Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The follwoing was submitted to chaptGPT: Consider a bond market with 2 bonds both with face values of $100. Both bonds mature in 2 years.

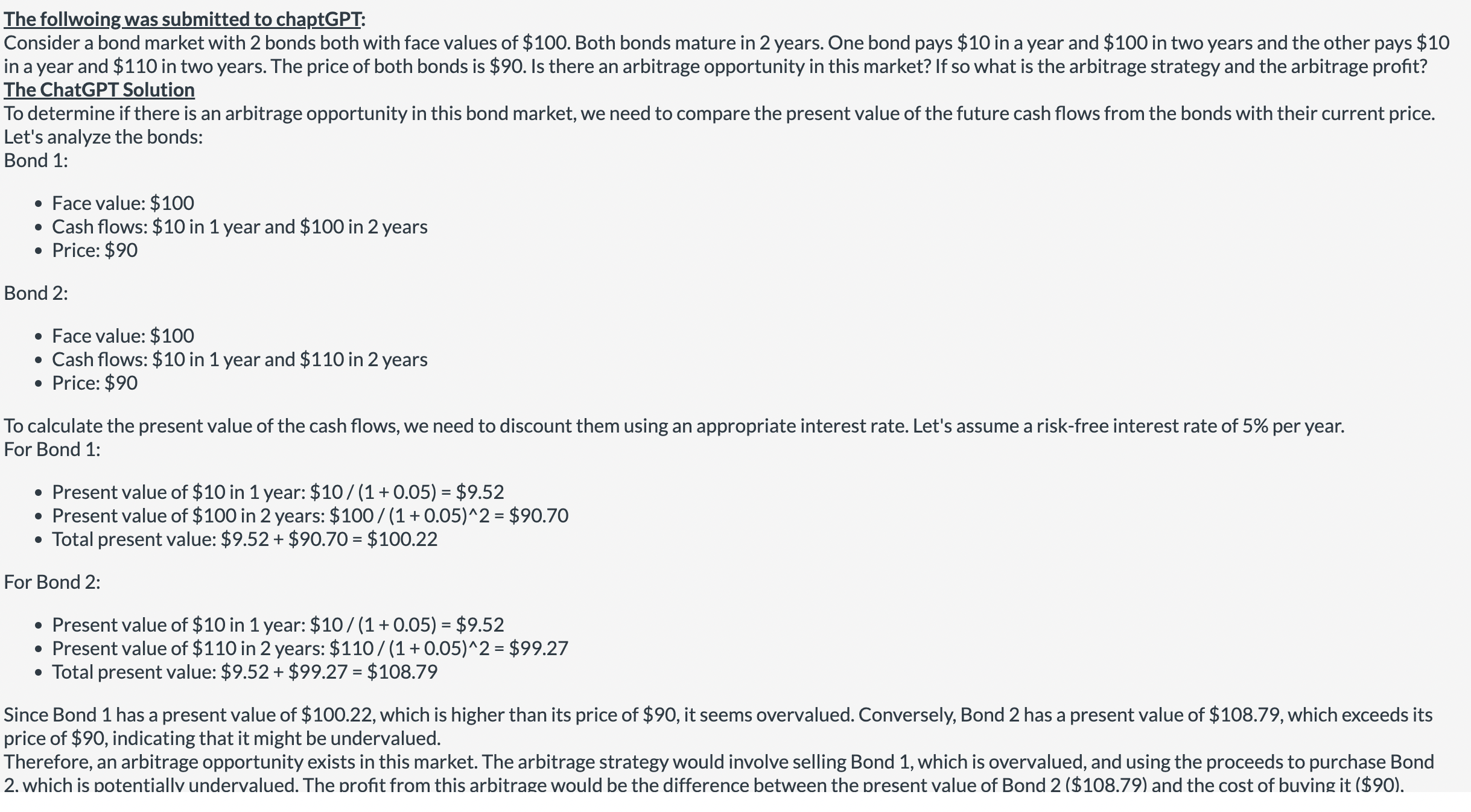

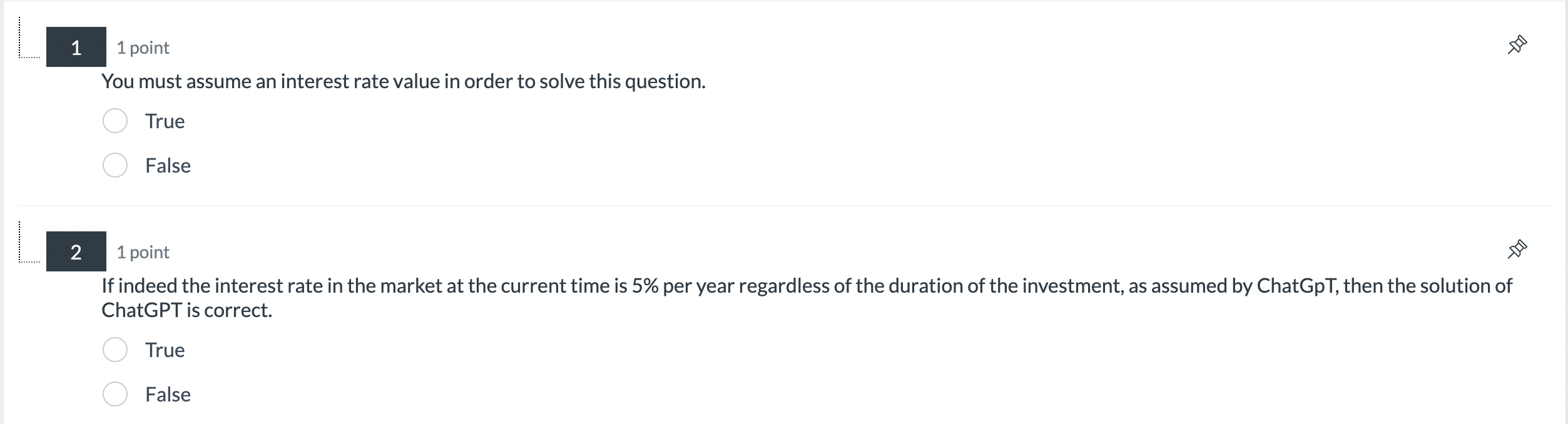

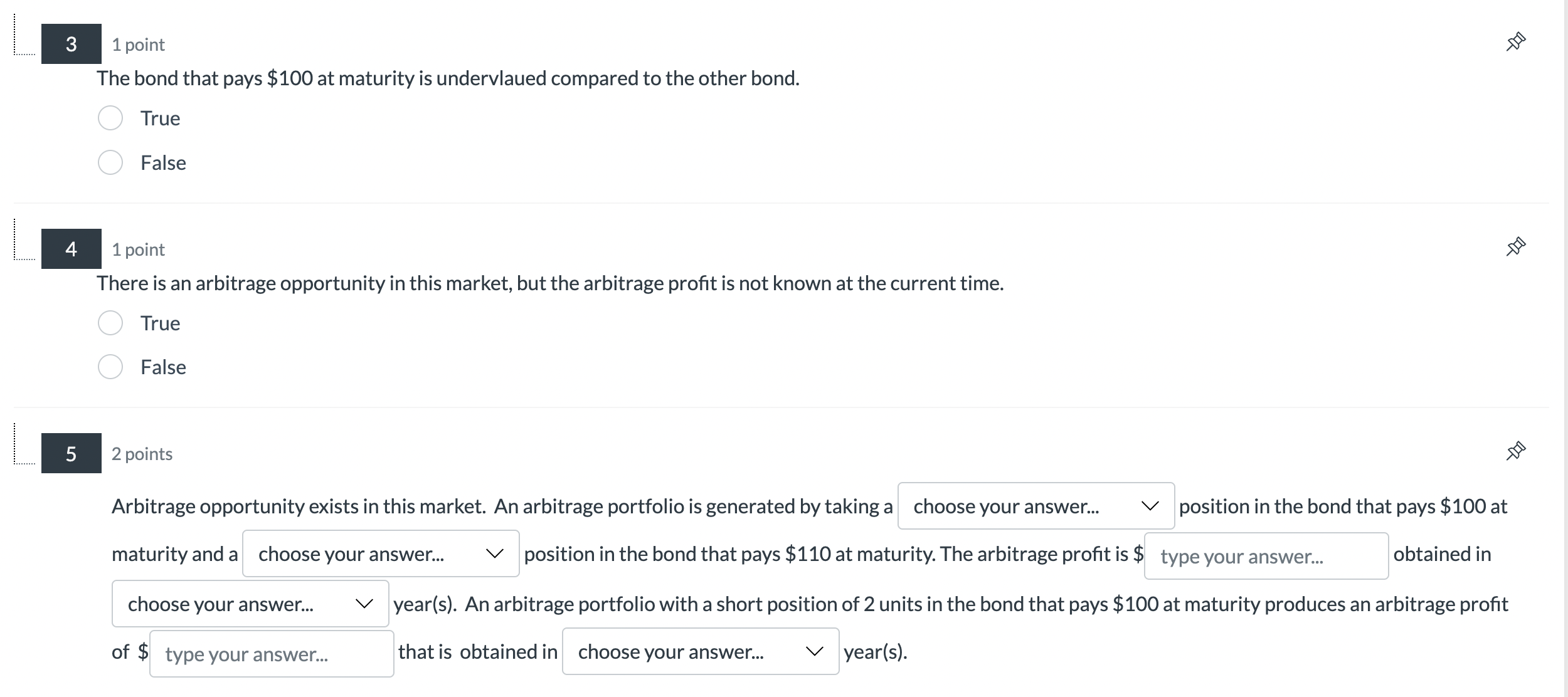

The follwoing was submitted to chaptGPT: Consider a bond market with 2 bonds both with face values of $100. Both bonds mature in 2 years. One bond pays $10 in a year and $100 in two years and the other pays $10 in a year and $110 in two years. The price of both bonds is $90. Is there an arbitrage opportunity in this market? If so what is the arbitrage strategy and the arbitrage profit? The ChatGPT Solution To determine if there is an arbitrage opportunity in this bond market, we need to compare the present value of the future cash flows from the bonds with their current price. Let's analyze the bonds: Bond 1: - Face value: $100 - Cash flows: $10 in 1 year and $100 in 2 years - Price: $90 Bond 2: - Face value: $100 - Cash flows: $10 in 1 year and $110 in 2 years - Price: $90 To calculate the present value of the cash flows, we need to discount them using an appropriate interest rate. Let's assume a risk-free interest rate of 5% per year. For Bond 1: - Present value of $10 in 1 year: $10/(1+0.05)=$9.52 - Present value of $100 in 2 years: $100/(1+0.05)2=$90.70 - Total present value: $9.52+$90.70=$100.22 For Bond 2: - Present value of $10 in 1 year: $10/(1+0.05)=$9.52 - Present value of $110 in 2 years: $110/(1+0.05)2=$99.27 - Total present value: $9.52+$99.27=$108.79 Since Bond 1 has a present value of $100.22, which is higher than its price of $90, it seems overvalued. Conversely, Bond 2 has a present value of $108.79, which exceeds its price of $90, indicating that it might be undervalued. Therefore, an arbitrage opportunity exists in this market. The arbitrage strategy would involve selling Bond 1, which is overvalued, and using the proceeds to purchase Bond 2. which is potentiallv undervalued. The profit from this arbitrage would be the difference between the present value of Bond 2($108.79 ) and the cost of buving it ( $90). 1 point You must assume an interest rate value in order to solve this question. True False 1 point If indeed the interest rate in the market at the current time is 5% per year regardless of the duration of the investment, as assumed by ChatGpT, then the solution of ChatGPT is correct. True False 1 point The bond that pays $100 at maturity is undervlaued compared to the other bond. True False 1 point There is an arbitrage opportunity in this market, but the arbitrage profit is not known at the current time. True False 2 points Arbitrage opportunity exists in this market. An arbitrage portfolio is generated by taking a maturity and a position in the bond that pays $110 at maturity. The arbitrage profit is $ year(s). An arbitrage portfolio with a short position of 2 units in the bond that pays $100 at maturity produces an arbitrage profit of that is obtained in year(s). position in the bond that pays $100 at obtained in

The follwoing was submitted to chaptGPT: Consider a bond market with 2 bonds both with face values of $100. Both bonds mature in 2 years. One bond pays $10 in a year and $100 in two years and the other pays $10 in a year and $110 in two years. The price of both bonds is $90. Is there an arbitrage opportunity in this market? If so what is the arbitrage strategy and the arbitrage profit? The ChatGPT Solution To determine if there is an arbitrage opportunity in this bond market, we need to compare the present value of the future cash flows from the bonds with their current price. Let's analyze the bonds: Bond 1: - Face value: $100 - Cash flows: $10 in 1 year and $100 in 2 years - Price: $90 Bond 2: - Face value: $100 - Cash flows: $10 in 1 year and $110 in 2 years - Price: $90 To calculate the present value of the cash flows, we need to discount them using an appropriate interest rate. Let's assume a risk-free interest rate of 5% per year. For Bond 1: - Present value of $10 in 1 year: $10/(1+0.05)=$9.52 - Present value of $100 in 2 years: $100/(1+0.05)2=$90.70 - Total present value: $9.52+$90.70=$100.22 For Bond 2: - Present value of $10 in 1 year: $10/(1+0.05)=$9.52 - Present value of $110 in 2 years: $110/(1+0.05)2=$99.27 - Total present value: $9.52+$99.27=$108.79 Since Bond 1 has a present value of $100.22, which is higher than its price of $90, it seems overvalued. Conversely, Bond 2 has a present value of $108.79, which exceeds its price of $90, indicating that it might be undervalued. Therefore, an arbitrage opportunity exists in this market. The arbitrage strategy would involve selling Bond 1, which is overvalued, and using the proceeds to purchase Bond 2. which is potentiallv undervalued. The profit from this arbitrage would be the difference between the present value of Bond 2($108.79 ) and the cost of buving it ( $90). 1 point You must assume an interest rate value in order to solve this question. True False 1 point If indeed the interest rate in the market at the current time is 5% per year regardless of the duration of the investment, as assumed by ChatGpT, then the solution of ChatGPT is correct. True False 1 point The bond that pays $100 at maturity is undervlaued compared to the other bond. True False 1 point There is an arbitrage opportunity in this market, but the arbitrage profit is not known at the current time. True False 2 points Arbitrage opportunity exists in this market. An arbitrage portfolio is generated by taking a maturity and a position in the bond that pays $110 at maturity. The arbitrage profit is $ year(s). An arbitrage portfolio with a short position of 2 units in the bond that pays $100 at maturity produces an arbitrage profit of that is obtained in year(s). position in the bond that pays $100 at obtained in Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started