Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The formulas needed are attached. Thanks 1. You are saving for a new house, and you put $2000 per year in an account paying 4%.

The formulas needed are attached. Thanks

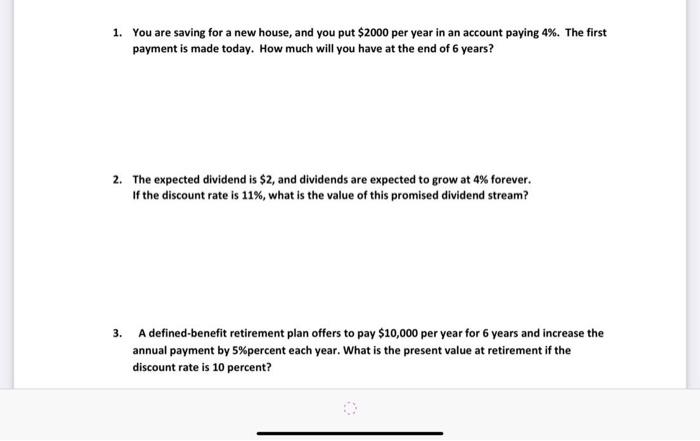

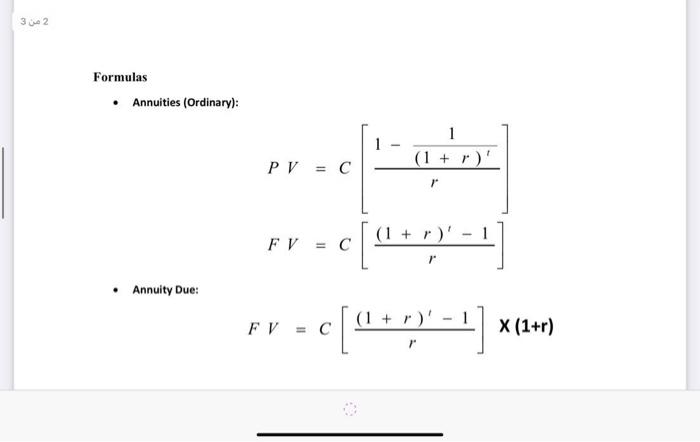

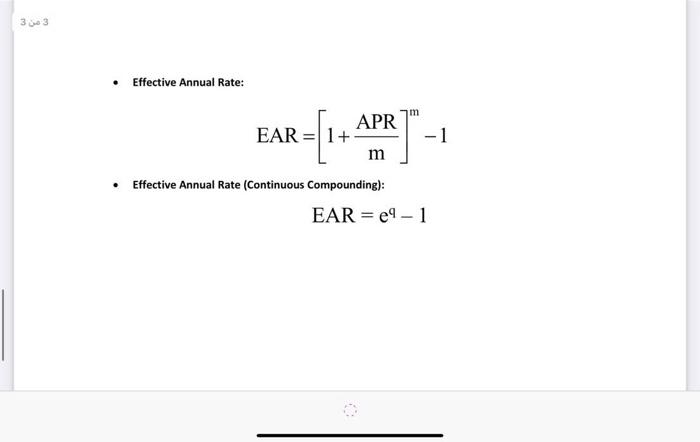

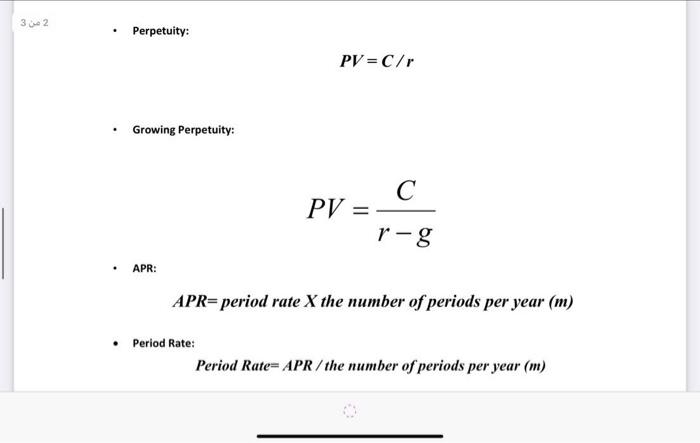

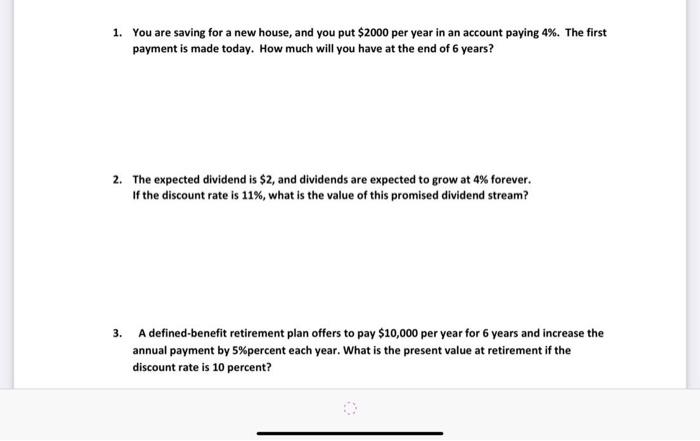

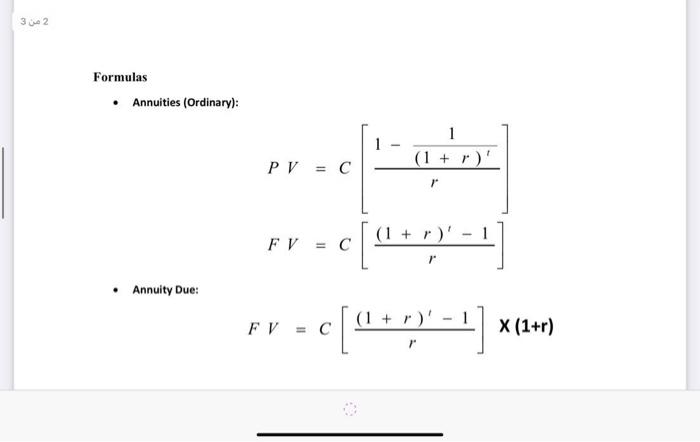

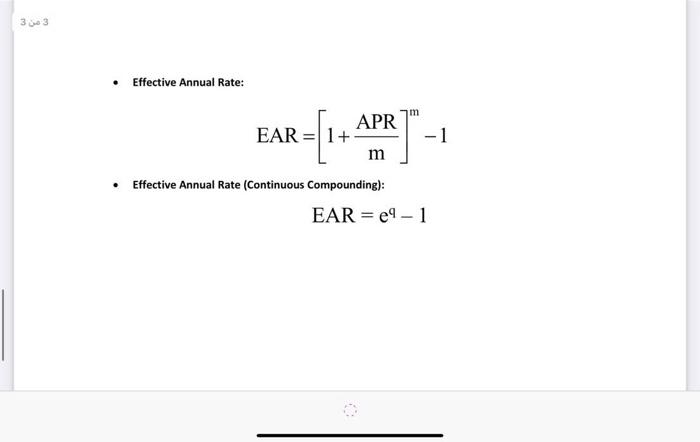

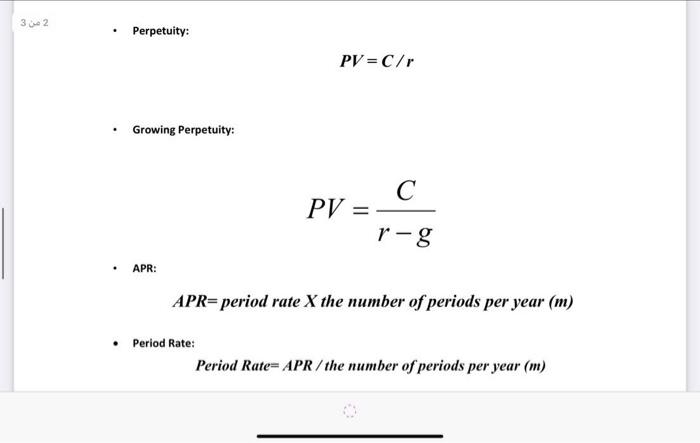

1. You are saving for a new house, and you put $2000 per year in an account paying 4%. The first payment is made today. How much will you have at the end of 6 years? 2. The expected dividend is $2, and dividends are expected to grow at 4% forever. If the discount rate is 11%, what is the value of this promised dividend stream? 3. A defined-benefit retirement plan offers to pay $10,000 per year for 6 years and increase the annual payment by 5% percent each year. What is the present value at retirement if the discount rate is 10 percent? Formulas - Annuities (Ordinary): PV=C[r1(1+r)t1]FV=C[r(1+r)t1] - Annuity Due: FV=C[r(1+r)1](1+r) Effective Annual Rate: EAR=[1+mAPR]m1 - Effective Annual Rate (Continuous Compounding): EAR=eq1 PV=C/r Growing Perpetuity: PV=rgC APR: APR= period rate X the number of periods per year (m) Period Rate; Period Rate =APR/ the number of periods per year (m)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started