Answered step by step

Verified Expert Solution

Question

1 Approved Answer

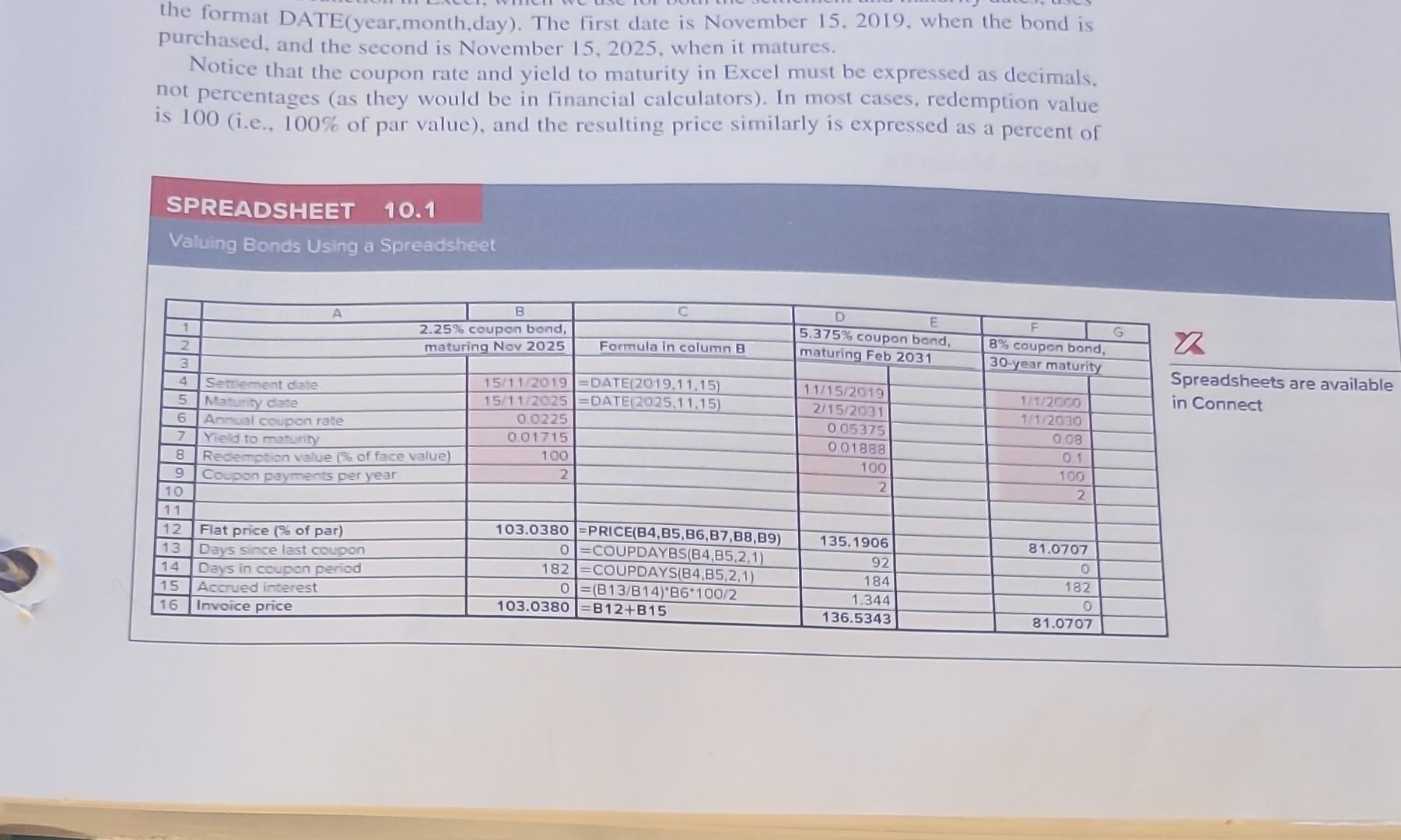

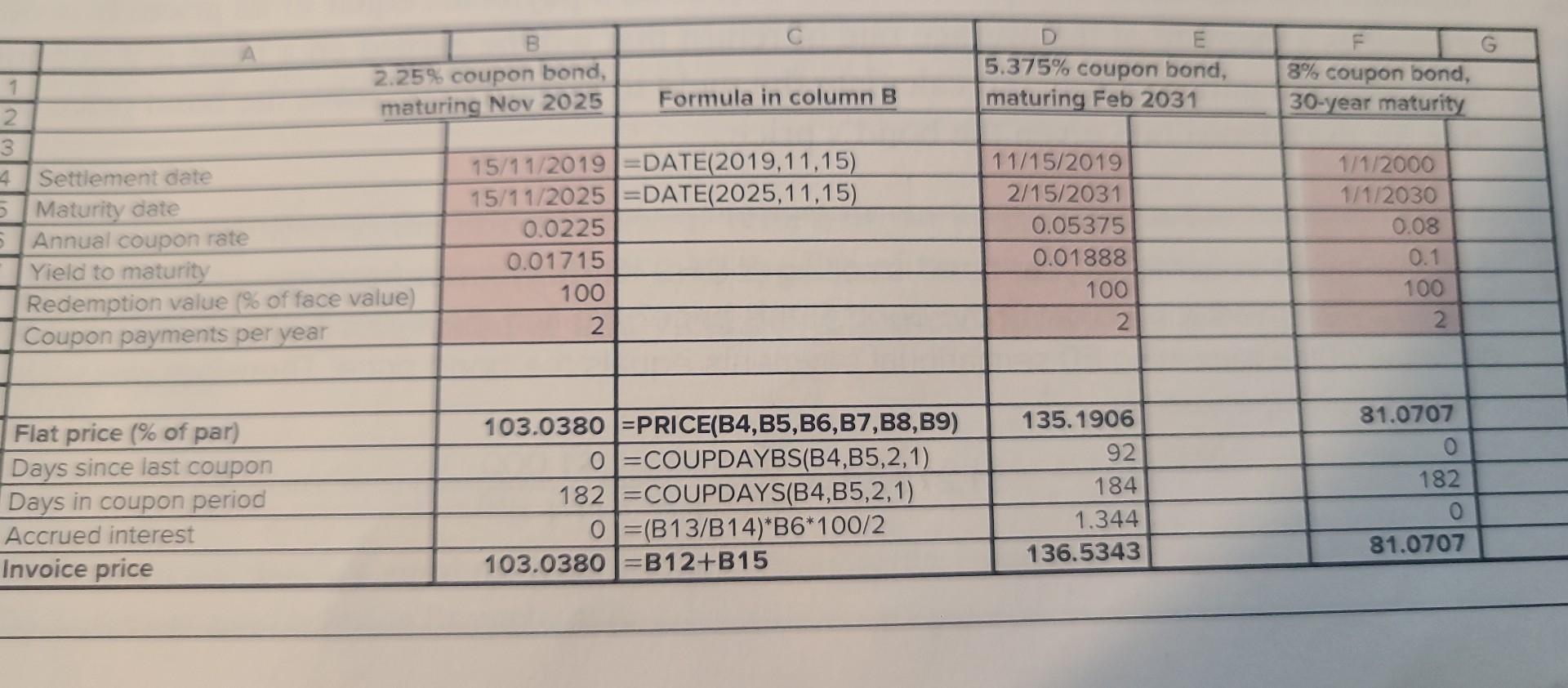

the format DATE(year,month,day). The first date is November 15,2019 , when the bond is purchased, and the second is November 15, 2025, when it matures.

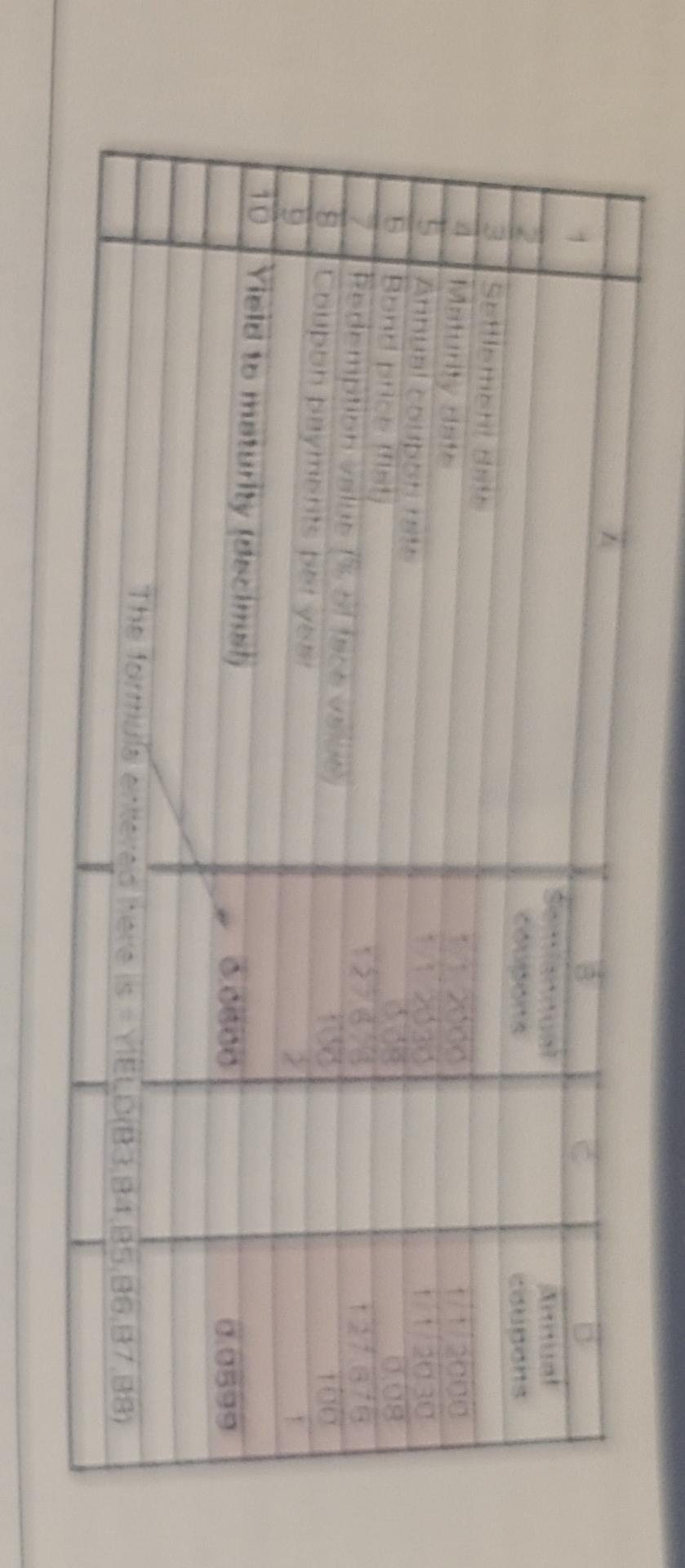

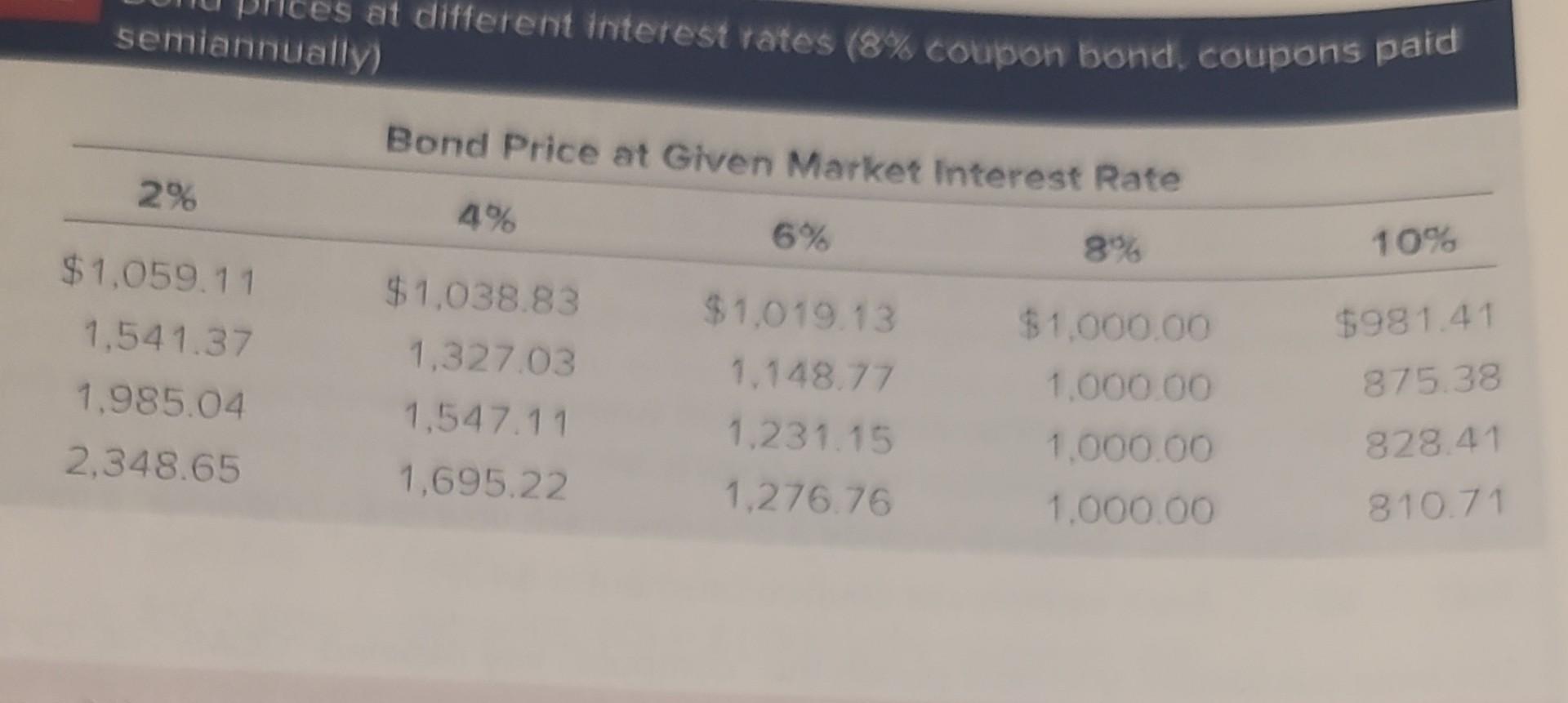

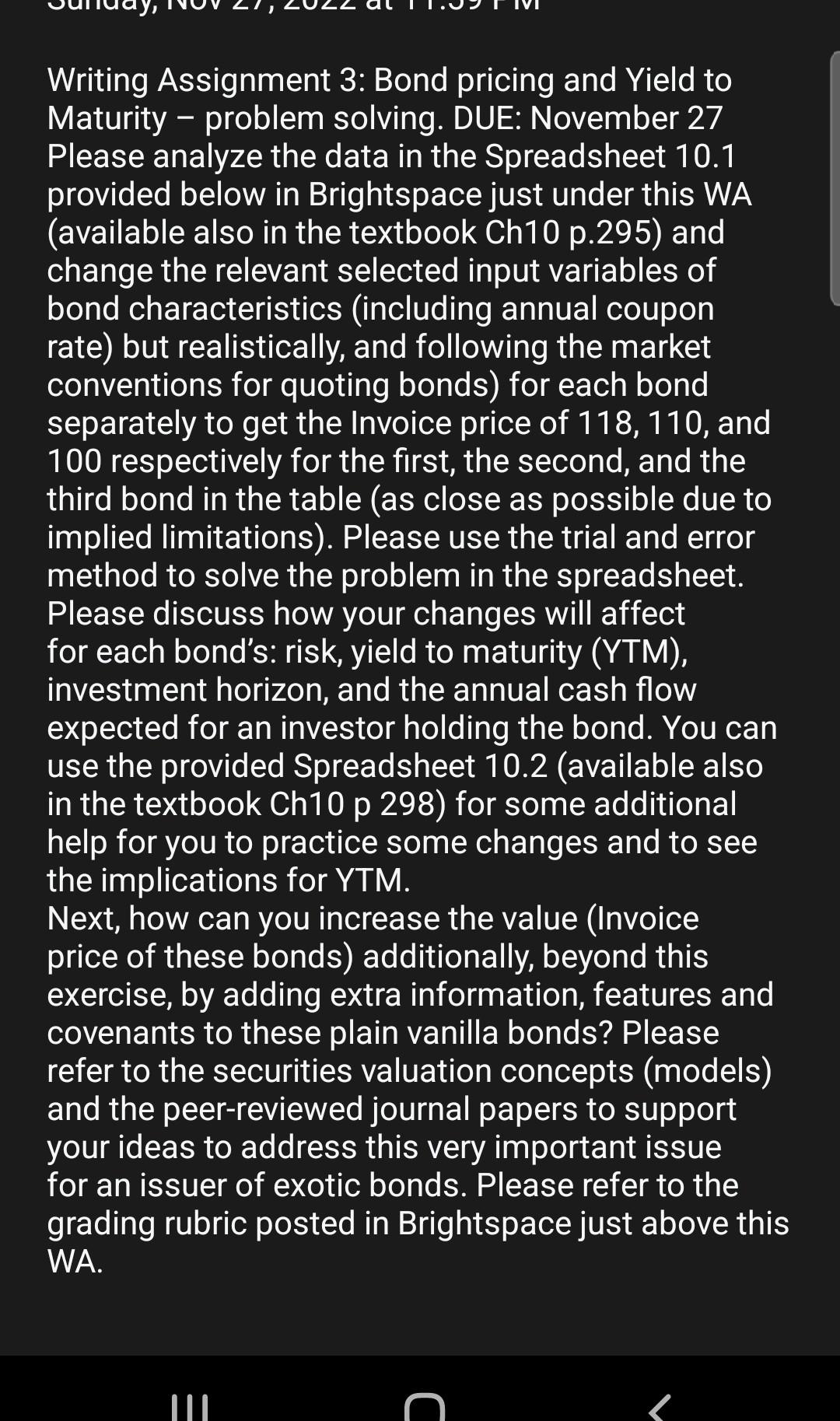

the format DATE(year,month,day). The first date is November 15,2019 , when the bond is purchased, and the second is November 15, 2025, when it matures. Notice that the coupon rate and yield to maturity in Excel must be expressed as decimals, not percentages (as they would be in financial calculators). In most cases, redemption value is 100 (i.e., 100% of par value), and the resulting price similarly is expressed as a percent of SPREADSHEET 10.1 Valuing Bonds Using a Spreadsheet Spreadsheets are available in Connect semiannu at different interest rates (8% coupon bond, coupons paid Bond Price at Given Market interest Rate \begin{tabular}{ccccr} \hline 2% & 4% & 6% & 4 & \\ \hline$1,059.11 & $1.038.83 & $1.019.13 & $1,000.00 & $981.41 \\ 1,541.37 & 1,327.03 & 1.148.77 & 1,000.00 & 875.38 \\ 1,985.04 & 1,547.11 & 1.231.15 & 1,000.00 & 828.41 \\ 2,348.65 & 1,695.22 & 1,276.76 & 1,000.00 & 810.71 \end{tabular} Writing Assignment 3: Bond pricing and Yield to Maturity - problem solving. DUE: November 27 Please analyze the data in the Spreadsheet 10.1 provided below in Brightspace just under this WA (available also in the textbook Ch10 p.295) and change the relevant selected input variables of bond characteristics (including annual coupon rate) but realistically, and following the market conventions for quoting bonds) for each bond separately to get the Invoice price of 118,110 , and 100 respectively for the first, the second, and the third bond in the table (as close as possible due to implied limitations). Please use the trial and error method to solve the problem in the spreadsheet. Please discuss how your changes will affect for each bond's: risk, yield to maturity (YTM), investment horizon, and the annual cash flow expected for an investor holding the bond. You can use the provided Spreadsheet 10.2 (available also in the textbook Ch10 p 298) for some additional help for you to practice some changes and to see the implications for YTM. Next, how can you increase the value (Invoice price of these bonds) additionally, beyond this exercise, by adding extra information, features and covenants to these plain vanilla bonds? Please refer to the securities valuation concepts (models) and the peer-reviewed journal papers to support your ideas to address this very important issue for an issuer of exotic bonds. Please refer to the grading rubric posted in Brightspace just above this WA. the format DATE(year,month,day). The first date is November 15,2019 , when the bond is purchased, and the second is November 15, 2025, when it matures. Notice that the coupon rate and yield to maturity in Excel must be expressed as decimals, not percentages (as they would be in financial calculators). In most cases, redemption value is 100 (i.e., 100% of par value), and the resulting price similarly is expressed as a percent of SPREADSHEET 10.1 Valuing Bonds Using a Spreadsheet Spreadsheets are available in Connect semiannu at different interest rates (8% coupon bond, coupons paid Bond Price at Given Market interest Rate \begin{tabular}{ccccr} \hline 2% & 4% & 6% & 4 & \\ \hline$1,059.11 & $1.038.83 & $1.019.13 & $1,000.00 & $981.41 \\ 1,541.37 & 1,327.03 & 1.148.77 & 1,000.00 & 875.38 \\ 1,985.04 & 1,547.11 & 1.231.15 & 1,000.00 & 828.41 \\ 2,348.65 & 1,695.22 & 1,276.76 & 1,000.00 & 810.71 \end{tabular} Writing Assignment 3: Bond pricing and Yield to Maturity - problem solving. DUE: November 27 Please analyze the data in the Spreadsheet 10.1 provided below in Brightspace just under this WA (available also in the textbook Ch10 p.295) and change the relevant selected input variables of bond characteristics (including annual coupon rate) but realistically, and following the market conventions for quoting bonds) for each bond separately to get the Invoice price of 118,110 , and 100 respectively for the first, the second, and the third bond in the table (as close as possible due to implied limitations). Please use the trial and error method to solve the problem in the spreadsheet. Please discuss how your changes will affect for each bond's: risk, yield to maturity (YTM), investment horizon, and the annual cash flow expected for an investor holding the bond. You can use the provided Spreadsheet 10.2 (available also in the textbook Ch10 p 298) for some additional help for you to practice some changes and to see the implications for YTM. Next, how can you increase the value (Invoice price of these bonds) additionally, beyond this exercise, by adding extra information, features and covenants to these plain vanilla bonds? Please refer to the securities valuation concepts (models) and the peer-reviewed journal papers to support your ideas to address this very important issue for an issuer of exotic bonds. Please refer to the grading rubric posted in Brightspace just above this WA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started