Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the form is what needs filled in. I have included the numbers CHAPTER 4 Statement of Cash Flow ase 4.2 Applied Materials omprehensive Analysis Case

the form is what needs filled in. I have included the numbers

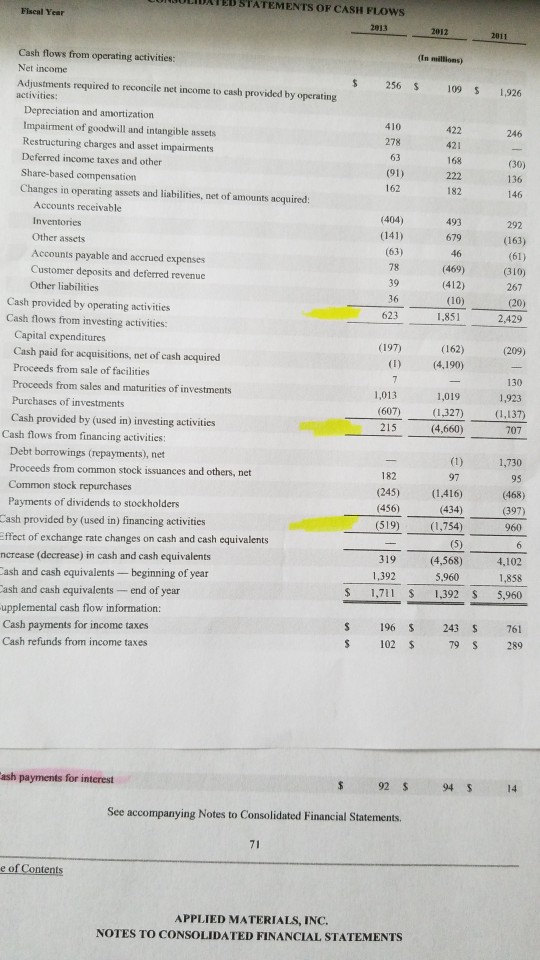

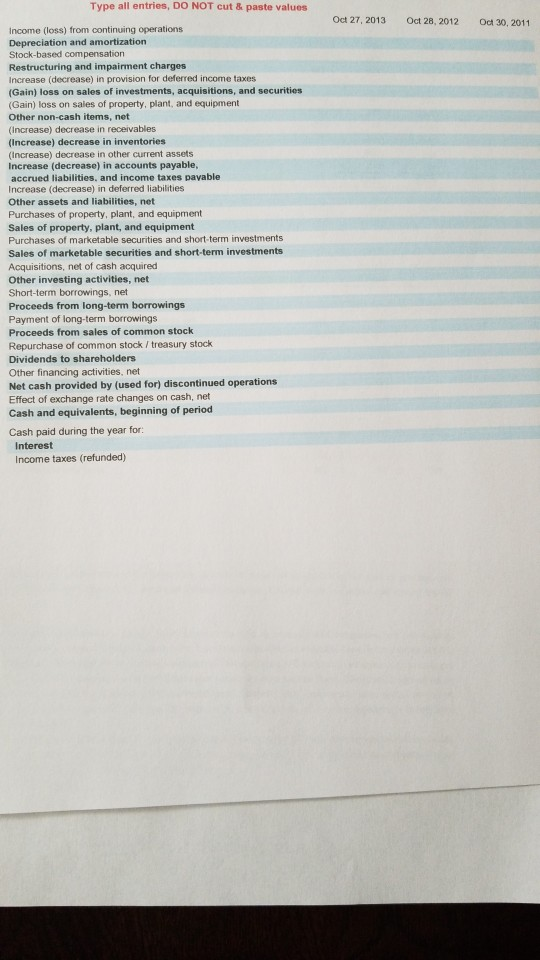

CHAPTER 4 Statement of Cash Flow ase 4.2 Applied Materials omprehensive Analysis Case using the Financial Statement Analysis Template 199 Each chapter in the to learn how to do a of each chapter is 1 (a) Open the finan ter in the textbook contains a continuation of this problem. The objective is w to do a comprehensive financial statement analysis in steps as the content apter is learned. Using the 2013 Applied Materials Form 10-K, which can be www.pearsonnignered.com/traser, complete the following requirements: the financial statement analysis template that you saved from the Chapter 1 Applied Materials problem and input the data from the Applied Werials cash flow statement. When you have finished inputting the data, view the cash flow statement to make sure there are no red blocks indicating hat your numbers do not match the cover sheet information you input from the Chapter 1 problem. Make any necessary corrections before printing out both your input and the common-size cash flow statement that the template automatically creates for you. Analyze the Consolidated Statements of Cash Flows for Applied Materials 2013, 2012, and 2011. Write a summary that includes important points that analyst would use in assessing the ability of Applied Materials to generate cash flows and the appropriateness of the use of cash flows. W statement when you h Put the data Fiscal Year LUNDULIDATED STATEMENTS OF CASH FLOWS 2013 2012 (a millions) 256 $ 109 $ 1,926 410 422 246 (30) 136 146 162 292 (404) (141) (63) 679 79 30 (469) (412) (10) 1,851 (163) (61) (310) 267 (20) 2,429 36 623 Cash flows from operating activities: Net income Adjustments required to reconcile net income to cash provided by operating activities: Depreciation and amortization Impairment of goodwill and intangible assets Restructuring charges and asset impairments Deferred income taxes and other Share-based compensation Changes in operating assets and liabilities, net of amounts acquired: Accounts receivable Inventories Other assets Accounts payable and accrued expenses Customer deposits and deferred revenue Other liabilities Cash provided by operating activities Cash flows from investing activities: Capital expenditures Cash paid for acquisitions, net of cash acquired Proceeds from sale of facilities Proceeds from sales and maturities of investments Purchases of investments Cash provided by used in investing activities Cash flows from financing activities: Debt borrowings (repayments), net Proceeds from common stock issuances and others, net Common stock repurchases Payments of dividends to stockholders Cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash equivalents ncrease (decrease) in cash and cash equivalents Cash and cash equivalents beginning of year Cash and cash equivalents -- end of year upplemental cash flow information: Cash payments for income taxes Cash refunds from income taxes (197) (!) (162) (4,190) (209) 130 1,923 1,013 (607) 215 1,019 (1,327) (4,660) (1.137) 707 (1) 182 (1.416) 1,730 95 (468) (397) 960 (456) (434) (519) (1,754) 319 1,392 1,711 (4,568) 5.960 4,102 1.858 5,960 $ $ 1.392 $ S $ 196 102 $ $ 243 $ 79 S 761 289 "ash payments for interest 92 S 4 S 14 See accompanying Notes to Consolidated Financial Statements. e of Contents APPLIED MATERIALS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Type all entries, DO NOT cut & paste values Oct 27, 2013 Oct 28, 2012 Oct 30, 2011 Income (loss) from continuing operations Depreciation and amortization Stock-based compensation Restructuring and impairment charges Increase (decrease) in provision for deferred income taxes (Gain) loss on sales of investments, acquisitions, and securities (Gain) loss on sales of property, plant, and equipment Other non-cash items, net (Increase) decrease in receivables (Increase) decrease in inventories (Increase) decrease in other current assets Increase (decrease) in accounts payable, accrued liabilities, and income taxes payable Increase (decrease) in deferred liabilities Other assets and liabilities, net Purchases of property, plant, and equipment Sales of property, plant, and equipment Purchases of marketable securities and short-term investments Sales of marketable securities and short-term investments Acquisitions, net of cash acquired Other investing activities, net Short-term borrowings, net Proceeds from long-term borrowings Payment of long-term borrowings Proceeds from sales of common stock Repurchase of common stock/treasury stock Dividends to shareholders Other financing activities, net Net cash provided by (used for) discontinued operations Effect of exchange rate changes on cash, net Cash and equivalents, beginning of period Cash paid during the year for: Interest Income taxes (refunded)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started