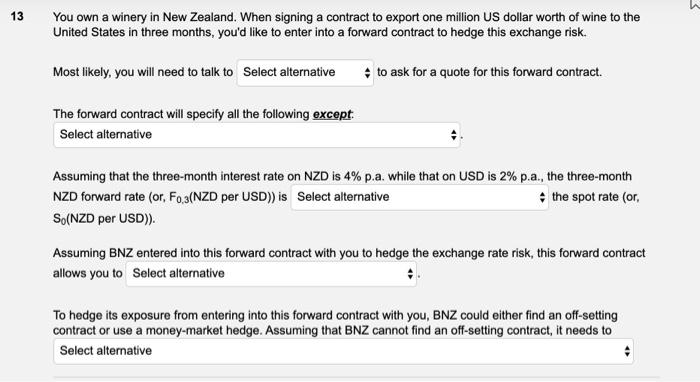

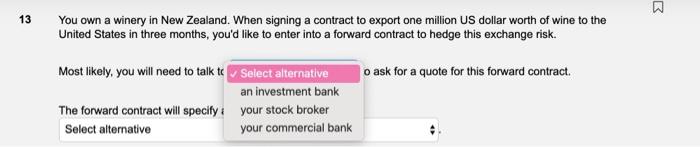

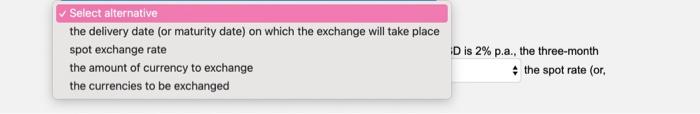

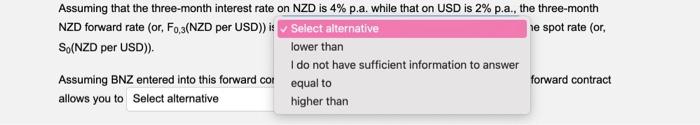

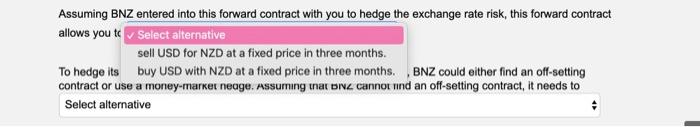

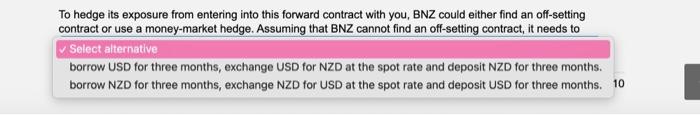

The forward contract will specify all the following except. Assuming that the three-month interest rate on NZD is 4% p.a. while that on USD is 2% p.a., the three-month NZD forward rate (or, F0,3( NZD per USD)) is the spot rate (or, S0 (NZD per USD)). Assuming BNZ entered into this forward contract with you to hedge the exchange rate risk, this forward contract allows you to To hedge its exposure from entering into this forward contract with you, BNZ could either find an off-setting contract or use a money-market hedge. Assuming that BNZ cannot find an off-setting contract, it needs to Select alternative 3 You own a winery in New Zealand. When signing a contract to export one million US dollar worth of wine to the United States in three months, you'd like to enter into a forward contract to hedge this exchange risk. Most likely, you will need to talk te o ask for a quote for this forward contract. an investment bank The forward contract will specify i your stock broker your commercial bank Select alternative the delivery date (or maturity date) on which the exchange will take place spot exchange rate ID is 2% p.a., the three-month the amount of currency to exchange the spot rate (or, the currencies to be exchanged Assuming that the three-month interest rate on NZD is 4% p.a. while that on USD is 2% p.a., the three-month NZD forward rate (or, F0,3 (NZD per USD)) is _ Select alternative le spot rate (or, S0 (NZD per USD)). lower than I do not have sufficient information to answer Assuming BNZ entered into this forward cot equal to forward contract allows you to Select alternative higher than Assuming BNZ entered into this forward contract with you to hedge the exchange rate risk, this forward contract allows you tc sell USD for NZD at a fixed price in three months. To hedge its buy USD with NZD at a fixed price in three months. , BNZ could either find an off-setting contract or use a money-market neage. Assuming that bre, cannot nnd an off-setting contract, it needs to To hedge its exposure from entering into this forward contract with you, BNZ could either find an off-setting contract or use a money-market hedge. Assuming that BNZ cannot find an off-setting contract, it needs to Select alternative borrow USD for three months, exchange USD for NZD at the spot rate and deposit NZD for three months borrow NZD for three months, exchange NZD for USD at the spot rate and deposit USD for three months