Answered step by step

Verified Expert Solution

Question

1 Approved Answer

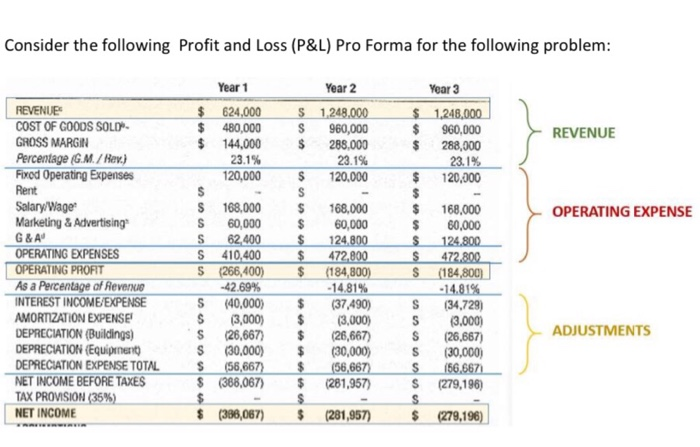

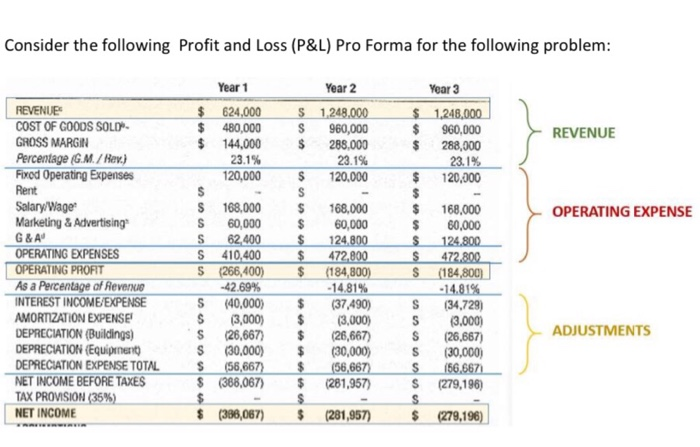

The forecasted EBIDTA (Operating Profit) in year-2 is negative $184,800 (the negative value of accounts is often represented by brackets) and presently the same for

The forecasted EBIDTA (Operating Profit) in year-2 is negative $184,800 (the negative value of accounts is often represented by brackets) and presently the same for year-3. However, after hiring a manufacturing consultant, you believe that you can achieve a 30% reduction in COGS in Year-3 (with improved material sourcing and increased production line efficiency). In addition, your CEO recommends reducing certain unnecessary manager positions in Year-3 (once workforce is fully trained), eliminating certain positions and rewarding efficiency in the work force. Likewise, the CEO offers to restructure his compensation package from non-incentivized bonuses to mainly Stock Options (which increase value with profitability). He estimates this strategy can reduce Salary/Wages and related G&A expenses by 15%. Given these improvements, what is the new Bottom Line (Net Income before tax and after tax) in year-3?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started