Answered step by step

Verified Expert Solution

Question

1 Approved Answer

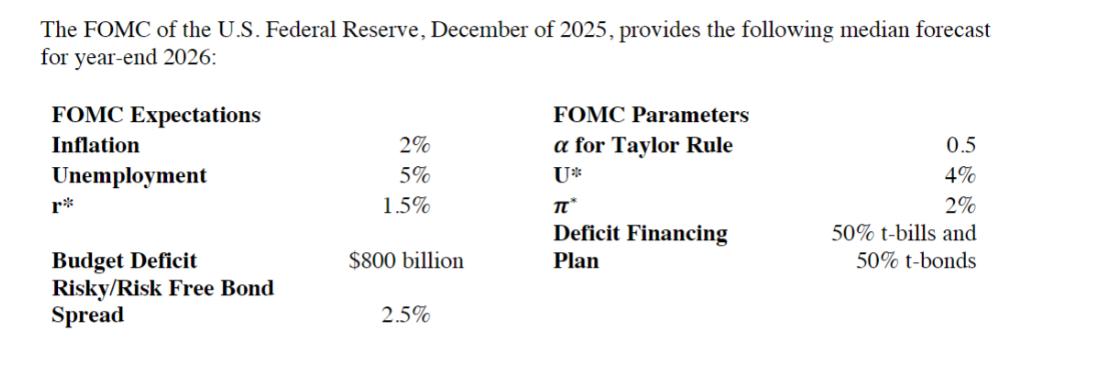

The FOMC of the U.S. Federal Reserve, December of 2025, provides the following median forecast for year-end 2026: FOMC Expectations Inflation Unemployment Budget Deficit

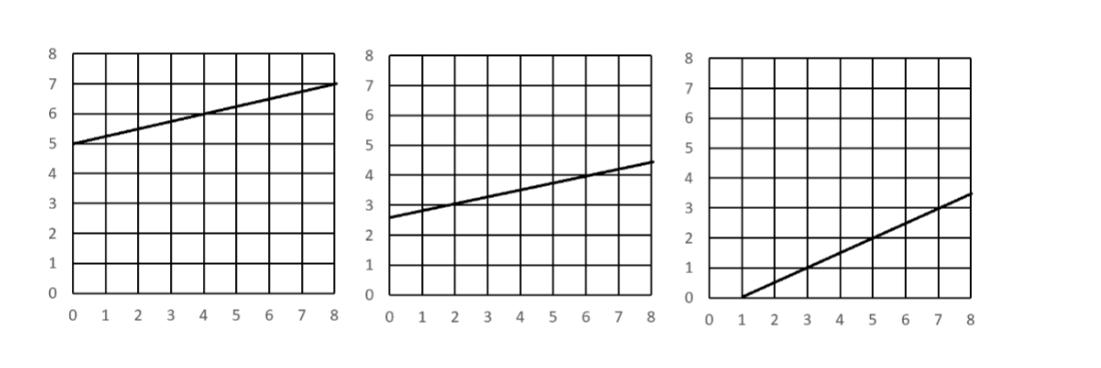

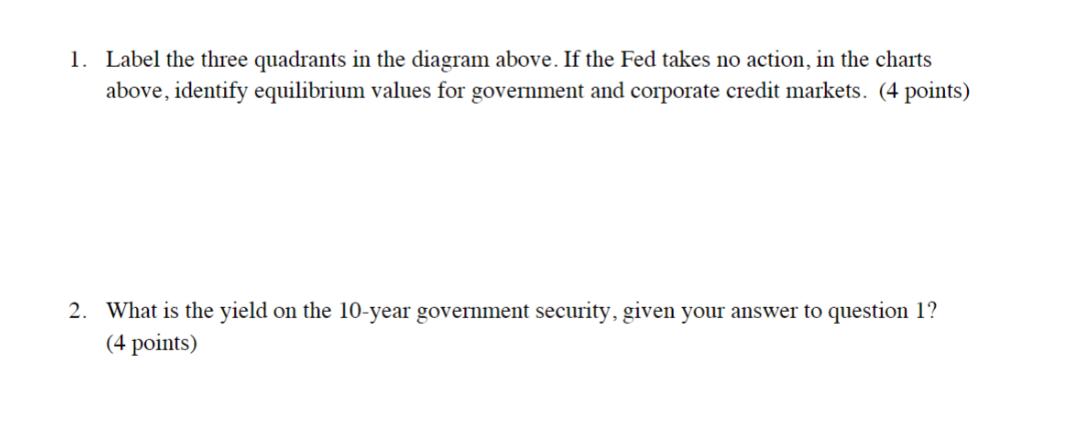

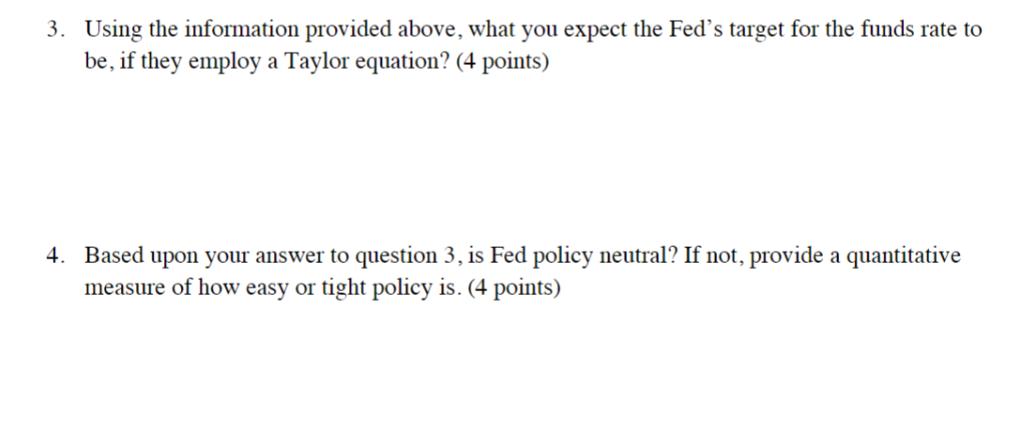

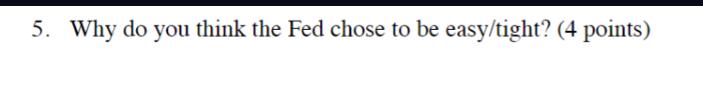

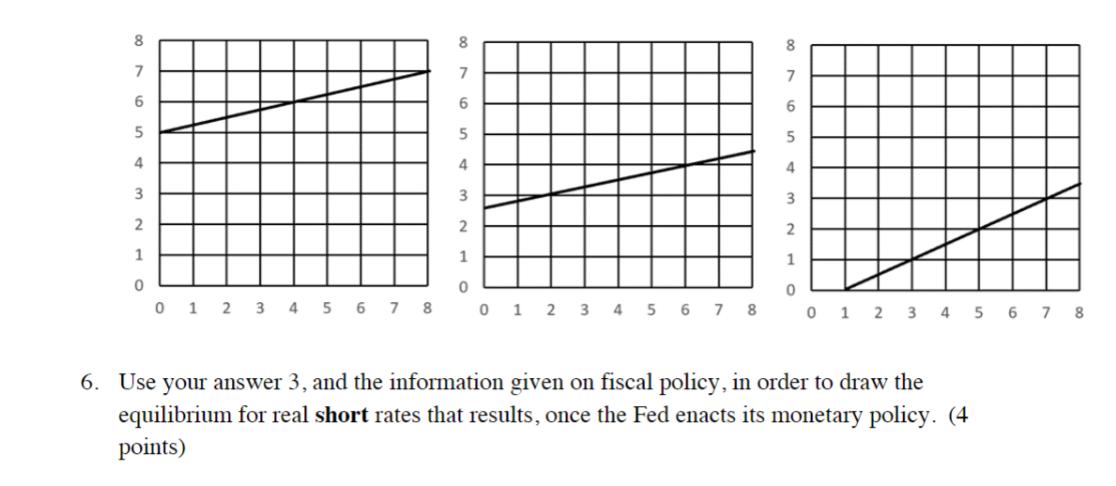

The FOMC of the U.S. Federal Reserve, December of 2025, provides the following median forecast for year-end 2026: FOMC Expectations Inflation Unemployment Budget Deficit Risky/Risk Free Bond Spread 2% 5% 1.5% $800 billion 2.5% FOMC Parameters a for Taylor Rule U TL* Deficit Financing Plan 0.5 4% 2% 50% t-bills and 50% t-bonds 8 7 6 5 4 3 2 1 0 0 1 2 3 4 5 6 78 8 6 5 4 3 0 0 1 2 3 4 5 6 7 8 8 7 6 5 4 3 2 0 0 1 2 3 4 5 6 7 8 1. Label the three quadrants in the diagram above. If the Fed takes no action, in the charts above, identify equilibrium values for government and corporate credit markets. (4 points) 2. What is the yield on the 10-year government security, given your answer to question 1? (4 points) 3. Using the information provided above, what you expect the Fed's target for the funds rate to be, if they employ a Taylor equation? (4 points) 4. Based upon your answer to question 3, is Fed policy neutral? If not, provide a quantitative measure of how easy or tight policy is. (4 points) 5. Why do you think the Fed chose to be easy/tight? (4 points) 8 7 6 5 4 3 2 1 0 0 1 2 3 4 5 6 7 8 8 5 4 3 1 0 8 7 6 5 4 3 2 1 0 01 2 3 4 5 6 7 8 0 1 2 3 4 5 6 7 8 6. Use your answer 3, and the information given on fiscal policy, in order to draw the equilibrium for real short rates that results, once the Fed enacts its monetary policy. (4 points) 7. Draw the original equilibrium for the government bond market. Assume the Fed's monetary policy move results in a 25 basis point reduction in the risk-free short-rate/long-rate spread. Now draw in the shifts in the curve(s) and the new equilibrium for the government bond panel. (4 points) 8. Assume the risky/risk free spread stays the same. Draw in any necessary curve(s) shifts and the new equilibrium for the corporate bond panel. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started