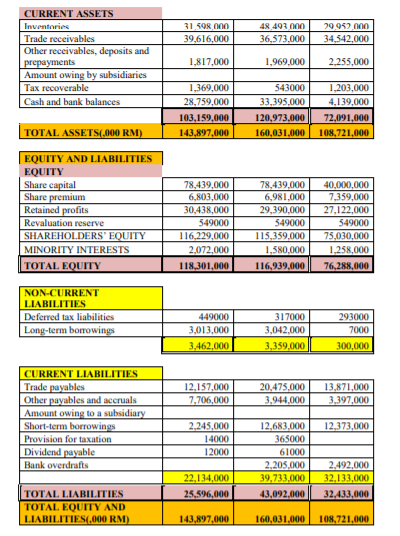

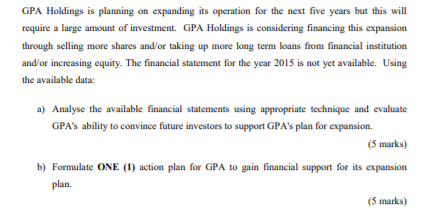

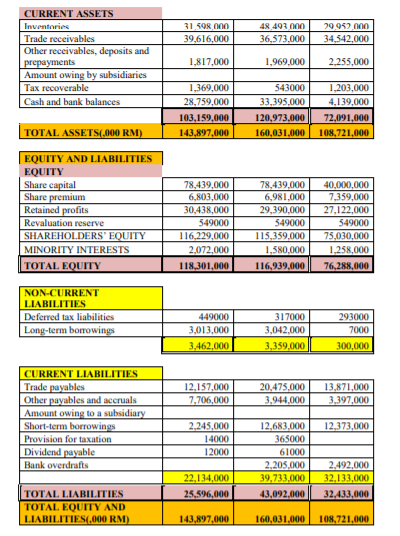

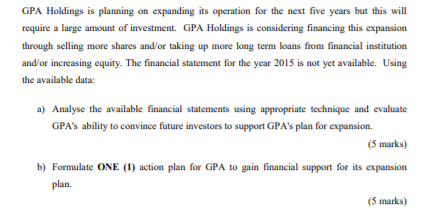

The followings are the Financial Statements for GPA Holdings Berhad for three consecutive years (2012 to 2014) Table 3.1 Income statement for GPA Holdings Berhad. (Adapted : Malaysia Bursa Saham) GPA Holdings Berhad Income Statement 31 December 2012, 2013 and 2014 The Group 2014 2013 2012 Revenue 1693890.00 141094000 112285000 Cost of sales 153341000 120186000 92363000 Gross profit 16,048.000 20.908,000 19,922,000 Other operating income 1415000 1526000 1946000 Administrative expenses 4329000 4862000 4486000 Selling and distribution expenses 8005000 10401000 11391000 Other operating expenses 668000 1437000 1237000 Finance cost 356000 864000 734000 profit loss before tax 4,105.000 4,870,000 4,020,000 taxation 996000 1492000 1133000 Profit /(Loss) for the financial year 3,109,000 3,378,000 2,887.000 Table 3.2 Balance Sheet for GPA Holdings Berhad (Adapted : Malaysia Bursa Saham) GPA Holdings Berhad Balance Sheet 31 December 2012, 2013 and 2014 The Group 2013 2014 2012 ASSETS NON-CURRENT ASSETS investments in subsidiaries Property, plant and equipment Investment properties Deferred tax assets Other investments Amount owing by subsidiaries Goodwill on consolidation 30,976,000 5,209,000 32,674,000 5,159,000 99000 39000 28,435,000 5.259,000 35000 134000 106000 2767000 40,738,000 2767000 39,058,000 2767000 36,630,000 31 598 000 39,616,000 48 493 000 36,573,000 29 952.000 34,542.000 CURRENT ASSETS Inventaries Trade receivables Other receivables, deposits and prepayments Amount owing by subsidiaries Tax recoverable Cash and bank balances 1,817,000 1,969,000 2.255,000 543000 33,395.000 1,369,000 28,759,000 103,159,000 143,897,000 1,203,000 4,139,000 72,091,000 108,721,000 120,973,000 160,031,000 TOTAL ASSETS(,000 RM) EQUITY AND LIABILITIES EQUITY Share capital Share premium Retained profits Revaluation reserve SHAREHOLDERS' EQUITY MINORITY INTERESTS TOTAL EQUITY 78,439,000 6,803,000 30,438,000 549000 116,229,000 2.072.000 118,301,000 78,439,000 6,981.000 29,390,000 549000 115,359.000 1,580.000 116,939,000 40,000,000 7,359,000 27,122,000 549000 75,030,000 1,258,000 76,288,000 NON-CURRENT LIABILITIES Deferred tax liabilities Long-term borrowings 449000 3,013,000 3,462,000 317000 3,042,000 3,359,000 293000 7000 300,000 12.157,000 7,706,000 20,475.000 3,944.000 13,871,000 3,397,000 CURRENT LIABILITIES Trade payables Other payables and accruals Amount owing to a subsidiary Short-term borrowings Provision for taxation Dividend payable Bank overdrafts 12,373,000 2.245,000 14000 12000 12,683.000 365000 61000 2,205,000 39,733,000 43,092.000 22,134,000 25,596,000 2,492,000 32,133,000 32,433,000 TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES(,000 RM) 143,897,000 160,031,000 108,721,000 GPA Holdings is planning on expanding its operation for the next five years but this will require a large amount of investment. GPA Holdings is considering financing this expansion through selling more shares and/or taking up more long term loans from financial institution and/or increasing equity. The financial statement for the year 2015 is not yet available. Using the available data: a) Analyse the available financial statements using appropriate technique and evaluate GPA's ability to convince future investors to support GPA's plan for expansion. (5 marks) 5 b) Formulate ONE (1) action plan for GPA to gain financial support for its expansion plan