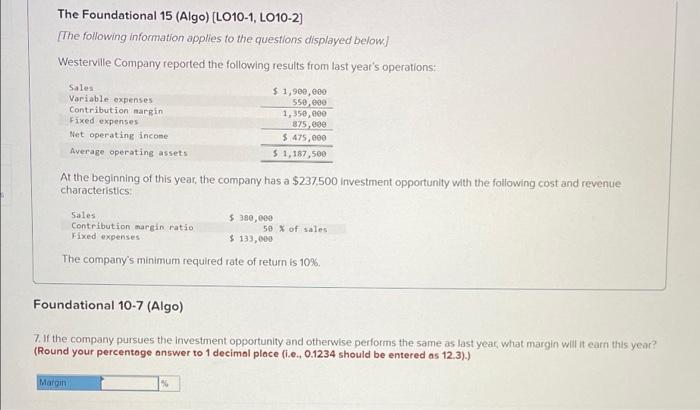

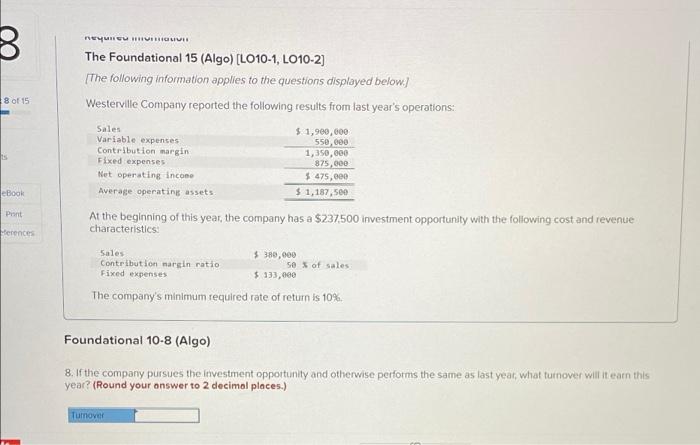

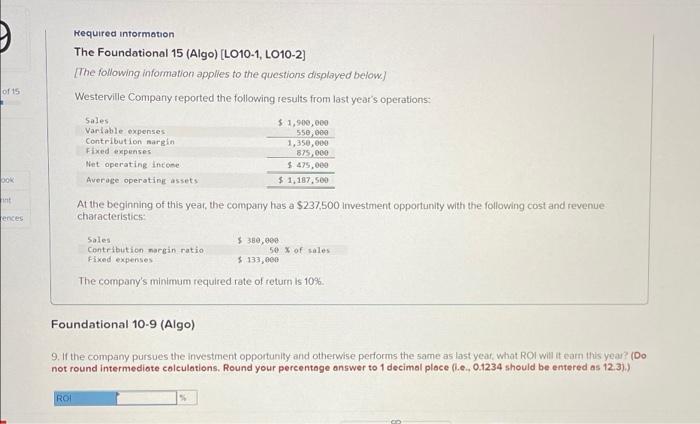

The Foundational 15 (Algo) (LO10-1, LO10-2] The following information applies to the questions displayed below) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,900,000 550,000 1,350,000 375,000 $475,000 $ 1,187,500 At the beginning of this year, the company has a $237.500 Investment opportunity with the following cost and revenue characteristics Sales Contribution margin ratio Fixed expenses 5 380,000 50 % of sales $ 133,000 The company's minimum required rate of return is 10%. Foundational 10-7 (Algo) 7 of the company pursues the investment opportunity and otherwise performs the same as last year what margin will it earn this year? (Round your percentage answer to 1 decimal place fi.e., 0.1234 should be entered as 12.3).) Margin 3 8 of 15 neyuncu MUITGLIVE The Foundational 15 (Algo) (LO10-1, LO10-2) The following information applies to the questions displayed below) Westerville Company reported the following results from last year's operations: Sales $ 1,900,000 Variable expenses 550,000 Contribution margin 1,350,000 Fixed expenses 875,000 Net operating income $475,000 Average operating assets $ 1,187,500 At the beginning of this year, the company has a $237500 investment opportunity with the following cost and revenue characteristics eBook Pont Herence Sales Contribution margin ratio Fixed expenses $ 380,000 50 % of sales $ 133,000 The company's minimum required rate of return is 10% Foundational 10-8 (Algo) 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your onswer to 2 decimal places.) 2 Turnover Required information The Foundational 15 (Algo) (L010-1, LO10-2) The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations of 15 Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $1,900,000 550,000 1,350,000 875,000 $475,000 $ 1.187,500 DOX int At the beginning of this year, the company has a $237,500 Investment opportunity with the following cost and revenue characteristics: ences Sales Contribution margin ratio Fixed expenses $ 380,00 50 % of sales $ 133,000 The company's minimum required rate of return is 10% Foundational 10-9 (Algo) 9. If the company pursues the investment opportunity and otherwise performs the same as last year what ROI will it earn this year? (Do not round intermediate calculations. Round your percentage answer to 1 decimal place (ie. 0.1234 should be entered as 12.3).) ROL