Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Fosters definitely want to plan for retirement. They would love to retire at 63, with 80% replacement of preretirement income. But they understand that

The Fosters definitely want to plan for retirement. They would love to retire at 63, with 80% replacement of preretirement income. But they understand that they may have to wait longer if that is not a possibility.

Assumptions:

In your conversations with the Fosters and from your research you have discovered:

- Inflation (CPI) is expected to be 3%

- The rate of return on their investments and any additional retirement savings is expected to be 8%

- Both have similar 401(k) plans at their respective employers. Both plans have an employer match of 100% for the first 3% of salary David contributes, and 50% for any contributions greater than 3% up to 5%. Briana would like to start contributing but hasn't gotten around to it. David contributes 10%.

- Based on their family history, they both expect to live to age 95

- Their combined Social Security Benefits are expected to be (in today's dollars):

- Age 63 - $36,450

- Age 65 - $42,120

- Age 67 - $48,600

- You should be able to perform all calculations using the methods found in your textbook.

- Calculate the amount they would have to invest today in a lump sum to fully fund retirement at Age 63. Show the steps performed to get your answer. In your paper, discuss with them whether they have assets to complete this.

- Calculate the annual savings amount required for the Fosters to retire at Ages 63, 65 and 67. Show the steps performed to get your answers.

- Provide a written explanation of the results, including your assumptions, explained as if you were explaining it to the client. Charts/Tables may help the Fosters understand better.

- Discuss in your paper a couple of options of what types of accounts they might use and how much they could save in each.

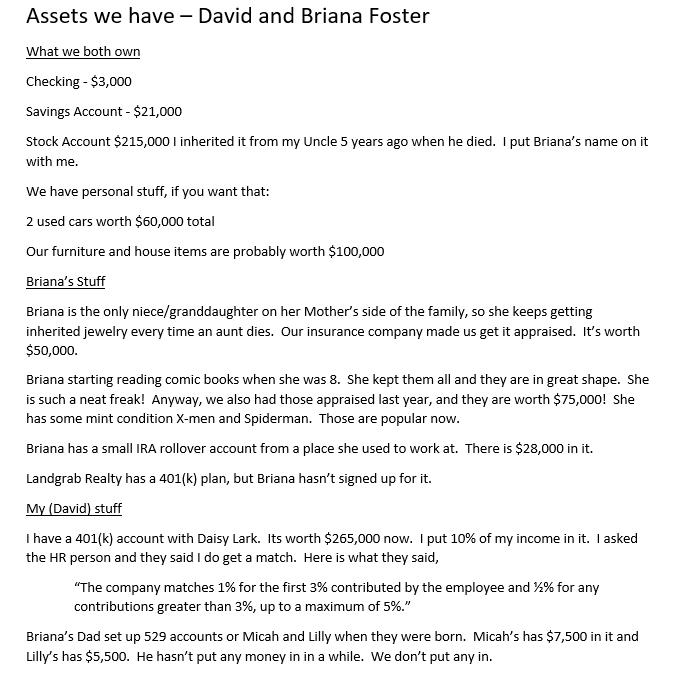

Cash Inflows David's Salary Briana's Salary Total Cash Inflows Cash Outflows Savings 401(k) Plan - David Taxes Federal Income Taxes Withheld David's Social Security Taxes Briana's Social Security Taxes Property Tax Principal Residence Debt Payments (Principal & Interest) Principal Residence Auto Credit Cards Living Expenses Utilities Principal Residence Child Care Auto Maintenance and Gasoline Entertainment and Vacations Church Donations Food Children's Field Trips, Lunches, Allowances Lawn and Cleaning Services Clothing Miscellaneous Insurance Payments Home Insurance Principal Residence Life Insurance Health Insurance Disability Insurance Auto Insurance Total Cash Outflows Net Discretionary Cash Flows $17,625 $5,738 $ 4,300 $3,825 $50,000 $3,600 $3,000 $5,000 $75,000 $1,200 $2,400 $125,000 $7,500 $24,529 $13,333 $12,001 $5,000 $3,600 $6,000 $5,000 $600 $10,000 $800 $1,400 $5,000 $3,000 $144,451 _($19,451)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is my analysis for the Fosters retirement planning based on the information provided 1 Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started